This is the abridged version of the article, which can be read in full here.

Observations across the region were mixed. The region’s long-term structural thematics remain firmly intact with the listed Infrastructure asset class benefiting from enduring secular tailwinds, including favourable demographic trends, a rising middle class, ongoing urbanization, the energy transition, and accelerating digitization. However, as always stock selection remains key as the array of opportunities come with increasing risk as a result of domestic politics, geopolitical tensions, and evolving economic policies and trade.

This piece outlines the key themes and takeaways from the trip, and how these have shifted our investment strategy across the region.

Politics

Trump

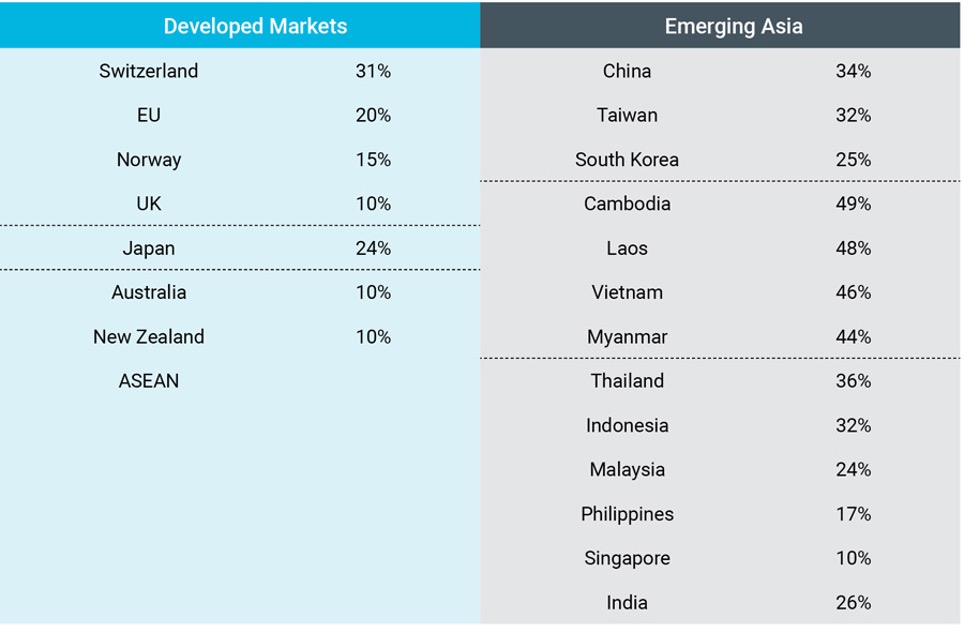

As we commenced this trip President Trump announced his ‘Liberation Day’ tariffs. The announced tariffs were far more aggressive than most bear cases, with a 10% Universal Base Tariff (as expected), very high reciprocal tariffs on 27 countries and the EU block, as well as ending De Minimis exemptions (which allow duty free goods entry under USD$800, typically from China and Hong Kong). No region was more impacted than Asia and in particular Emerging Asia. As such, it was an interesting time to be travelling through the region.

Country level Liberation Day Tariffs

Source: DBS, White House

Source: DBS, White House

Immediate concern gave way to wary optimism as Trump paused implementation awaiting trade negotiations. However, the tariff level and impact to the in-region economies remained and remains a core overhang. As such, we look to prioritise investment opportunities in countries, sectors and companies that have relatively resilient fundamentals and/or are more immune to the impact of tariffs.

Vulnerabilities from proposed reciprocal tariffs

Source: DBS, CEIC

Source: DBS, CEIC

The question was posed to all companies regarding the impact of these tariffs, aiming to assess their effects on operations, earnings, and supply chain management. The direct and indirect impacts vary by sector, regional exposure, and pre-emptive mitigation strategies. While global trade faces significant challenges, it is not disappearing; rather, it is transforming.

We recently published an article News & Views: Are we there yet?! Assessing Trump’s tariff policies, the impact on the economy and global listed infrastructure. As such we will not go into detail on this theme here except as it directly impacted corporate-level discussions.

Malaysia

Malaysia’s domestic landscape feels relatively stable under Prime Minister Anwar Ibrahim’s unity government. The 2023 state elections maintained the status quo, with Anwar’s coalition holding key states, although the opposition Perikatan Nasional (PN) made notable inroads in Malay-majority areas, highlighting a polarized electorate. We did not observe any domestic political unrest or disharmony with the heightened tension with the US the key near term concern for domestic politics.

Malaysia is still viewed as a potential ‘China +1’ beneficiary, but progress remains slow amid uncertainty over a cohesive national strategy. Public sentiment remains cautiously optimistic, underpinned by ongoing reforms and efforts to strengthen regional economic ties, including the expected finalization of the ASEAN-China free trade agreement. Further, in an effort to attract foreign investment, the government introduced Budget 2025, which includes tax incentives for high-value sectors and, notably, infrastructure development. However, competition from regional peers and persistent bureaucratic hurdles continue to weigh on investor confidence, limiting the near-term upside of the policy.

The weakening ringgit continues to be an overhang and while there is speculation about potential capital controls, no concrete policy action has been taken.

Thailand

Thailand continues to face underlying political tension following the 2023 election, in which the progressive Move Forward Party (MFP) was prevented from forming a government despite winning the popular vote. In August 2024 the Constitutional Court dissolved the MFP and banned its leaders from politics for a decade, citing their push to reform the lèse-majesté law - a major blow to progressive politics. Pheu Thai, led by Paetongtarn Shinawatra, subsequently formed a coalition government with conservative and military-aligned parties, a strategic reinforcing of existing power structures and deepening concerns over democratic backsliding.

While political uncertainty and bureaucratic inertia continue to weigh on foreign investment public sentiment remains relatively calm, supported by a steady post-COVID tourism recovery. However, a major concern for us post this trip was the increased government intervention across key sectors, particularly where cost-of-living pressures or an economic recovery agenda have driven short-term populist policies. We observed damaging policies enforced upon the Airport, Expressway, Rail, and Utilities sectors, which have not only eroded company earnings but could also reshape the structure of concessions and contracts in certain sectors going forward. This was a key negative from this trip and the current political overhang sees us question Thailand as an investment destination over the near term.

Hong Kong/China

Hong Kong continues to operate as a hybrid jurisdiction, functionally distinct yet politically aligned with Beijing. While the mainland’s presence remains influential, it has become more institutionalised and less visible in day-to-day affairs. It felt like the post-COVID business environment has stabilised, supported by resumed cross-border activity and an influx of high-net-worth mainland Chinese residents, which is reshaping demand in property, retail, and education. The expatriate outflow has slowed, but the city’s demographic and economic profile continues to evolve.

On the mainland, confidence remains fragile amid regulatory unpredictability and ongoing geopolitical tensions. However, targeted policy support for strategic sectors—particularly AI, green tech, and advanced manufacturing—is creating pockets of opportunity. The feel on the ground had definitely taken a further step forward from our trip in 2024 with increased confidence that structural government stimulus would be used to stabilise the outlook.

Infrastructure remains a bright spot across both Hong Kong and China, buoyed by Greater Bay Area integration and a renewed push into transport, logistics, and clean energy. These investments offer clearer visibility and long-duration potential for long-term capital, particularly where they align with national priorities.

Philippines

The Philippines continues to navigate a complex political landscape, marked by deepening divisions within its leadership. In the 2022 presidential election, Ferdinand Marcos Jr. won decisively with 58.8% of the vote, defeating Leni Robredo, who garnered 27.9%. However, the once-powerful alliance between the Marcos and Duterte families has fractured. Vice President Duterte now faces impeachment proceedings over allegations of corruption and threats against President Marcos, highlighting a significant rift between the two factions. This political breakdown adds uncertainty ahead of the May 2025 general election, which will reshape the composition of Congress and local governments.

A win for the current regime would be a boost for infrastructure. The Marcos administration continues to prioritize infrastructure as a cornerstone of economic growth through its ‘Build Better More’ (BBM) program. The 2025 national budget allocates ₱1.03 trillion (USD 18.7 billion) to public works, representing over 5% of GDP. This supports 194 Infrastructure Flagship Projects (IFPs) valued at ₱9.54 trillion (USD 163 billion), spanning transportation, energy, digital infrastructure, water, and agriculture. To attract foreign investment, the government has opened several infrastructure-related sectors to 100% foreign ownership and is advancing public-private partnerships (PPPs), with over ₱50 billion in projects expected to be awarded by year-end. These efforts aim to improve connectivity, drive economic activity, and strengthen the Philippines’ appeal as a regional investment hub. It felt like the country was in a holding pattern until a political agenda could be defined but we remain hopeful that Marcos’ goals can be realised.

Indonesia

Following the 2024 election, Prabowo Subianto assumed the presidency with strong backing from outgoing President Joko Widodo, signalling broad policy continuity. While concerns remain over Prabowo’s military past, markets have responded positively to his emphasis on stability and growth.

He has set an ambitious target of achieving 8% annual GDP growth by 2029, up from the current rate of approximately 5%. To fund his administration’s expansive programs, some of which have drawn criticism over affordability and logistics, the government has introduced austerity measures totalling around US$19 billion, affecting sectors including education, health, infrastructure, and the public service. Notably, infrastructure spending has been cut sharply in 2025, with the Ministry of Public Works’ budget reduced by over 70% - a Rp81 trillion (approximately $5 billion) drop - leading to suspended toll road and maintenance projects and the furloughing of thousands of contract workers. This shift places greater importance on alternative financing models, particularly from the private sector, and highlights the need for stronger regulatory certainty to maintain momentum in infrastructure development.

A key structural reform is the launch of the sovereign wealth fund, Daya Anagata Nusantara (Danantara), which aims to consolidate and optimise state-owned assets to attract investment and build long-term resilience. While we remain cautious on issues of transparency and political influence, beyond the supervisory board, the managing, advisory, and steering committees are composed entirely of seasoned professionals from the private sector, both domestic and international, which suggests potential for more commercially driven outcomes. Danantara’s performance will serve as an early indicator of the administration’s commitment to institutional reform and could make or break this administration.

Economics

Malaysia

Economic headwinds have emerged, including potential US tariffs and a revised 2025 GDP growth forecast that now falls below the original 4.5%–5.5% target. Inflation is expected to rise moderately to between 2.0-3.5%, driven by subsidy reforms, while Bank Negara Malaysia has held its key rate at 3.0%, with a possible cut later this year.

The tourism sector is recovering steadily, aided by momentum ahead of “Visit Malaysia 2026” - aiming to attract 45 million international visitors and generate ~USD 61 billion in tourism receipts.

Fiscal reforms, including targeted fuel subsidies and new taxes, aim to reduce the deficit, but foreign investors remain cautious amid political uncertainty and bureaucratic hurdles.

The feel on the ground was one of relative calm, albeit news flow on US tariffs dominated discussions with a real risk to the Malaysian economic outlook should they proceed as announced.

Thailand

We would describe the feel in Bangkok as cautiously optimistic amid the ongoing global trade uncertainties and ongoing political instability. The growth outlook is relatively muted, with the Finance Ministry recently downgrading its GDP growth forecast to 2.1% (from 3.5%), citing headwinds from US tariffs and a slowing global economy. The IMF is even more conservative, projecting just 1.8% growth, the lowest among ASEAN peers, due to high household debt and trade exposure. However, with levers to pull, the Bank of Thailand has cut its key interest rate to 1.75%, a two-year low, to stimulate domestic activity. Inflation remains muted, with a projected rate of just 0.5%, well below the central bank’s 1-3% target range.

While Thailand positions itself as a viable ‘China +1’ alternative, foreign investment has lagged, hampered by political uncertainty and bureaucratic inertia that have driven some investors toward more stable regional markets.

Tourism, a key economic pillar, continues its recovery but has yet to return to pre-pandemic levels. Key tourist destinations in Bangkok were busy, much more so than 12 months ago, giving credence to the ongoing return of the tourist. However, a recent Chinese tourist kidnapping had dampened the return of Chinese tourists with expectations that this incident would remain an overhang for the next few months until trust could be rebuilt in its safety as a tourism destination.

Hong Kong

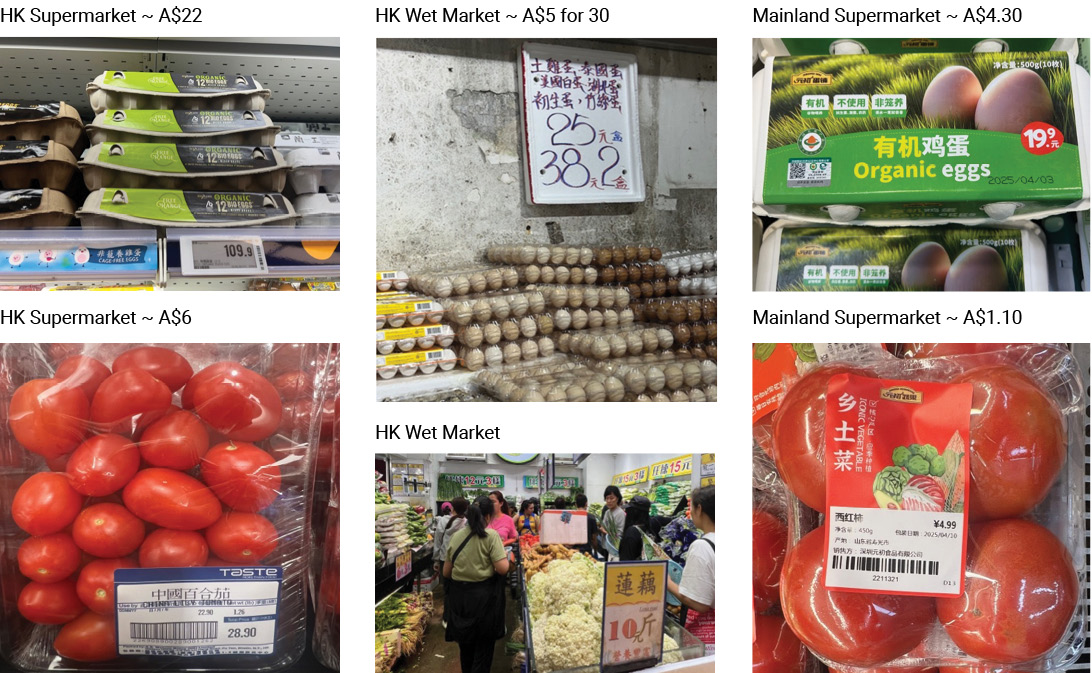

The feel in Hong Kong was well articulated by one management team that stated “Everything in HK is expensive except for the stocks”. Affordability remains a big issue but with a growing divide between locals and expat living. Restaurants and grocery stores again shocked with their pricing while a visit to wet markets offered some insight into how the populous survives.

The disconnect between pricing in HK versus the mainland has enticed many living in HK to travel to Shenzhen each weekend to eat, shop and (strangely) get massages. In some extreme cases we heard of people relocating to the mainland and commuting to HK daily via high speed rail connections or metro. This option was a much more affordable option than living in HK, despite Shenzhen being one of the more expensive Tier One cities in China. This is a significant reversal from pre COVID when mainland residents use to flock to HK for luxury goods and cheap weekends away.

China

China continues with a measured economic strategy, favouring targeted stimulus over large-scale interventions to promote long-term sustainability. Small-scale bursts are aimed at stabilising sectors like manufacturing and real estate without exacerbating fiscal deficits.

While on the ground US tariffs reached up to 145% on Chinese goods. Interestingly, there was little concern, with many flagging that US exports is not a big driver of Chinese GDP (at less than 3% of GDP) and a real consensus view that there was a lot that the Central government could do and would do to support the domestic economy without giving in to Trump threats. Conversations with brokers, strategists, and corporates suggested that while the situation remains fluid, their base case assumes tariffs around the 60% level (aligned with Trump’s campaign rhetoric) - viewing any level above as downside risk, and anything below as a potential upside surprise.

Beijing is employing strategies to mitigate the impact, including supporting exporters and bolstering domestic demand. Central to this effort is the ‘dual circulation’ strategy, which emphasizes strengthening the domestic market while maintaining foreign trade. Additionally, China's focus on the ‘New Trio’ (advanced manufacturing, renewable energy, and high-tech industries) underscores its commitment to transitioning towards a more resilient and innovation-driven economy. We heard many reports around the strength of the EV manufacturing base in China with some strong initiatives to support EV ownership in the developing world through the production of a low cost, high value vehicles at a cost of <USD$20k to the end user. These vehicles, as well as the better known BYD, were prevalent on the roads. We view a strategy to target 85% of the global population while supporting a greener future and global net zero targets as a very positive one. Interestingly, just post the trip, BYD Shenzhen (the world’s largest car carrier with 9,200 standard loading spaces) undertook its maiden voyage transporting 7,000 BYD vehicles to Brazil.

The Central government is targeting ‘around 5%’ GDP growth, slightly ahead of the IMF’s 4.6% forecast. The IMF have reiterated China’s need to shift away from its export-driven economic model, emphasizing the importance of transitioning to a consumption-led economy, resolving challenges in the property sector, expanding the services sector, and reducing state intervention in economic activities.

Philippines

Despite ongoing political challenges, the Philippines’ economic outlook remains positive. Although the IMF recently revised its 2025 growth forecast down to 5.5% (from 6.1%), the economy continues to be supported by strong household consumption, a resilient services sector, and improved trade dynamics. Inflation has eased sharply, falling to a five-year low of 1.4% in April 2025, primarily due to declining food and transport costs. This has provided the Bangko Sentral ng Pilipinas (BSP) room to adopt a more accommodative monetary policy stance, resuming its easing cycle with a 25-basis point cut to bring the policy rate to 5.5%. The Philippine peso has also strengthened, buoyed by favourable investor sentiment and a weaker US dollar. Looking ahead, the government's record budget for 2025, with significant allocations for education and infrastructure, is expected to underpin economic growth and contribute to poverty reduction.

The major overhang is the US tariffs which, like their peers, could definitely see some downgrades to the current exuberance. Importantly, on a relative basis, the Philippines feels like it has more to play with.

Indonesia

Indonesia’s economic outlook reflects a balance of ambition and caution. The Prabowo administration has set a GDP growth target of 5.2%, supported by continued infrastructure investment and expanded social programs. However, the IMF’s forecast is more conservative at 4.7%, citing external trade pressures and domestic fiscal limitations. While the government maintains a long-term goal of achieving 8% annual growth by 2029, near-term progress will depend on prudent policy execution amid global uncertainty.

The launch of a new sovereign wealth fund (Danantara), aimed at consolidating state-owned assets and attracting long-term investment, and modelled on Singapore’s Temasek, is an interesting development. The fund aspires to manage up to $900 billion in assets and draw in significant global capital. Despite the very recent establishment of Danantara, the consensus view from companies and investors alike was that it was a positive development supporting further development of the infrastructure sector and economy alike, without further pressure on government budgets.

Infrastructure

While the Asian infrastructure landscape remains dynamic in 2025, key themes have emerged and evolved. Our latest observations highlight several interesting trends, including:

- Energy: Growing power demand, supportive policy, the energy transition and rise of technology remain dominant regional themes, with the focus now firmly on execution over ambition. As with elsewhere in the world, Asian utilities are working to scale generation, decarbonise portfolios, and/or invest in network infrastructure, all while managing the pressures of affordability, supply security, and sustainability. The investment opportunity lies in multi-decade development pipelines, underpinned by network augmentation, growing or greening the generation fleet, and rising power consumption. If executed well, these factors can support incremental and long-term earnings growth. However, the question of ‘who pays’ (governments, consumers, or investors) and quantifying an acceptable level of bill-shock, remain central to investment risk and return.

- Airports: Despite persistent global affordability challenges, travel momentum remains strong, supported by pent-up demand, competitive fares, and structural shifts in consumer behaviour post-COVID. While Chinese outbound tourism remains slower than expected, regional markets—particularly in Southeast Asia—are driving growth. We note especially strong premium segment demand and record load factors across key hubs, supporting ongoing passenger and earnings momentum through at least 2025.

- Ports: Throughput growth, while moderating, remains solid. However, the current operating environment makes it challenging to distinguish between underlying organic growth and volumes driven by the front-loading of orders to circumvent US tariffs. Global trade is evolving in response to rising nationalism, reimposition and potential escalation of trade wars and geopolitical tensions, creating both challenges and opportunities for port operators. While no operator is entirely immune, those with diversified port portfolios (as opposed to single-port operators) and a greater composition of gateway throughput tend to be more resilient and better positioned to adapt across a range of trade or economic scenarios.

- Transport: Expressways and rail remain vital arteries for the movement of passengers and goods, supporting economic growth and regional integration. For the most part, traffic and ridership have normalised post-pandemic, with investment focus shifting toward capacity upgrades, network expansion, and operational efficiency. In road infrastructure, traffic growth remains steady, driven by growing MV penetration, urban congestion and both greenfield and brownfield expansion. In rail, intercity and regional projects continue to advance, though funding structures and execution timelines vary. Asset performance will increasingly hinge on demand predictability, regulatory clarity, and the ability to monetise ancillary opportunities.

- Communications: The rise of data infrastructure remains a major global theme, underpinned by sustained demand for high-speed connectivity, fiber backhaul, data centres, and cloud services. New tower and tenancy growth has moderated between investment cycles, and tower companies are increasingly investing in ancillary services that leverage existing infrastructure and customer relationships to either enhance revenue per tower or create alternate income streams. While regional execution varies, the long-term fundamentals remain solid, underpinned by 5G expansion, fiber rollout, small cell deployment, and how to future-proof assets to capture the next wave of digital connectivity.

We touch on each of these in detail in the full article, which can be read here.

Tariffs

At the time of writing the scope and scale of the proposed tariffs have surprised markets and triggered immediate disruption to global shipping and trade activity. Port operators had largely anticipated that trade negotiations would remain focused on China, Canada, and Mexico. However, they were caught off guard by the announcement of a worldwide blanket 10% baseline tariff on all imports, alongside differentiated rates targeting specific countries. This broad-based strategy has introduced a new layer of uncertainty to global trade flows and container logistics, with far-reaching implications for pricing, routing, and demand. The impacts are multifaceted:

- Manufacturers are accelerating shipments or re-routing trade flows, pushing up short-term freight rates.

- Bonded warehouse capacity is increasingly stretched, as businesses rush to clear goods ahead of tariff implementation.

- Some shippers are delaying cargo movement, awaiting clearer policy guidance or clarity on potential retaliatory tariffs.

- Trade volumes are expected to enter a period of volatility and realignment, disrupting established shipping lanes and rate structures.

- These dynamics are likely to contribute to congestion, delays, and broader inefficiencies across the supply chain.

Supply chain experts caution that reconfiguring supplier networks is a long-term undertaking. It is not a matter of simply switching to new producers as full relocation and network establishment can take years. This hesitancy is further compounded by political uncertainty, with many manufacturers reluctant to commit to long-term investments that may be unwound after the conclusion of President Trump’s current (and arguably final) term.

In response to escalating trade tensions, port operators have moved swiftly to assess their exposure either across the entire network or at key terminals. CMP reports minimal direct exposure to the US (<5%), though it acknowledges rising indirect risks from Southeast Asia-US trade flows. CSP similarly cites limited direct exposure (~5%) but expressed heightened concerns under the Trump 2.0 tariff regime, particularly as 80% of flows transit through Southeast Asian countries, with a substantial portion ultimately bound for the US. ICTSI noted that its US exposure is modest, with only 15% of total exports destined there. A deep dive into its Mexican operations revealed that, while 60% of imports are from China, only one-third are routed to manufacturing hubs in northern parts of Mexico, and of these, just half eventually reach the US. This translates to around 6% direct exposure at its Mexican terminals, with the remainder consumed domestically or re-exported. WPRTS acknowledged the broader economic and social disruptions stemming from tariffs, citing early evidence of consumer boycotts in Malaysia. While these developments may pressure its throughput guidance, management’s primary concern is that sustained aggressive tariffs could dampen global growth, potentially escalating into a container volume recession should broader economic conditions deteriorate.

Portfolio positions

Despite ever-evolving political and economic headwinds across the globe, this trip sees us reaffirm our investment in the Asian region. We have factored in the risks and believe the value proposition of the quality infrastructure names continue to be very attractive.

In summary:

- Energy: A growing middle class, a global desire for a greener future and the increasing importance of technology in everyday life makes for a huge investment opportunity globally, including Asia. However, as investors we seek not only growth but reliable returns which limits the current regional investment universe to Malaysia where we are increasingly confident in the development of this sector in a shareholder-friendly way. By contrast, despite an improved regulatory outlook, we see increasing structural headwinds in the Chinese gas sector making it relatively less attractive than historically. Elsewhere we see ongoing regulatory hurdles across the region that need to be resolved before we would look to take a position.

- Airports: Asia is a driver of global air passenger growth seeing a structural need for increased airport capacity globally. Unfortunately, we do not see an attractive way to play this thematic in the region, but rather gain our exposure via destination airports in Europe and those Asian airports under European ownership (Vinci owns a global airport network including assets in Japan and Cambodia which are both benefiting from Asian tourism).

- Ports: Sentiment and uncertainty around tariffs and trade routes remains a significant headwind for the port sector in the near term. However, we were surprisingly positive on the fundamentals of the core operators we met with, particularly those prioritising diversity in gateway locations while structurally mitigating US exposure.

- Toll roads: The rise of the middle class remains a core theme across the region, and we believe toll roads are a fantastic way to capitalise on this evolution – both passenger and heavy vehicle travel momentum supported by a growing middle class and improving economic outlook. Further, the opportunity for more growth in the sector provides upside support – roads are core to economic evolution. We favour Indonesian toll road operator Jasa Marga and the Chinese operators exposed to the relatively resilient Tier 1 cities such as Shenzhen International and those operators capitalising on supportive regulatory change such as Jiangsu Expressway.

- Communications: Not all tower companies are created equal. While the opportunity set of 5G and data is universal, the framework and ability to execute is disparate. Within the Asian space we favour Mitratel in Indonesia who has the geographic footprint, asset quality, balance sheet, and strong management team to truly capitalise on the opportunity. However, we still see better relative tower value in other regions where MNO consolidation and spectrum issues are not a headwind.

- Yield: This trip again highlighted the importance of yield to the domestic investor, particularly in China. While we (like most investors) like yield, more important to our investment decision is fundamental value, total return, and quality.

- Thailand: A comment on Thailand as this trip highlighted the detriment of government intervention in the infrastructure sector at the expense of shareholder value. A clear take away was that we don’t see an opportunity to invest in Thailand under the current regime.

As always, we maintain a diversified portfolio of high-quality infrastructure names globally, and at the moment, believe parts of Asia are offering an attractive mix of quality and value while other areas are less attractive than has historically been the case.

To view the full article, download the article below.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.