At 4D Infrastructure, responsible investment is integrated into our investment process and is an important component of our investment stewardship.

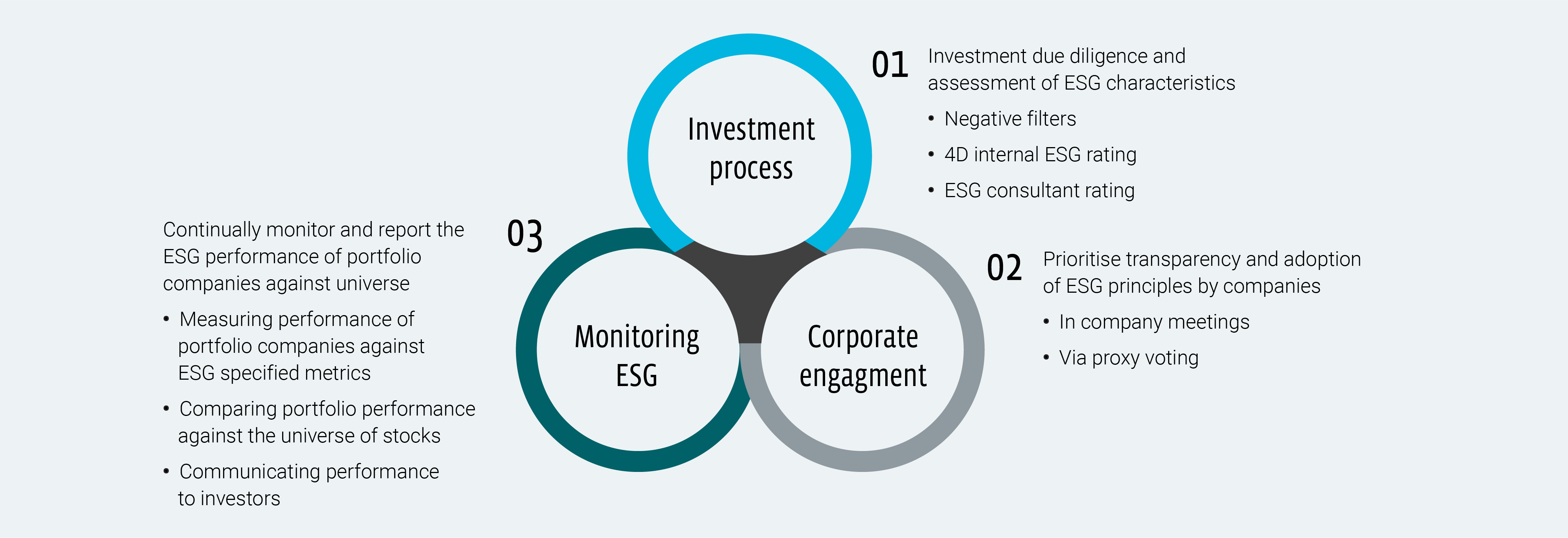

We define responsible investment as the consideration and promotion of environmental, social and governance (ESG) factors in the decision-making and active ownership of investments. This incorporates inclusion of ESG considerations in due diligence processes; appropriate value attribution to ESG factors; perseverance in promoting ESG considerations and transparency; a disciplined routine of monitoring ESG factors in existing investments; and a fostering of a strong ESG culture within the business.

We believe supporting responsible investment not only results in better moral outcomes, but also enhances investment outcomes for our investors. The consideration of the influence of ESG factors on the risk, return and longevity of investments provides a more thorough due diligence process, and better risk-adjusted returns.

Policies and reports |

|

Signatories / memberships |

|

4D articles |

|

ESG performance

| 4D Global Infrastructure Fund | Investment Universe3 | |

| Environment: | ||

|---|---|---|

| Carbon Emissions Score (MSCI rating up to 10) | 8.44 | 7.89 |

| Carbon Intensity (TCO2 / US$M Rev) | 604 | 870 |

| Companies with good or moderate carbon reduction targets6 % | 82.1% | 70.4% |

| Social: | ||

| Average ratio of women on Boards | 33.8% | 30.5% |

| Proportion companies that adopted diversity workforce policy % | 38.5% | 40.7% |

| Proportion companies that are signatory to UN Global Compact | 53.1% | 40.5% |

| Governance: | ||

| Average % Board independent7 | 79.6% | 73.7% |

| Proportion with independent Chair or Lead Director | 73.9% | 65.3% |

| Proportion companies with bribery and anti-corruption policies and/or adhere to recognised external standards | 93.5% | 89.6% |

Source: MSCI and 4D Infrastructure

1) This data relates to the 4D Global Portfolio (Unhedged)

2) Data is as of 30 September 2025

3) Equal stock weightings applied to Investible Universe

4) The larger the measure represents a more optimal outcome, except for Carbon Intensity

5) 91% of investment universe; and 97% of 4D Global Infrastructure Fund is covered in the above

6) Company targets assessment by MSCI

7) Independence assessed by MSCI

8) Safety data is available for specific sub sectors but not fulsome enough to represent for the complete portfolio/universe