In his annual letter to investors, released on 24 February 2024, Warren Buffett drew the public’s attention to the increasing wildfire risk that electric utility investors in parts of the US are exposed to.

He confirmed this risk had negative ramifications on essential investment required to support utilities and communities alike. This messaging was further reinforced by the experience of Xcel Energy, who in early March confirmed that its assets in Texas were likely responsible for the ignition of the Smokehouse Creek wildfire.

Strong words from Buffet on an increasingly concerning utility risk

Buffett drew broader investor attention to an issue which is already well understood by US utility investors, attributing the poor performance of Berkshire Hathaway Energy (BHE) to increased wildfire risk - to “the regulatory climate in a few [US] states has raised the spectre of zero profitability or even bankruptcy (an actual outcome at California’s largest utility and a current threat in Hawaii)”.

This was in reference to BHE’s utility company, PacifiCorp (referenced in the previous article listed above), which BHE believes is facing at least $8 billion in legal liability claims associated with fires it allegedly ignited in October 2020[1]. The scale of such potential liabilities obviously raises the question of the financial viability of PacifiCorp.

To this Buffett stated, “At Berkshire, we have made a best estimate for the amount of losses that have occurred. These costs arose from forest fires, whose frequency and intensity have increased – and will likely continue to increase – if convective storms become more frequent”.

Importantly, with regard to BHE’s appetite in bailing out the company from financial distress Buffett stated, “Berkshire can sustain financial surprises but we will not knowingly throw good money after bad”[2].

This should be a major concern for legislators and regulators in exposed states, as an electric utility in financial distress (potentially bankruptcy proceedings) will struggle to attract investment capital and service its customers. This is particularly important in the current environment, with massive capital investment required to support the energy transition and power demands of AI and data centres. Indeed, Buffet recognises the investment proposition on which utilities were historically based could be in question, “Now, the fixed-but-satisfactory return pact has been broken in a few states, and investors are becoming apprehensive that such ruptures may spread”.

Xcel Energy the latest utility at risk

Shortly after the release of Buffett’s investor letter, Xcel Energy confirmed that its assets are likely to have ignited the Smokehouse Creek wildfire in Texas. A lawsuit against the company has claimed that one of the company’s utility poles near Stinnett, Texas, had been blown over by strong winds sparking the initial blaze.

The fire based in the largely rural Texas panhandle and parts of Oklahoma burnt around 1.2 million acres, destroyed 400-500 structures, and is associated with two casualties. Despite it being too early to understand the potential legal liabilities facing the company, Xcel Energy’s share price fell 17% (representing a c.US$6 billion devaluation in market capitalisation) in the week after media reports implicated the company in the fire. This again reinforced the risk facing electric utility investors from the unintended ignition of wildfires.

The states, and therefore companies, physically exposed

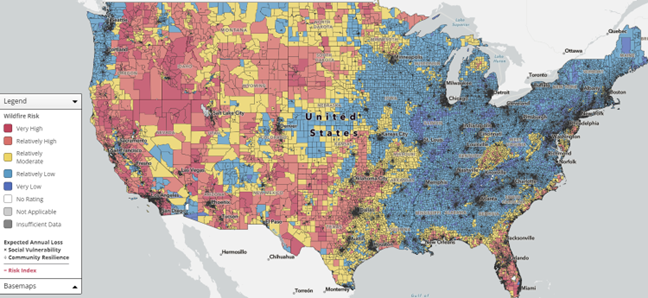

One major problem in identifying wildfire risk is that the geographies exposed to wildfires are increasing over time as a result of global warming – which we touch on in our article, Extreme weather risks and their impact on investors. Despite the increasing occurrence, the states that are currently most exposed to wildfires are depicted by UBS below, utilising data provided by FEMA on the National Risk Index. The map shows that the highest risk areas are in the western, central and southern parts of the US.

Source: California Board of Forestry and Fire Protection (CAL Fire)

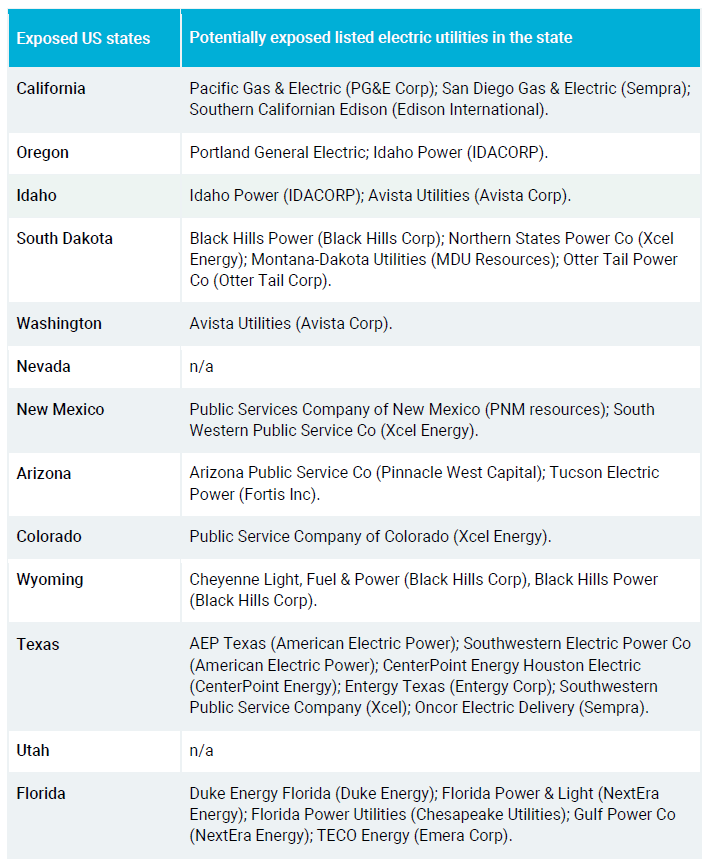

The map helps identify states that are most exposed to wildfires, and the utilities which have significant operations in those states (listed in the table below). This provides a first pass as to utilities in 4D’s investment universe which have/could have risk from wildfires.

This a high-level geographic assessment only and captures many of the US utility operators. A deeper dive would see some with little real wildfire exposure at present as they operate in more urbanised areas with little vegetation to support the damaging fires – for example CenterPoint Energy Houston Electric (in the Texas section of the table above) have confirmed that their operations in downtown Houston is highly unlikely to be impacted.

Other considerations to wildfire liability exposure

Other major considerations as to electric utilities’ exposure to wildfire liabilities include:

1) how prepared electric utility companies are to mitigate physical wildfire risks;

2) what litigious environments exist in various states; and

3) are companies able to manage wildfire liabilities of various scale if incurred?

These are the areas that 4D undertakes significant due diligence in when considering a company for investment.

When researching a potential investment in a US electric utility that is in (or could develop into) a high wildfire risk geography, we spend significant time understanding the company’s wildfire mitigation preparedness.

This incorporates getting a thorough understanding of wildfire mitigation plans in its totality, which incorporates vegetation management processes, situational awareness (video monitoring of the network, lineman visual inspections, and drone surveillance), investment in hardening the network from fire ignition, and established public safety power shutdown (PSPS) procedures as a last resort. Significant investment in the insulation of overhead wires, replacement of weak/old power poles and undergrounding of wires in particularly high-risk regions all ‘harden’ the grid from wildfires.

The particular litigious framework established in individual states identified in the table above vary considerably. Some key factors, which will influence the level of legal liability risk, include:

- Absolute cap on liabilities – some states have established legal liability caps on the absolute amount that an individual/company can be litigated for.

- Judge vs jury presided courts – jury courts are more likely to be influenced by their emotions (with wildfire damage being very emotional for communities) rather than by the strict interpretation of the law.

- Whether punitive damages can be applied in addition to actual (property) damages –punitive damages are often multiples larger than actual damages, which are usually massive for wildfires in their own right. The application of punitive damages is usually dependent upon the establishment of gross negligence on behalf of the company, which should have a high threshold of evidence, but this has been depleted in some examples. A jury court in Oregon ruled that BHE’s PacifiCorp was grossly negligent in its operation of the network during the October 2020 fires in the state, based largely on the company not shutting power off in the lead up to the fires. This would have had far reaching operational ramifications that made the decision far from straight forward. The court’s decision is being appealed. The level of wildfire preparedness (or robustness of wildfire mitigation plans) that a company can demonstrate will reduce the risk of being found (grossly) negligent by a court.

- Specific state-based legal concepts – some specific legal standards can be applied in individual states such as inverse condemnation in California (see The real risk of wildfires to US infrastructure investors for more information on this).

The question of a company’s ability to manage wildfire liabilities will be dependent upon its balance sheet capacity and liquidity, which are obviously influenced by its size. Smaller electric utilities, including smaller municipal owned utilities, will be less able to manage large legal liabilities and are more likely to be forced into financial distress and/or bankruptcy. Could this be a driver of M&A consolidation in some states?

A financially distressed company is unlikely to have the capacity and/or willingness to continue to invest much-needed capital in the networks (replacement, growth and hardening) which could hinder economic and social development in the exposed region.

We expect there will be growing questions around insurance for these events – what can be insured, what premiums will do as this risk intensifies, and when does insurance pay out? It could get harder for utilities to protect themselves from this risk.

4D’s approach

Wildfire risk is becoming a bigger concern for market investors and is probably something that is still being understood. At 4D, we don’t recommend avoiding these companies from investment altogether.

We do, however, recommend thorough due diligence of the risk to a company before taking a position. As always, we balance quality, risk and return in making investment decisions. In some cases, that risk will be too great - as Buffett outlines, there is the potential for the adoption of risk that outweighs the potential regulatory return of a utility, which can end up in the loss of all equity value (as experienced by PG&E Corp). However, in others we see the moderated risk more than compensated by valuations, with network hardening against fires also a strong driver of earnings growth.

The content contained in this article represents the opinions of the authors. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.

[1] Warren Buffett’s western utility facing untold billions in wildfire damages after the latest bombshell jury verdict came down – The Associated Press; 7/3/2024

[2] Charlie Munger – The Architect of Berkshire Hathway; Warren Buffett; 24/2/2024