Our 2025 Responsible Investment and Stewardship Report outlines how sustainability considerations are integrated into company analysis, engagement, proxy voting and portfolio decision-making across the global infrastructure universe.

Source: 4D Infrastructure

Source: 4D Infrastructure

The year was shaped by heightened geopolitical tension, trade disruption and renewed inflationary pressures, alongside accelerating power demand driven by data centres and AI. These dynamics brought increased focus on energy transition, infrastructure resilience, affordability and regulatory credibility. Through active stewardship, we engaged with companies to better understand how they are navigating these challenges while continuing to deliver essential services and long-term shareholder value.

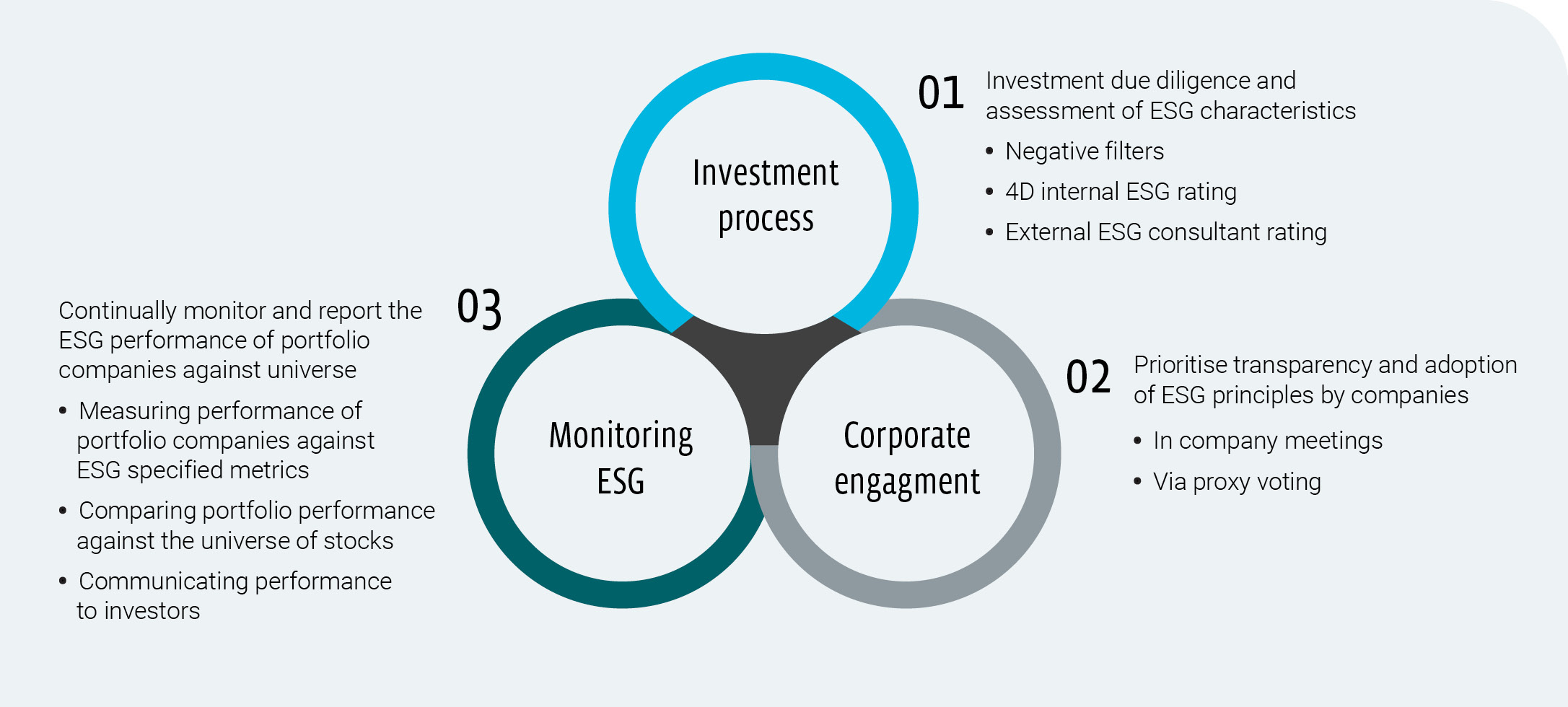

Engagement remains central to our approach and is a core component of how we fulfil our stewardship responsibilities. In 2025, our engagement with companies focused on key themes including decarbonisation pathways, the ability to deliver large-scale capital programs, resilience to extreme weather events, labour relations, customer affordability and governance standards. Through regular and targeted discussions with boards and management teams, we sought to understand how long-term sustainability objectives are being balanced against operational, regulatory and financial pressures. Insights from these engagements were systematically captured in our engagement logs and risk register, ensuring consistency and accountability across the investment team. This information is actively incorporated into our investment analysis, directly informing valuation assumptions, portfolio positioning and decisions to initiate, adjust or exit investments.

The report also features four case studies that demonstrate our stewardship in action:

- Los Angeles wildfires: We reassessed exposure to Californian utilities amid uncertainty around wildfire liability, regulatory protections and customer affordability. As a result, we exited our position in Edison International and reduced exposure to Sempra.

- Iberian blackout: Following the April 2025 power outage, we engaged with Spanish and Portuguese network operators, highlighting the need for increased grid investment while closely monitoring regulatory, fault and compensation risks.

- Pembina Pipeline: Engagement focused on long-term energy transition risk and asset resilience. This lead to enhanced scenario valuation analysis, and a better informed regulatory decision.

- Bangkok Expressway and Metro: Discussions highlighted rising sovereign and policy intervention risk in Thailand, resulting in a cautious “watch and wait” stance despite the strategic importance of the assets.

Through disciplined engagement, active proxy voting and transparent sustainability reporting, 4D continues to promote best practice ESG outcomes while supporting resilient, long-term investment returns. In an environment shaped by heightened geopolitical risk, shifting trade dynamics and accelerating energy transition, stewardship remains a critical risk management and value creation tool.

Looking ahead to 2026, we have identified priority risks and opportunities that will guide our engagement and inform portfolio decision making. As outlined in our Global Matters: 2026 outlook, these include AI-driven power demand, the impact of tariffs and geopolitical fragmentation on global trade, evolving regulatory frameworks, and rising debt levels alongside fiscal stimulus. Through ongoing engagement, we will continue to assess how companies are positioned to navigate these challenges, execute sustainable investment programs and deliver essential services while earning appropriate shareholder returns.