This is the abridged version of the article, which can be read in full here.

US listed infrastructure companies didn’t perform as well during 2023 generally, with increasing base and discount rates dampening valuations. Sectors also faced specific headwinds to earnings and cashflows through 2023, albeit stronger management teams were able to navigate these challenges and deliver steady growth in line with longer-term expectations.

Visiting management teams in early November 2023 was vital to get an understanding of their expectations for 2024, and gauge their confidence in delivering strong earnings. It feels that sector specific headwinds are moderating, and management teams were more optimistic on prospects for 2024. And from a macro perspective, stabilising or potentially declining Fed rates should also be supportive of company valuations.

In this piece, we highlight some interesting themes and observations from the trip that support our views on the region.

Politics

Elections

Political tensions are beginning to increase with US elections to be held this year. They will likely take place in the midst of cost-of-living concerns and inflated geopolitical risks associated with conflicts in the Ukraine and Middle East.

Donald Trump is also likely to petition for the Republican primary nomination again, which is remarkable considering he is facing a litany of criminal charges, some relating to his efforts to overthrow the previous election result. This raises constitutional questions if he were to be elected president with the outstanding charges against him. Despite these concerns, it’s obvious that Trump still holds strong favour with parts of the voting public. He has made selected public appearances such as at the UFC (pictured below) in November, whose viewing demographic seems to fit with his targeted voting demographic.

Donald Trump at the UFC in New York

Onshoring

Reshoring, nearshoring or onshoring, is the process of multinational companies establishing manufacturing operations within their home nation The process of onshoring operations can take time and usually requires significant investment. Since 2021, private companies have spent more than half a trillion dollars onshoring facilities back to the US, according to the White House.

US companies are increasingly looking to unwind over four decades of globalising operations. In a recent poll by Forbes and pollsters, Zogby, 55% of CEOs of US companies surveyed have plans to reshore their manufacturing operations[1].

Key motivations in companies committing significant time and money to onshoring, is to avoid the perceived elevated supply chain and geopolitical risks in manufacturing key components of their products in offshore locations. Covid and its associated shut-down of global economies raised questions regarding the effectiveness of global supply chains. This combined with developing geopolitical conflicts, such as the Ukraine-Russia war, the isolation of China by western nations, and the more recent instability in the Middle East, has highlighted the importance of manufacturing in (or close to) home markets.

Legislation passed since President Biden’s term began in the oval office has incentivised the establishment of US manufacturing, to support associated domestic economic and job growth. Specifically, the Infrastructure and Jobs Act, the Inflation Reduction Act (IRA), and the CHIPS and Science Act are all pieces of legislation that are driving the growth in onshoring of manufacturing in the US. They provide incentives for sectors such as semi-conductors, renewable generation components, EVs, etc. The development of these sectors is likely to spur the growth in other sectors which support these that are the focus of legislation. Importantly, for infrastructure investors, this economic growth will drive power demand growth as well.

Energy transition

The IRA also supports the widespread development and utilisation of a broad range of low/no fossil fuel technologies to expedite the energy transition and net zero goals. The seminal legislation was signed into law in August 2022, and is expected to deliver the US to a 40% greenhouse gas (GHG) reduction (compared to 2005) by 2030.

More detail on the legislation is included in our News & Views article, The Inflation Reduction Act will drive US' efforts towards net-zero. Utilities and independent power providers (IPPs) are supportive of the legislation in incentivising the adoption of renewable generation, batteries, carbon capture, clean(er) hydrogen, and driving investment. It’s very pertinent that Donald Trump is rumoured to be eager to tear up the legislation if he wins the upcoming election in 2024. Trump has an ideological view that global warming is not real, or at least overstated, and therefore the IRA represents a waste of money. It’s likely he will run for president on a mandate of maximising the US oil/gas industry through incentivising production.

Geopolitics

The Russian-Ukraine war began in February 2022, and continues with no signs of resolution. The ramifications for global energy markets of the embargoes on Russian commodities has been mitigated to some degree since the war began. Financial support for Ukraine from the US continues, but this is beginning to become a sensitive subject amongst US voters, who believe those funds are better utilised domestically.

The cold relationship with China, which was largely initiated under the Trump presidency, continues. There has been some relaxation with President Biden meeting President Xi at an adjacent meeting to the Asia-Pacific Economic Cooperation (APEC) meeting in November 2023. Biden did raise eyebrows when he referred to Xi as a dictator during the meetings, but analysts seem to suggest expectations were low and some progress on specific issues was made.

More recently the Israel-Palestine tensions have ignited. This has increased tensions domestically for the US, with protests by supporters of both sides. In addition, it’s feared that the tensions could escalate with the participation of other countries in the Middle East, destabilising the region and having serious political and economic impacts. With the Middle East being central to global oil/gas production, it’s feared that a widespread conflict could disrupt global energy supplies, which would create a tailwind for commodity and energy prices generally.

Economics

2023 defied many expectations, with a widely expected recession in the US never eventuating.

When inflation soared in 2021 and 2022 central banks globally, including the Fed, hiked rates aggressively. The easing of inflation in many developed markets was another surprise in 2023, with US CPI peaking over 9% and falling back to 3.2% as of October 2023. Six monthly annualised core CPI is now running under 3%.

While short-term rates moved up quickly as the Fed raised rates, long bond rates only started to move aggressively in the second half of 2023. From July 2023 the US ten-year rate went from 3.75% to peak at 5%, the highest since the GFC in 2007/08. Part of this was the market’s acceptance of a ‘higher for longer’ central bank stance to manage stickier inflation.

The market is currently pricing in c125bps of rate cuts for 2024 for the Fed, on the back of moderating economic and labour force data, but it’s ultimately a goldilocks scenario: not too hot and not too soft. While this has taken some heat out of the US ten-year yield (back to 4.2% in December), the long bond yield should remain elevated with the settling of inflation at higher levels than the 2010s averages, as well as higher government budget deficits and term premiums.

The US household has shown resilience among the rate hikes, supported by excess Covid savings (which depleted in Q3 2023) as well as a very tight labour market. Retail sales continued to surprise to the upside in 2023. This is particularly interesting considering cost of living concerns in large parts of the population, with significant cost increases since the Covid outbreak (in January 2020), such as electricity up 25%; natural gas up 26%; groceries up 25% and rent up 20%.

The consumer is feeling less of a pinch from higher mortgage rates, even with the cost of a 30-year mortgage around 7% (the highest since 2000), because 85% of US mortgages are fixed to the 30-year rate and haven’t experienced the increases.

Consensus forecasts sees US GDP growth moderating to 1.2% in 2024 from 2.4% this year, and a very hot Q3. CPI should fall back to below 3%, but will still be higher than historical averages, which should further take the pressure off households.

Communication towers

In Houston we met with the listed communications towers company, Crown Castle. Crown Castle differentiates its strategy from the other two listed US tower companies – it’s completely domestic focused and is delivering nonorganic growth through the rollout of small cell and fibre technology. This technology is intended to facilitate higher data demand levels through high frequency bandwidth, predominantly in urbanised areas. During the visit, we did a tour of downtown Houston with management to observe the small cell network installed in the area and see how it’s utilised.

Up until the beginning of November 2023, the three listed communications tower companies had experienced a long period of poor share price performance, which began between 18-24 months ago. The poor performance over this period was driven by a number of factors, including the initial high valuations of the companies; rising interest rates affecting their cost of debt and discount rates; reducing customer investment activity (that is activity by the mobile network operator (MNO)) post the initial roll-out of 5G; and contractual churn as a result of the merger between MNOs, Sprint and T-mobile.

Mobile network operators roll-out of 5G

There are three major MNO customers to the tower companies, with a fourth operator building out a mobile communications network. These MNOs have spent over $100 billion on C-band (or 5G) spectrum in the auction processes, which were held from early 2021 through 2022. Following these auctions, the MNOs were rapidly investing in the roll-out of updated antenna technology on tower assets to facilitate delivering 5G to customers. This technology update improves the leasing fees and services charges paid to the tower companies from the MNO customers.

Cown Castle management outlined their view that following the initial rapid roll-out of 5G antenna technology, the MNOs had established a basis national 5G network for customers, and therefore have begun to wind down their technology upgrade activity. The MNOs are still contracted to upgrade a certain number of towers with 5G technology, which will drive organic leasing growth for the tower companies out to at least 2027. Management confirmed that approximately 85% of organic leasing growth to 2027 from augmentation of 5G technology was contractually locked in with MNOs.

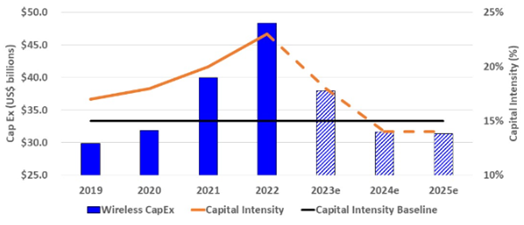

Annual MNO capital investment in wireless mainly for 5G as at 1Q23

Source: Company accounts and Inside Towers Intelligence

To varying degrees, the MNOs have been inhibited from investing in updating 5G antenna technology because of constrained balance sheets. The rapid rise in interest rates has impeded free cashflow growth of the MNOs, placing pressure on balance sheets and the ability to raise reasonably priced debt to finance investment. There have been other issues raising market concerns for MNOs financial viability, such as potential legal liabilities associated with legacy lead covered cables. This issue has dissipated in recent months compared to when it was first raised in the media and by analysts.

Further information and other key themes on communications towers can be found in the PDF version of this article.

Midstream oil/gas

We spent several days in Houston, Texas and Tulsa, Oklahoma meeting key oil/gas midstream companies. It’s clear that the economies of these cities are very much driven by the oil/gas sector (see picture from Tulsa Airport below). Shareholder returns of midstream companies in the year-to-date have largely been strong, with few outliers. After a strong 2023 we wanted to explore if valuations were getting stretched going into 2024; what the likely drivers of cashflow growth would be; and what companies intended to prioritise for cashflow allocation.

Mural depicting Oklahoma’s oil/gas drilling past at Tulsa International Airport. Source: 4D Infrastructure

Strong cashflow and solid balance sheets

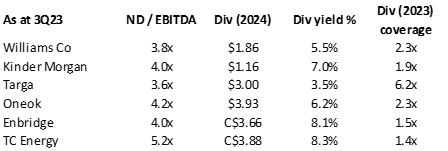

Unlike pre-Covid times, North American midstream companies generally now have strong balance sheets and are producing free cashflows, often after consideration of discretionary capital investment. This provides flexibility for companies to withstand operational challenges, and finance capital investment opportunities. A summary of gearing levels, dividend yields, and dividend coverage ratios are summarised in the table below. Dividend coverage ratios exclude discretionary capital investments, but with dividend coverage close to and above 2x, companies are able to significantly finance their capital programs without accessing capital markets.

Source: 4D Infrastructure

A key question for various management teams is - what do companies do with the excess free cashflow? The unanimous preferred option was to invest in growth projects associated with their existing business strategy to maximise future earnings growth. Making organic investments in existing networks which enhance capacity for low capital cost, provides companies attractive returns on invested capital (ROIC). This is also low risk investment, as companies are investing in enhancements where they have strong visibility on demand dynamics, and lower permitting requirements than greenfield projects.

Beyond these discretionary investments, companies varied on their preferred allocation of excess cashflow. Companies like Williams Co and Kinder Morgan opted to grow dividends at levels consistent with the recent past – within 2-5% annually. They were happy to retain some cash to reduce debt gearing levels in light of the high interest rate environment. Gearing levels (as measured by net debt/adj EBITDA) of Williams Co and Kinder Morgan as at Q3 2023 were 3.5x and 4.0x respectively, which were below their communicated target levels of 4.0x - 4.5x.

Targa Resources communicated a big increase in their dividend. This follows Targa management’s prudent decision to cut the dividend 90% during the Covid pandemic, in order to rapidly reduce debt in light of concerns around lack of NGL volumes being utilised by the company’s assets when oil prices went negative in April 2020. With the balance sheet in a much healthier position, and volumes and earnings having grown significantly, management felt it was the right time to re-establish the dividend to a reasonable level, increasing it 50%, to a payout ratio of 40-50%. Targa management outlined the significant investment needs through 2023 and 2024, but that 2025 would represent a step-down in capital requirements.

Further information and other key themes affecting midstream oil/gas can be found in the PDF version of this article.

Electric and gas utilities

Most engagement with electric and gas utility companies occurred during the Edison Electric Institute (EEI) Conference, which was held over three days just outside Phoenix, Arizona. We had 16 meetings over the three-day period with companies based across the US.

Rewinding approximately 12 months to our attendance at the 2022 EEI Financial Conference, the messaging from companies was that they were expecting significant headwinds to financial performance in 2023, including high inflation, rising interest rates, and more scrutiny from regulatory commissions due to customer affordability concerns. At the time, some companies communicated confidence in being able to ‘pull levers’ to navigate these challenges and deliver upon long-term earnings guidance. Others had less flexibility, or greater challenges, and so were more bearish on the 2023 earnings outlook. A few companies announced strategic reviews, with the intention to divest non-core assets and repair balance sheets.

The messaging from companies at this year’s EEI conference was a lot more optimistic. Energy demand in the US is expected to be strong over the medium term, driven by growing commercial and industrial (C&I) demand associated with onshoring of certain industries, and the buildout of data centres. This should support investment growth and provide a tailwind to earnings for some companies in 2024. It also diminishes the concerns of regulatory bodies around customer affordability – by sharing the network’s fixed cost base with new, high load demand customers.

Strong load demand growth

The overwhelming message from companies at the EEI conference was their expectation for a step-change in load demand across multiple parts of the country. This strong net load demand growth was expected with C&I customer load growth surpassing a slight fall in demand from residential customers across most jurisdictions. Residential load demand is expected to be impacted by continued implementation of ‘return to work’ policies following covid-19, combined with energy efficiency efforts.

Companies outlined that the C&I load demand was partially driven by government legislation incentivising the establishment of manufacturing facilities in the US, especially for specific industries such as technology (outlined above).

The strongest load demand growth was expected from utilities operating in the Midwest and southern states. The southern states were experiencing the aforementioned manufacturing demand growth, and also benefitted from net migration inflow of the domestic population. Specific examples of C&I and retail load growth includes:

- American Electric Power - increased 2023 normalised retail sales growth from 0.8% to 2.3%, largely driven by increased commercial growth from 0.8% to 7.3%. The company also doubled 2024 and 2025 retail sales growth to 1.7% and 3.3% respectively.

- Sempra - Texas power market, ERCOT, set 10 peak demand records in summer 2023, with a new all-time peak of 85 GW, representing 16% growth since 2018. Significant C&I growth in Oncor service territory evidenced by ~34% year-over-year increase in active transmission point of interconnection requests.

- WEC Energy - communicated strong manufacturing developments within its jurisdiction including Microsoft, Foxconn, and Amazon. Long-term retail power sales growth of 4.5% - 5.0% pa expected.

- Pinnacle West Capital – have communicated long-term demand growth expectations of 4.5% - 6.5%, driven by customer premises growth and manufacturing developments by companies such as a Taiwan Semiconductor company, Proctor & Gamble, Air Products & Chemicals, and KORE Power.

Updated investment plans

As is normal practice, many companies updated their multi-year capital investment guidance at the EEI conference. Others will update their guidance on Q4 calls, which occur early in 2024, but did give indications as to the size of forecasted capital programs.

Almost unanimously, companies communicated significantly increased capital investment programs. The drivers of the increased investment programs include the aforementioned increased load growth; strong decarbonisation efforts supported by legislation; resiliency investment in light of storms and wildfires; and the impact of high inflation on regular replacement investment.

This increased capital investment is expected to support rate base growth at high single digits over the next five years or so. The improved rate base growth didn’t really result in improved EPS growth expectations. Over recent years, companies have generally converged EPS growth guidance over the forward five year to between 5-8%. Based on the improved rate base growth expectations, management teams pointed expectations to the upper half of this range. EPS growth was moderated by increased expectations for equity issuances to finance the increased capital plans, while maintaining balance sheet credit ratings.

Further information and other key themes affecting electric and gas utilities can be found in the PDF version of this article.

Water utilities

American Water Works (AWK) attended the EEI Conference, which seemed a wise decision considering it was one of only two water companies to attend, so received significant investor attention. The messaging from management was – 1) increasing water/wastewater regulation was increasing pressure on small municipal water networks to amalgamate with larger players; 2) continued asset replacement investment was required; and 3) there was a legislative focus on reducing the intensity of ‘forever chemicals’ in water which would require upfront investment and ongoing management costs.

Continued strong investment drivers

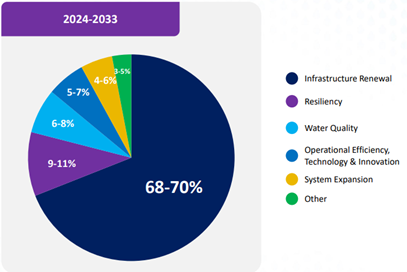

AWK outlined confidence in the continued investment needs of its various networks, and the capacity to grow rate base and earnings. It updated its five and 10-year capital plans, which increased $2 billion and $4 billion respectively since the last guidance provided by the company. The 10-year capital plan of $34 - $38 billion (excluding regulated acquisitions of municipal networks) to 2033 is expected to be the key driver of rate base growth 8-9%. This rate base growth incorporates an allocation to municipal network acquisitions, but still represents one of the stronger growth rates of any utility.

The drivers of investment focus on asset renewal, with many areas of the US water network in bad condition. AWK’s efforts in improving the asset quality makes up approximately 70% of its 10-year capital plan. The requirement for this investment is well understood by regulatory bodies, and the likelihood of rejection is low. Most scrutiny will be in ensuring the investment is cost-efficient, and affordability for customers is maintained. Some of the other drivers of investment are graphed below.

Source: American Water Works investor presentation

Further information and other key themes affecting water utilities can be found in the PDF version of this article.

Increasing optimism for US infrastructure

Share price performance of all US infrastructure sub sectors, excluding midstream oil/gas, was disappointing over the course of 2023. The share price reaction was potentially associated with weaker earnings expectations through the year for some companies, but for many names, the negative share price reaction was despite delivering consistent earnings growth.

No doubt increasing US treasury bond yields increased valuation discount rate expectations through the course of the year. Higher discount rates deflated valuations of many listed infrastructure companies, more so than the rest of the market, with capital intensive sectors such as regulated utilities and tower communication companies most penalised by investors.

Looking into 2024, management teams seem less concerned about negative impacts of cost inflation and rising interest rates on earnings expectations. They were buoyed by the prospect for rates to decline in 2024, and the potential for strong load growth from manufacturing, data centres and the tech sector generally.

- Towers communication: concerns regarding the capacity of MNO customers to invest in the continued roll-out of 5G raised questions regarding the domestic leasing growth potential for tower companies in 2023. Some MNOs are now looking more financially healthy, which reduces this risk in 2024. Although, the impact of contractual churn from the T-mobile/Sprint merger will continue to dampen earnings. The potential for long-term growth from small cells needs to be proven out over time.

- Midstream oil/gas: companies are optimistic going into 2024 based on the continued demand for oil, gas and NGLs in light of strong domestic demand for energy, and overseas supply concerns associated with geopolitical tensions. The sector is well positioned, with companies largely within their debt gearing targets, and with expectation of strong cashflow generation to be maintained.

- Utilities: plateauing and potentially falling interest rates in 2024 should be supportive of valuations, which are currently at the lowest point since the start of Covid. This, combined with moderating regulatory concerns and strong earnings drivers, should provide a strong year for shareholder returns.

At current valuations, a number of US infrastructure companies offer attractive implied shareholder returns. We prefer companies that offer quality asset exposures, predictable and steady earnings growth, and are valued below their estimated intrinsic value.

[1] https://www.globenewswire.com/news-release/2023/01/10/2586151/0/en/Accelerating-Reshoring-Strategies-Spur-CEOs-To-Modernize-America-s-Vast-Manufacturing-Industry-The-Latest-Building-American-Manufacturing-Resilience-Poll-With-Forbes-And-Zogby-Reve.html

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.