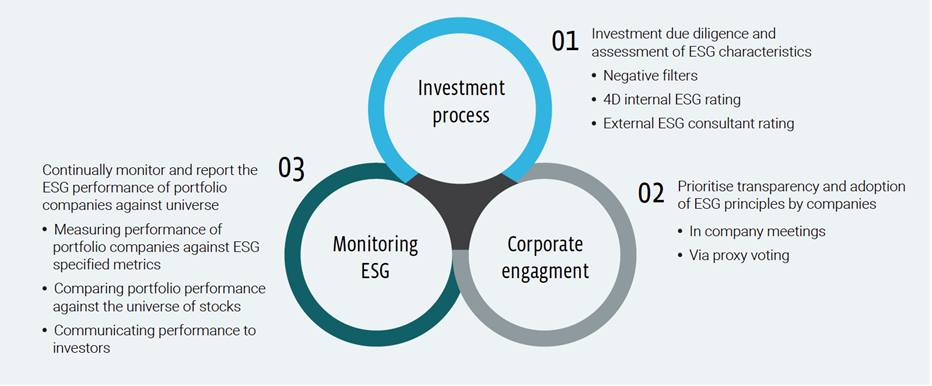

The consideration of the influence of sustainability factors on the risk, return and longevity of investments provides a more thorough due diligence process and better risk-adjusted returns. The interaction between our investment, stewardship and reporting activities is depicted below.

Source: 4D Infrastructure

We believe sustainability factors are often interlinked for companies in our investment universe. Therefore, while assessed on an individual basis, their inter-relationship also needs to be understood and assessed. For example, when assessing the pace of energy transition in decommissioning fossil fuel generation facilities, utility companies should consider social factors, such as the impact on energy affordability for customers, the impact on reliability of service, and the employment opportunities of displaced workers.

As a signatory to UNPRI, and for the benefit of our investors, we undertake stewardship activities with companies both in our portfolios and greater investment universe. As part of our commitment to UNPRI, we actively incorporate responsible investment in our investment and stewardship activities; incorporate information learned through our engagement activities into our decision making; promote enhanced transparency through engagement and proxy voting; and promote implementation of responsible investment in the infrastructure sector.

Responsible investment is integrated into our investment process and is an important component of our investment stewardship. This document outlines our stewardship activities over the past year to investors and stakeholders.

Preface to 2023

Infrastructure companies faced a number of challenges in 2023, including higher input prices, constrained supply chains, increased financing costs aligned with higher interest rates, and fears of a technical and/or earnings recession impacting some subsectors. These issues raised investor concerns regarding the ability of companies to execute on their communicated ESG plans, especially those that had ambition to decarbonise their operations.

Regulated utilities and independent power producers (IPPs) are perceived as instrumental in the energy transition process globally. Their ability to invest in networks and clean generation to facilitate more low-carbon power being delivered to customers, while maintaining affordability of service is central to the success of net-zero ambitions. With increasing financing costs associated with rising interest rates, combined with increasing input costs and constrained supply chains, many companies were challenged to make progress in 2023 on their longer-term energy transition plans. Investors were suspicious of IPP players’ ability to earn a reasonable return on renewable generation in light of increasing input and financing costs. These factors contributed to utilities and IPP companies’ share prices being challenged through 2023, and questions were raised as to the longer-term investment proposition associated with the energy transition process. Much of 4D’s engagement with companies centred on the robustness of company plans to accommodate the energy transition and getting an understanding of whether the investment proposition of renewables withstood short-term challenges.

With less direct exposure to the energy transition, user-pay infrastructure companies were more focused on other issues such as affordability of service for customers, the impact of a recessionary environment on customer demand, and employee relationships (to avoid industrial action). Some more developed world user-pay companies had energy transition plans which focused on scope 1 and 2 emissions (emissions from their own operations), and were starting to tackle the greater, and more impactful, challenge of scope 3 emissions (those not directly associated with their companies, like car emissions for a toll road). 4D meetings with these companies were focused on the elasticity of demand to measures such as GDP growth, how companies were looking to reduce costs and how companies were managing union relationships considering the debilitating impact industrial action can have on operations.

Governance continued to be a consistent theme across all infrastructure companies in 2023. In both proxy voting and engagement activities, we wanted to limit the occurrence and impact of conflicts of interest, and support minority investor protections. We quizzed companies on their governance practices/procedures, focusing on strategic issues specific to various companies.

Engagement

4D believes that company engagement is crucial to our investment and stewardship duties, as fiduciary managers of clients’ funds. We look to engage with companies in our portfolios as well as the broader investment universe to:

- Undertake due diligence as part of the company assessment and investment decision process;

- Support our efforts in valuing a company, including short- and long-term scenario analysis;

- Engage with companies to understand and challenge their strategy and operations;

- Support our determination of a quality grade for the company, with over 50% of the quality assessment assigned to responsible investment factors;

- Gauge other investors concerns and focuses;

- Gauge companies’ willingness to listen to and address investor concerns;

- Support improving transparency; and

- Promote the consideration of sustainability (ESG) factors.

4D establishes distinct engagement priorities and objectives to enhance the effectiveness of our engagement activities and monitor companies' progress over time. Specific objectives may vary based on company, industry, geography, and theme.

Insights gathered from engagement activities are systematically integrated into our investment analysis and decision-making processes. Each analyst maintains a detailed record of their engagement activities, accessible to all team members, including relevant portfolio managers. A summary of these detailed discussions is also incorporated into an Engagement Log.

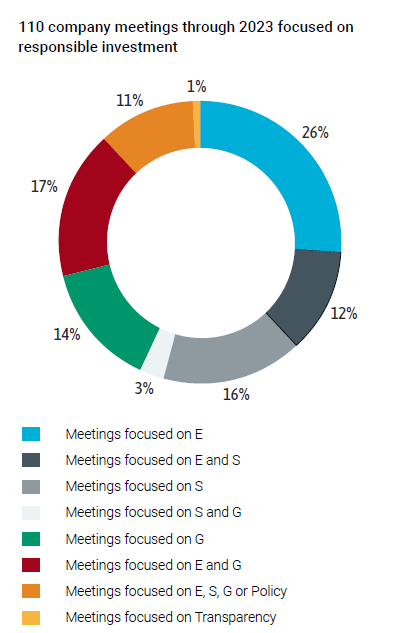

A representation of our engagement activities for 2023 is summarised in the graph below.

Source: 4D Infrastructure

A summary of focus areas for our engagement includes:

- A large proportion of meetings (26%) with investee companies focused solely on environmental issues. The majority of these, combined with those that considered environmental and social issues, were with utility and IPP companies from across the globe. The energy transition, and how it impacts investment/divestment plans, continues to be one of the key investment considerations for utility companies.

- Energy transition-focused meetings also considered social issues, specifically affordability and reliability considerations in transition plans. We challenged utility energy transition plans to ensure they were well considered and had reliability, customer service and affordability at the forefront. We believe that transition plans that don’t fully consider affordability and reliability of service were doomed to fail, as utility companies lost the confidence and support of customers, and invariably, regulatory bodies. This would impede the execution of transition plans in the medium to long term.

- With high inflation and interest rates in many global locations through 2023, raising concerns for customer affordability of essential services, we were interested in understanding how management teams of a number of utility sectors (power, gas and water) were managing bills for the end customer. This was of particular concern in early 2023 with inflation levels and energy costs still high. Some companies were less effective at moderating bills than others, and the result was some adverse regulatory decisions through the year – specifically in state regulatory filings in the US. This impacted company earnings, whose growth failed to reach their longer-term guidance levels.

- Issues discussed with European companies varied but included the following:

- The energy transition was still a focus for European utilities, but companies often were also increasing fossil fuel capacity in the short term in response to remaining concerns in fulfilling capacity requirements post the energy crisis of 2022. Ironically, this seems less of an investor concern in 2023. We will monitor closely to ensure that short-term solutions to capacity concerns do not become long-term solutions, and hinder the energy transition to low/no carbon fuels.

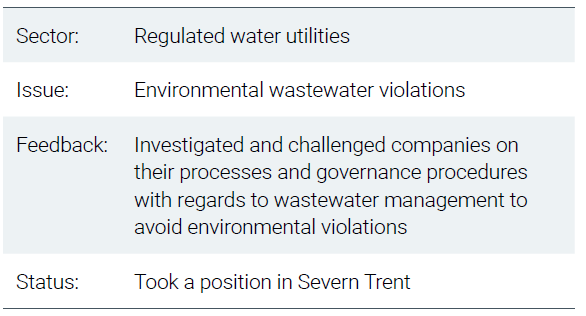

- Environmental wastewater violations were discussed with UK water companies (elaborated below). This drew negative public and government focus, which could result in operational costs and potentially significant fines.

- Execution of strategy driven by strong governance and management structures, as well as appropriate disclosures was a focus for specific names, such as Sacyr, Cellnex, Hera and Fraport.

- Political and industrial relations concerns were also discussed with companies all over Europe and the UK. The increasing cost of living was a key driver of social and political upheaval.

- The majority of meetings focused purely on governance issues were with companies based in emerging markets. Members of 4D raised concerns regarding controlling shareholders, board independence, minority shareholder rights, and minority shareholder and management alignment. The responses from company management teams varied – giving us confidence to invest in companies with more robust responses. Other specific governance issues were raised in conversations with US and European companies such as NextEra (summary in Case studies section), Orsted, and Cellnex.

Case studies

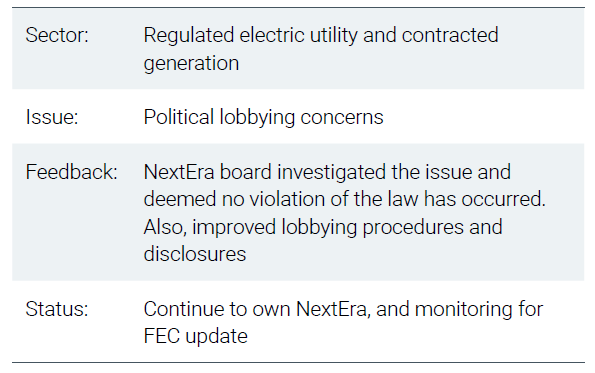

NextEra Energy (NEE-US)

In late October 2022, NextEra Energy utility subsidiary, Florida Power & Light (FPL), was embroiled in a political lobbying scandal, which was reported on in Florida media outlets. Despite the company suggesting there was no connection, on its earnings call in January 2023, the FPL CEO retired from his role. A referral to investigate was made to the US Federal Elections Commission (FEC), that is currently reviewing information to ascertain whether a criminal investigation into FPL and its executives is warranted.

With NextEra a significant holding in 4D’s main strategy portfolio, we requested a call with management and were offered a discussion with FPL’s Investor Relations (IR) team. We wanted to understand if there was any significant breach of the law and/or ethics by NextEra (or FPL) executives, and better understand the company’s internal rules and processes to ensure the company didn’t fall foul of the law or its own code of ethics. The FPL team outlined that the board of NextEra had undertaken extensive internal and external investigations of the incident, which included legal advice, and concluded that no FPL executive had committed a crime and there was no contravention of the company’s lobbying policies. IR outlined the company has a political lobbying policy on its website which governs interactions with political individuals and parties, and importantly, with political lobbying/consulting companies. This policy outlines the chain of command for managing interactions with such companies, that includes some level of reporting to the board. NextEra was considering its future use of 501(c)4 and other anonymous structures.

The 4D Investment Committee discussed the situation and considered the potential ramifications for the company’s reputation and ability to achieve reasonable regulatory outcomes. We also took advice from an external political analyst firm. We felt that the board had taken reasonable efforts in investigating the situation using external resources. We felt that NextEra’s internal controls were reasonable but should be extended to cover anonymous structures.

We wrote to the NextEra IR team and outlined our concerns that their lobbying policy allowed for the utilisation of 501(c)4 and other anonymous political funding structures. They responded that NextEra have enhanced their lobbying policy to include an additional layer of review of political contributions by a recently established management committee. The board will also now review and sign off on any contribution to a 501(c)4 entity, or anonymous structure.

We await the outcome of the FEC referral. To the degree that a criminal investigation is determined as warranted, we will review our holding/s in the company.

In response to what was the second or third industry allegation of inappropriate lobbying behaviour, we undertook a broader look at the US utility sector, what its role was in US politics, the risks to investors of inappropriate lobbying and our updated approach to political lobbying risk. We published these in a News & Views article, Political lobbying risk in the US, in July 2023.

UK water companies (SVT.LN; PNN.LN; UU.LN)

In November 2021, the UK Environmental Agency (EA) and water utility regulator Ofwat launched separate investigations into storm overflows at UK water companies.

These investigations concerned flow to full treatment, referring to the level of rain and wastewater, a wastewater treatment works must treat before it is legally permitted to discharge excess flows to storm tanks or into the environment. These potentially illegal discharges had captured significant public, media and government attention. The UK government subsequently legislated to place legally binding duties on companies to reduce the number of overflows, especially near bathing or high priority or ecologically important sites.

Whilst we didn’t initially own a position in the UK water sector, we increased our engagement with the three listed water names to better understand the issues at hand and the likelihood of wrongdoing. Through our interactions, we challenged the companies on their environmental track records and governance processes. Severn Trent highlighted their strong track record in environmental compliance and monitoring. It had achieved the highest 4-star rating from the Environmental Protection Agency four years running and was on track to achieve 100% performance commitments for this year. Amongst other factors, this was a key consideration for the 4D Investment Committee in our risk assessment and we ultimately decided to take a small position in the company as we believed it had been oversold on these sector overhangs.

Subsequently, we continued to engage with the company to understand the steps it was taking to address concerns around sewer flows and pollution incidents, to deliver better service to its communities. It continued to highlight its sector-leading progress on various environmental measures. This culminated with its latest submitted business plan, which showed compliance with statutory and regulatory obligations well ahead of time and ahead of the sector average. Almost 45% of its enhancement investment was dedicated towards environmental issues, and the company had brought forward investment to tackle these challenges as soon as possible. We felt these were positive actions, and as such, the 4D Investment Committee was supportive of increasing our exposure to Severn Trent by participating in its recent equity raise.

At the time of writing, we still own a position but will review if the investigations find material wrongdoing on their part.

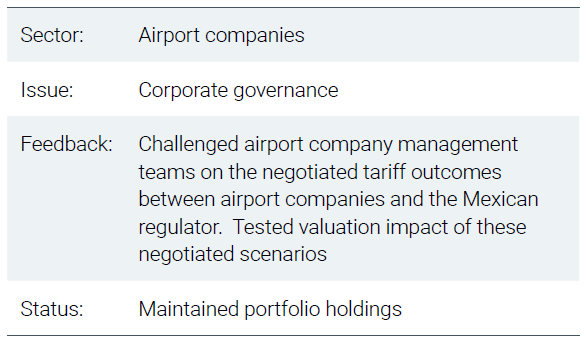

Mexican airport companies (ASURB.MM; OMARB.MM; GAPB.MM)

The Mexican airport regulation has long been considered some of the best in the world - very constructive and very stable, having not been ‘tested’ since privatisation over 25 years ago. It was a key quality assessment supporting our investment in the sector.

In early October 2023, the Mexican airport operators informed the market that they received a notification from the Mexican Federal Civil Aviation Agency (AFAC) informing them that it had decided to amend, with immediate effect, the terms of the tariff base regulation of the airports’ concession agreements. Also, according to the press release issued by the companies, the move was unilateral and without prior consultation. The changes were in contravention of the Concession Contract that states that any regulatory re-design must be agreed between the parties.

This was a complete surprise to the companies (and the market), and all three companies stated that they were evaluating the potential impact that the changes to the tariff base may have on their businesses, results and financial condition. The stocks completely sold off given the perceived threat to a historically stable regulatory construct, the fact that the operators themselves had been unaware of the threat and a clear lack of detail on the proposals. We immediately put a halt to our investments until we could undertake an assessment of the situation.

The operators did have legal recourse, and importantly, Mexican courts have proven to be independent of governments in assessing contracts/concessions. However, the companies were looking to negotiate a ‘reasonable’ outcome and spent two weeks doing so. Once negotiated, we had conversations with each of the management teams to fully understand the rationale, the impact, and the sector outlook from a regulatory standpoint. We identified five key regulatory changes which we assessed to be largely valuation neutral to positive in certain instances.

As a result of these detailed conversations, valuation and quality re-assessments, we received comfort in the ongoing investment proposition and reinstated our core positions at the end of October. In December, Grupo ASUR announced that it had received approval from the Mexican Department of Infrastructure, Communications and Transportation for its next five-year plan (2024-2028), the first re-set under the negotiated changes. This was positive news as it was approved as submitted, easing fears that the regulator was going to be increasingly antagonistic, and the outcome was positive; beating consensus and our forecasts.

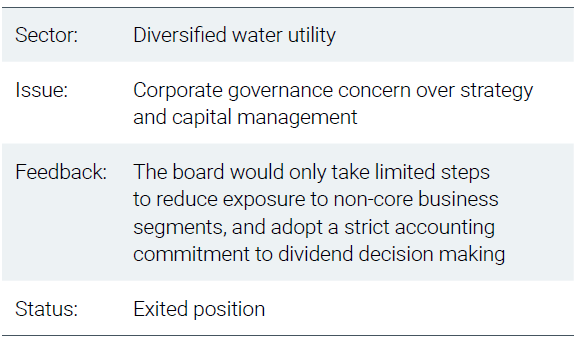

Guangdong Investment (270-HK)

GDI is an investment conglomerate, with its core focus being water supply and treatment. Other ancillary business divisions consist of property investment and development, department store operations, hotel operations, and infrastructure (energy projects and road and bridge operation). The water division accounts for 55-70% of earnings. Historically, the water business has presented high visibility of cashflows, supported by concession contracts, underpinning an attractive, sustainable and growing distribution.

We initially expressed concerns with management over the company’s ancillary exposures, including the property exposure, in November 2021. At the time, management attempted to address investor concerns by altering the strategy so that GDI would no longer directly participate in property development – instead only investing through its subsidiary, GD Land (thus no recourse to the holding company). Additionally, GD Land would focus on project delivery rather than sourcing any additional projects. We felt this was a small step in the right direction.

With structural issues prevailing in the Chinese property market, we were conscious that GDI’s property division would remain under pressure leading into FY24. Following the FY23 interim results (September 2023), we questioned management as to whether the full year DPS could be sustained (despite the interim dividend being held flat) in light of looming non-cash property impairments against the property division. Management was explicit that despite being non-cash, the board would not approve a dividend payout ratio in excess of 100%, implying a DPS cut. On 4D’s earnings estimates, assuming a 100% payout ratio, the DPS would be cut by 10% - implying a potential negative surprise to consensus estimates.

The board and management team's disregard for looking through the non-cash impairments, in setting distributions, raised capital management and corporate governance concerns for us. 4D discussed the situation at an Investment Committee meeting. We felt that the board should primarily focus on cashflow strength and the credit standing of the company, rather than basing the dividend decision on an accounting measure. We decided to exit the stock based on concerns for potential ongoing non-cash impairments from the non-core property business segment, and the potential for a significant dividend cut. This was actioned on 9 September 2023.

On 26 January 2024, GDI issued a profit warning, expecting NPAT attributable to shareholders to decrease 35%. This was below both 4D estimates and consensus (likely due to higher than anticipated non-cash impairments booked). The implied payout ratio adopting the existing dividend was 129% (management had already communicated it would not payout in excess of 100%), with a 100% payout ratio implying a DPS cut of 23-35%.

The stock was subsequently sold off, and is now trading (as at 9 February 2024) ~23% below the share price of our decision to exit and 27% below the price at the date of the profit warning.

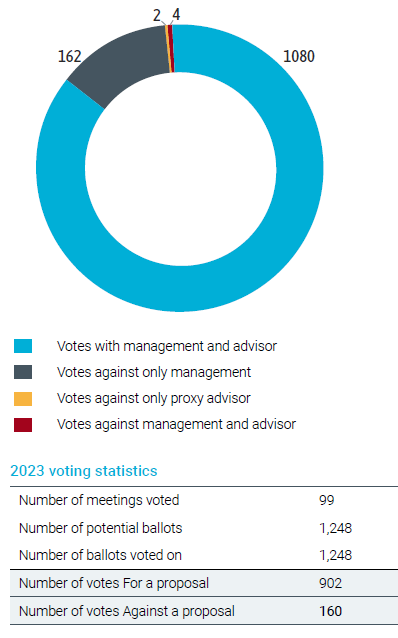

Proxy voting

Proxy voting on specific portfolio company ballots is undertaken by the covering investment analyst and is based on the principles determined by the 4D group. The covering analyst is most knowledgeable on, and familiar with, companies within their coverage group. In the situation where a vote is considered contentious or unclear in regards to 4D principles, it may be discussed by the wider team at an Investment Committee meeting.

4D has engaged a proxy voting advisor (currently ISS) to support voting decisions. 4D understands that ISS recommends voting decisions based on supporting minority shareholder interests, therefore its voting motivations are largely aligned with that of 4D. ISS has indicated that it has sufficient resourcing to adequately research and analyse proxy proposals.

ISS recommendations are adopted as the default vote for 4D, albeit all ballots are reviewed by a 4D analyst, and they have discretion to change the vote from ISS’ recommendation. ISS generally provides a rationale for its vote recommendation, which assists the 4D analyst in making their own independent voting decision.

4D makes proxy voting decisions that are in the best interests of our clients. That is, we vote proxies in support of initiatives that are likely to improve the risk/return of investments in the portfolio over the long term. We believe that there is a strong connection between good corporate governance and the creation of long-term shareholder value. We also generally support initiatives which enhance transparency and corporate governance practices, and the consideration of the environmental and social impacts of company strategies.

A summary of our proxy voting decisions is included below.

Source: 4D Infrastructure and ISS

4D proxy votes were largely aligned with the recommendations of ISS. We selected the proxy advisor based on its values in supporting minority shareholders and ensuring alignment between the Board and management. We believe its recommendations generally reflect this.

We have deviated from ISS recommendations on some issues.

One such issue was the election of specific members to the boards of Kinder Morgan. Richard Kinder is a major shareholder in the company (holding c.15%) and Kimberley Dang is the current CEO. We believe having both of them on the board of Kinder Morgan could overly exert influence, resulting in a stranded board and less minority shareholder control. With a number of strategic decisions needing to be made, 4D abstained from the vote on their appointments.

We also abstained from the appointment of former CEO of American Electric Power (AEP), Nick Akins, as the chairman of the company. We felt that leadership of the company needed a new influence and Nick was not ideal to do that. ISS recommended to support the appointment of Nick in line with management’s recommendation.

We voted in favour of a shareholder proposal that requires the appointment of an independent chair at the US utility company, Sempra. We felt supporting the proposal would enhance the independence of the board, which was also undertaking some important strategic decision making. Management rejected the proposal outright, and ISS supported the rejection based on its wording.

We were uniquely contacted by one of our investee companies, Yuexiu Transport Infrastructure (Yuexiu), following our proxy vote against proposed company constitutional changes recommended by management. Management proposed a number of changes to align with requirements under Hong Kong law. One of the proposed changes to the constitution was to reduce the notification requirement to call special general meetings from 21 days to 14 days - which is more in line with standard company requirements in Hong Kong, but not essential for the law changes. ISS recommended rejection of all the proposed constitutional changes based on this notification change (all the proposed changes were under a single proxy vote).

The Investor Relations team at Yuexiu contacted us following the vote and asked what would be required for us to vote in favour of the constitution changes. Considering the notification period change wasn’t essential to the constitutional changes, we recommended the removal of this component. The required constitutional adjustments were proposed again at the next annual general meeting, and were supported by 4D and the majority of the shareholder base.

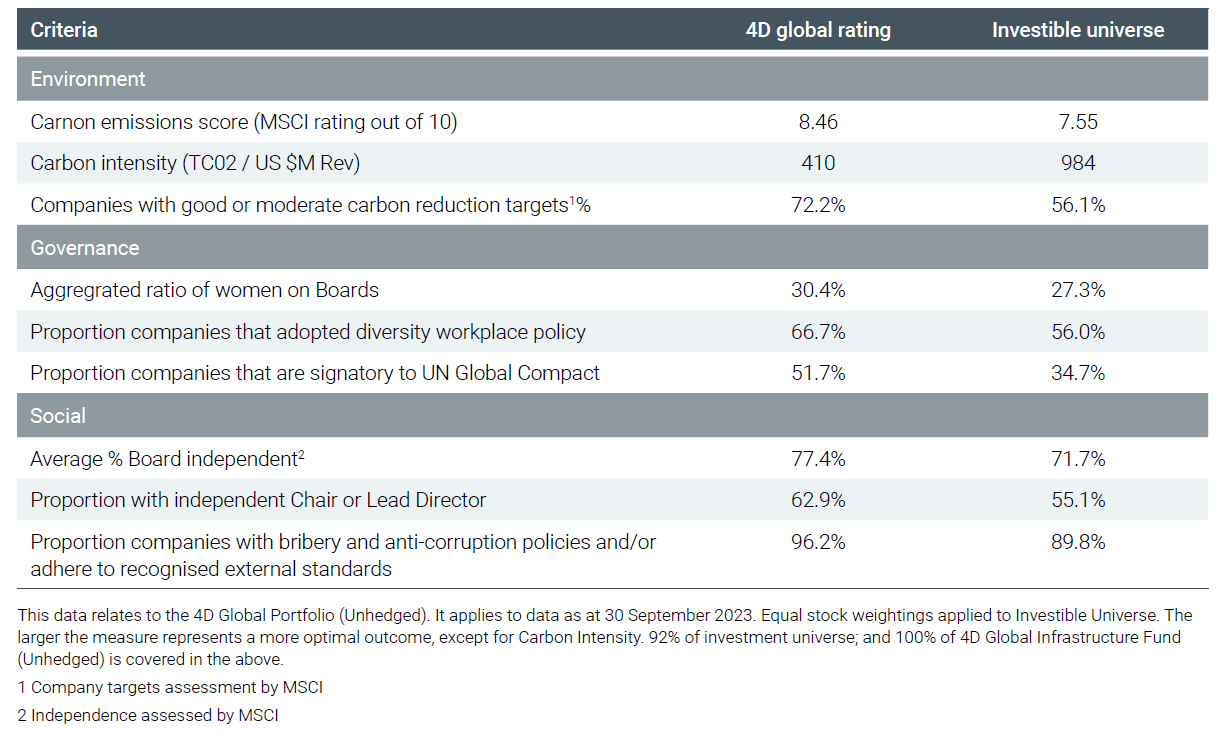

Sustainability reporting

4D reports its flagship strategy’s performance across key identified ESG metrics on a bi-annual basis. We present this information on our website for investors and stakeholders. The most recent reporting metrics are summarised below.

Source: MSCI and 4D Infrastructure

Conclusion

We are establishing our engagement and proxy voting priorities for 2024 around companies in our portfolios and investment universes. This will drive our conversations with companies and how we vote on proxy filings. The sustainability of company strategies and earnings will, again, be key considerations in determining focus areas for stewardship.

In our Global Matters: 2024 outlook article, we identify political turbulence as a likely feature in 2024. This is due to a combination of factors, including high cost of living in many parts of the world; a high number of scheduled elections with 40 nations to go to the polls; and geopolitical conflicts. This increased political risk could result in market volatility and potentially have negative ramifications on company earnings. Amongst other issues, its likely we will need to engage with management teams to ensure that they are strategically and operationally prepared to deal with this political uncertainty.

We look forward to working with companies in our investment universe to enhance the integration of sustainability practices in the sector, as well as transparency of communications with investors and stakeholders.