Five of the ten most destructive US wildfires since records began in the mid-to-late 1800s have occurred since 2013[1]. Climate change driven by human intervention has, through attribution analysis, been proven to be a key contributor to the increased frequency and ferocity of fires in the US. These fires are a real risk for utility companies and their investors, and with global temperatures continuing to rise, it seems the issue could intensify going forward.

In our recent Global Matters article, Extreme weather risks and their impact on investors, we outlined the observed link between extreme weather events and climate change globally. Here, we'll focus specifically on wildfires and their impact on US utilities.

Wildfire ignitions

Wildfires are somewhat unique compared to extreme weather events – even though conditions are exacerbated by global warming, wildfire ignition is usually started by lightning strikes, human intervention (accident, negligence or intent), or electric utility equipment.

There have been numerous examples in the US where electric utility company assets have ignited wildfires, which have gone on to cause significant third-party damage. The utility therefore faced billions of dollars in litigation liabilities, well in excess of their insurance protection. This has resulted in significant financial losses, cash liability payments, and increased probability of corporate financial distress, which itself has social ramifications.

It started in California

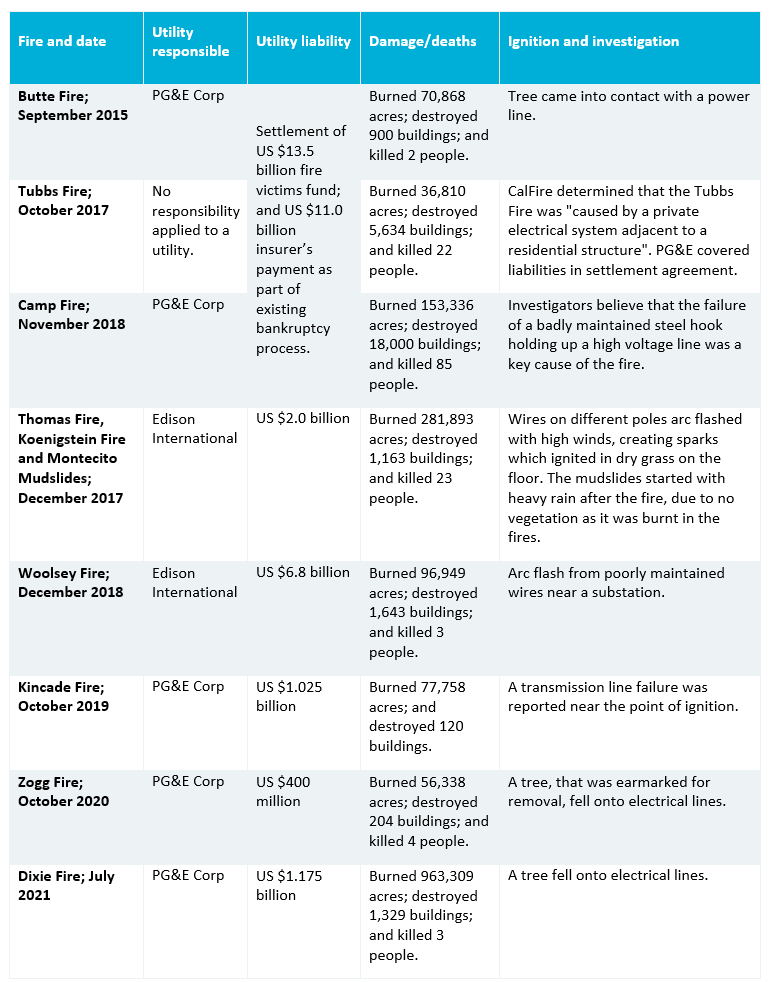

The detrimental shareholder impact of wildfire liabilities experienced by Californian utilities is well known. PG&E Corp (PCG-US) and Edison International (EIX-US) were most negatively affected by wildfires ignited by company assets over the period 2017-2021.

Courts in California have adopted a unique application of the legal concept, inverse condemnation. It applies legal liability on electric utilities for all third-party damages caused by a fire which the utility’s assets are found to have ignited. The courts’ application of inverse condemnation removes the legal requirement to prove negligence on behalf of the utility in order to enforce third-party liabilities, which is required in other states. The courts have assumed the utility will recover these third-party property damages from customer bills, but the Californian utility regulator has been reticent to allow this.

A number of fires were found to be ignited by utility assets in the state, incurring significant third-party property damages, as well as civil, regulatory and criminal penalties.

Source: California Board of Forestry and Fire Protection (CAL Fire)

PG&E filed for bankruptcy protection in January 2019, due to the quantum of liabilities facing the company at the time. This process rendered the remaining equity value in the company zero. As part of PG&E coming out of bankruptcy, the company negotiated with legal representatives of uninsured wildfire victims and insurance companies of the Butte, Tubbs and Camp Fires to make payment of $24.5 billion (partially through an established fund) for property damages. However, it became clear that the situation for the utilities in the state was untenable.

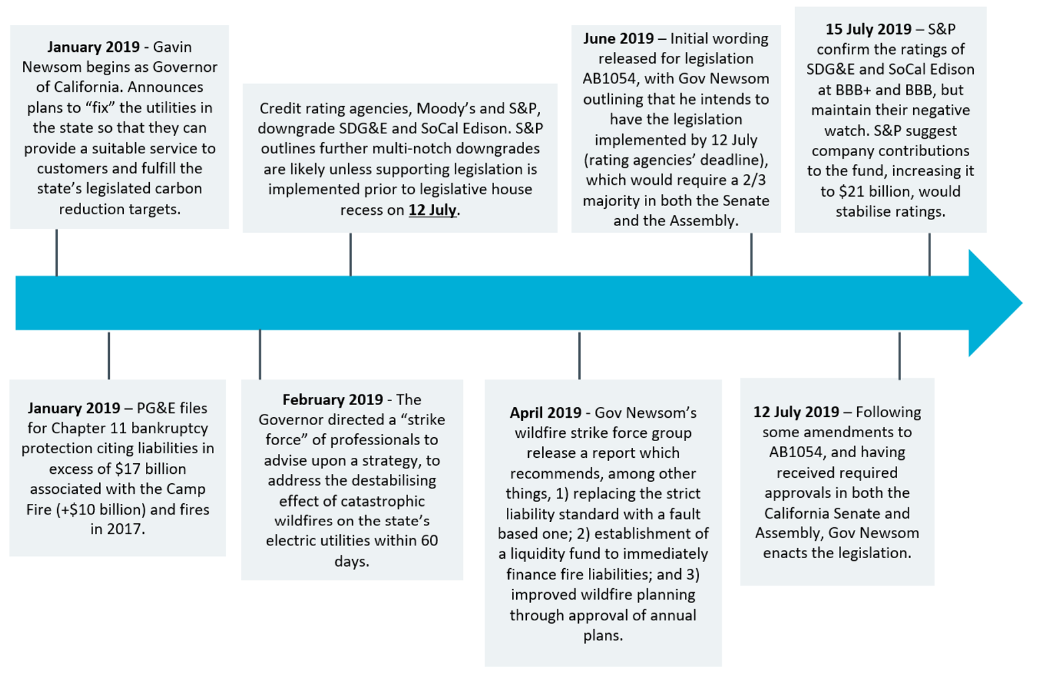

In 2019, Governor Newsom began his gubernatorial tenor in California. He identified wildfire risk as a key risk to the state, and understood that properly functioning and sustainably financed utilities were needed to deliver the energy prerogatives of California.

He went about establishing a framework to mitigate wildfire liabilities for utilities which are prudently operated, in order to improve their credit assessment and ability to finance themselves. The below timetable summarises legislative steps taken, and the corresponding credit rating agency response.

Legislation SB 1054 not only established a wildfire liquidity fund which would finance wildfire legal liabilities sustained by the utilities, but it also established a process of ensuring that the utilities were prudently operating their electricity assets and were taking reasonable steps to mitigate the ignition of wildfires. If classified as a prudent operator under an annual certification, the utility can recover any fire liabilities in customer bills or from the established liquidity fund.

Since 2018/19, companies have significantly reviewed their operational management of fires, and invested billions of dollars in ‘hardening’ their networks to avoid future fires. Key initiatives include:

- Structured processes to shut off parts of the network (PSPS) in extreme conditions;

- Insulating overhead wires in high risk areas;

- Undergrounding wires in the highest risk areas where appropriate;

- Investing in a network of cameras and monitoring stations to increase situational awareness;

- Replacing old wooden poles; and

- Undertaking massive amounts of vegetation management

The major electric utilities in California experienced significant share price corrections associated with the wildfires, and only recently have started to recover. The market seems to appreciate steps taken by the companies and state legislators in mitigating future fires, combined with the liquidity fund and pre-prudency test in avoiding future legal liabilities when fires do occur.

But recent developments suggest wildfire risk is not specific to California...

More recent experiences of wildfire risk

Investors thought that debilitating financial damages from wildfire risk was limited to Californian utilities because of the state’s unique application of inverse condemnation. The requirement in other states, to prove utilities have acted negligently, was perceived as a mitigant against them incurring similar legal liabilities, unless negligent. That view may be changing.

PacifiCorp litigation

In June 2023, unlisted electric utility, PacifiCorp, received an Oregon court decision relating to its alleged involvement in five major fires which burned across the state in October 2020. The fires burnt 850,000 acres of land, causing damage to around 4,000 homes, and killing at least 11 people[2].

Despite PacifiCorp not having been found responsible for ignition of the fires by any formal body at the time of writing, a jury court made a number of decisions including:

- PacifiCorp was liable for actual and punitive damages for fires;

- The company was liable to pay $70 million in damages associated with 17 homeowners under a single case; and

- Punitive damages of 25% of property damages and emotional distress were to be applied to all victims of the fire.

The jury found PacifiCorp negligent in failing to shut-off power to its 600,000 customers during a windstorm, despite warnings from officials. The company did not have any established power shut-off process, and argued the ramifications of cutting power would have broader and serious ramifications.

The decision that PacifiCorp was liable for the fires also means that the company is likely to incur further actual and punitive damages associated with approximately 2,500 householders under a separate class action lawsuit. A very basic assessment suggests PacifiCorp could be liable for billions of dollars associated with this class action lawsuit. There is a clear risk of financial distress for the company.

Maui fires of 2023

The Maui fires that started on 8 August 2023 destroyed more than 2,700 structures, and killed 97 people, with 31 unaccounted for as of 18 September 2023. An investigation is ongoing into the cause of the fire, but Maui County has already filed a lawsuit against a subsidiary of the utility company, Hawaiian Electric Industries (HE-US), based on suspicions that the fire was ignited by the utility equipment (uninsulated wire contacted dry grassland when strong winds downed a wooden power pole). Hawaiian Electric has suggested that the lawsuit is imprudent in pre-empting the outcome of the formal investigation into causation.

The share price of HEI fell from the closing price of $37.36 on 7 August, to $12.85 as at 17 October 2023 (a 65% decrease) based on legal risk associated with the fire. There is conjecture as to the prudent operation of the network on behalf of Hawaiian Electric, but the findings in the PacifiCorp case clearly show a high legal risk being faced by the company.

Other exposed companies

A number of other companies are also exposed to wildfire risk in the US including:

- An Xcel Energy subsidiary is currently being litigated for its alleged involvement and negligence in the ignition of the 2021 Marshall Fire in Colorado.

- Like PacifiCorp, Portland General Electric was also exposed to the October 2020 fires in Oregon.

- A number of other utilities operate in regions of the US which exhibit the conditions supportive of destructive wildfires which includes hot weather, strong winds, and dense vegetation. These include Fortis Inc, IDACORP Inc, NorthWestern Corp, PNM Resources, Blackhills Corp[3].

4D’s approach to mitigating the risk

There is no doubt that the environmental conditions for wildfires are being exacerbated by climate change. In doing nothing, utilities will be at greater risk of wildfire liabilities (physical and legal) as global temperatures increase. Many utilities are enhancing their operational preparedness and investing in ‘hardening’ the network to mitigate the risk of fire ignition. Governments and fire authorities are also focused on reducing the fuel for fires, being able to respond effectively to fires after ignition, and protecting prudently operated utilities from legal liabilities.

At 4D, we undertake significant due diligence to understand utilities’ operational preparedness and investment plans in hardening their networks against wildfires. We also keep abreast of legal and regulatory developments in utility operating jurisdictions to ensure the companies aren’t exposed to risks that they cannot mitigate through prudent operation of their networks. This due diligence flows through our capex modelling and values, as well as our quality assessment of the utilities’ jurisdiction, asset quality and management. We will exit a position, or rule a stock uninvestable, if there is a real risk of unquantifiable liability.

The content contained in this article represents the opinions of the authors. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.

[1] https://earth.org/worst-wildfires-in-us-history/

[2] Forest Facts: 2020 Labor Day Fires: Post-fire challenges with invasive plants; Oregon Department of Forestry

[3] Assessing Wildfire Risk and What Utilities Are Doing to Adapt; Wells Fargo; 6 September 2023