This is the abridged version of the article, which can be read in full here.

While observations across the region were mixed, in general they were supportive of our strong overweight to the region. The structural Infrastructure thematics continue to grow with our names benefiting from ongoing travel buoyancy, growing demand for energy security, and accelerating digitization. However, as always stock selection remains key given divergent political, economic and policy responses to the growing demand for investment.

This piece outlines the key themes and takeaways from the trip, and how these have shifted our investment strategy across the region.

Politics

MEGA – Make Europe Great Again

The political landscape across Europe remains fluid, with rising fragmentation, right wing populism, and policy uncertainty creating divergent investor implications. While Italy and UK continue to deliver relative political stability, France is entering a volatile period marked by the ascendance of the far right. In Spain the government remains fragmented but functional while confidence has increased in Germany following recent elections and fiscal changes.

Over the last decade Europe has significantly lagged the dominant US economy. On this trip however, there was a palpable sense that things may be changing. We felt there was an aura of optimism throughout our conversations on the ground driven by well publicised strategic initiatives and a change in fiscal posture. This growing confidence stems from a variety of factors including:

- Newfound confidence from Germany's seismic shift in fiscal policy with substantial debt-financed fiscal stimulus unveiled to reignite its economy and bolster defence spending. This is expected to create positive spillover effects across the Eurozone through increased demand and investment in infrastructure.

- Mario Draghi's review of European competitiveness instilling hope for overdue structural reforms, aiming to enhance the continent's long-term economic resilience and innovation capacity.

- Resurgence in European manufacturing to decouple from US reliance in defence, technology and industry amid uncertain geopolitics.

While the slogan MEGA – Make Europe Great Again – is associated with populists and right wing groups, it did genuinely feel like there was an ongoing drive to spur growth back in the continent.

United Kingdom – A new political era under Labour

The UK is undergoing a political reset following Labour’s decisive victory in the 2024 general election, which ended 14 years of Conservative rule. Prime Minister Keir Starmer now commands a strong majority, with a centrist mandate focussed on restoring economic credibility, improving public services, and resetting UK-EU relations.

Starmer’s early focus on fiscal discipline, institutional stability, and pro-business signals (including a new industrial strategy and support for green investment) has been well received. The appointment of centrist, technocratic figures to key cabinet positions has further reassured business and investors. While public finances remain concerning and growth prospects constrained, the political backdrop appeared much more stable. Since our return, a few cracks have appeared within the party, albeit Starmer continues to back his existing cabinet.

France – Gridlocked presidency under growing far right pressure

The political environment remains unstable and fragmented in France. This follows the collapse of the previous government due to a no-confidence vote over the budget. President Emmanuel Macron remains deeply unpopular, and his party now governs in the National assembly under a minority government. We were quite surprised that domestically Macron’s popularity had deteriorated even further from last year, when it was already very low. From an international lens, Macron appears to have handled the recent Trump noise relatively well. However, domestically, the situation remains dire. This setup presents significant legislative challenges particularly given the major economic issues facing France – namely high debt, pension reform and subdued growth.

The rise of the far-right National Rally (RN) under Marine Le Pen has become the defining political trend. France faces the real prospect of a far-right-led government which would deeply affect both domestic and EU-level policymaking. Complicating this further has been Le Pen’s recent conviction for embezzlement in March 2025, making her ineligible to run for office until 2030, with presidential elections expected in 2027.

Italy – Continued stability under Meloni defies past norms

Italy continues to enjoy a period of relative political stability under Prime Minister Giorgia Meloni’s right-wing coalition, now approaching its third anniversary in charge. This is of course highly unusual for Italy, where governments have historically been short-lived — with 69 different administrations since World War II and an average lifespan of just over one year.

Despite right wing populist roots, Meloni’s government has pursued fiscally orthodox, pro-EU policies, surprising markets with its discipline. Public spending has been relatively contained, and Italy remains on track to meet EU Recovery Fund milestones.

Italy’s standing in both Europe and on the global stage has also improved, with Meloni gaining influence amid political instability in Paris and Berlin. She has positioned herself as a leading voice for Europe’s conservative movement, resonating with a rising right-wing base across the continent and in Washington.

Tighter BTP-Bund spreads (spread of Italian Bond over German Bund) reflect investor confidence and a view that Italy carries less risk than it has for much of its recent history.

Unlike historical trips, there was very little discussion around political concern in Italy. Rather, was a real feeling of stability supporting ongoing execution.

Spain – Fragmented but functional

Spain’s political system remains highly fragmented, but Prime Minister Pedro Sánchez has again surprised in forming a functioning minority government following the inconclusive 2023 general election. He secured support from a patchwork of regional and nationalist parties, including Catalan groups—sparking controversy over his amnesty deal for separatists, but ensuring governability.

While the structure of the government is considered fragile, to date it has been relatively stable and considered ‘business as usual’. Despite the fragmentation, the government has been able to secure key votes in passing the 2024 and 2025 budgets – critical for maintaining access to EU recovery funds. However, outside the budget, very little else has been passed so while business as usual, execution remains muted which could have longer term implications.

On the ground, while some pessimism about the ability to execute and the competing priorities of managing the left and supporting much needed investment policy (see discussion around the Blackout below), there was no real expectation of new elections or increased political instability. Additionally, the Spanish government’s pro EU stance and commitment to EU objectives has supported investor confidence.

Germany – Improving optimism amid significant challenges

Germany's political landscape has seen significant shifts following the federal election in February which was held early due to the collapse of the previous government. The conservative CDU / CSU won a majority of the votes and formed a grand coalition with the centre left Social Democrats to form government. The election saw a marked shift to the right, with the far-right Alternative for Germany (AfD) doubling its previous best performance, becoming the second-largest parliamentary group with 21% of the vote.

The political environment remains fragmented and challenging, but the formation of a Grand Coalition and its introduction of much welcomed fiscal changes / stimulus have instilled a degree of renewed, albeit cautious, confidence among investors.

Section 899

A very brief comment on Section 899 of the One Big Beautiful Bill Act (‘OBBBA’) as it was a keen topic of conversation on the trip. The proposed S899, imposed additional taxes on US sourced income paid to foreign individuals, entities and governments with connections to countries imposing ‘unfair’ taxes. It had been dubbed the ‘revenge tax’, targeting Europe’s digital tax on US Tech, as well as the OECD’s 2021/2 global minimum tax rate of 15% on multinationals.

S899 is now dead following US Treasury Secretary Scott Bessent’s deal with G7 nations on the minimum tax rates. However, while the threat appears to be gone for now, should it be revived in some form in the future the comments below may be of interest.

The main European companies in our Universe directly impacted by the taxes were those that have large US operations and revenues – that are from ‘offending foreign countries’.

- Ferrovial – Has the largest exposure out of the European listed names, with US managed lanes ~35% of group revenues and €538m of dividends paid by US lanes in 2024. Conversations with Ferrovial management recognised the potential impact, but they felt there was a long way to go before being approved with expected country carve outs and mitigation tools. This statement proved to be very accurate. They also commented that S899 did not change their US investment strategy.

- European renewable operators (Orsted, EDPR, RWE) - Generally have significant US exposure despite recently reducing US growth ambitions in response to the Inflation Reduction Act (IRA) repeal. Likely among the most impacted sectors, but varies significantly across companies.

- Iberdrola – Spanish domiciled utility with an exposure in the US via its now wholly owned subsidiary Avangrid. The US contributes €8.5bn to their €48bn in group revenues (€1.7bn in renewables/€6.7bn in networks). However, due to large US re-investment plans it was well positioned to manage its exposure while limiting dividends back to parent at least in the next 5-10 years.

- National grid – UK Domiciled but with roughly 50% of revenues coming from Utility exposure in the US. Company acknowledged there would have been a potential impact, but again though it was still too early to quantify. Did feel like there were various mitigation options that could be used.

- Vinci – French domiciled contractor, with global airports and tollroads. Not a real concern at this stage given the limited US exposure, which is mostly from lower margin contracting business (4.5% of group revenues).

Economics

We are publishing a broader H2 2025 macro outlook given the significant volatility of H1. As such, we have kept our comments below brief and trip specific.

The Pacific Peso

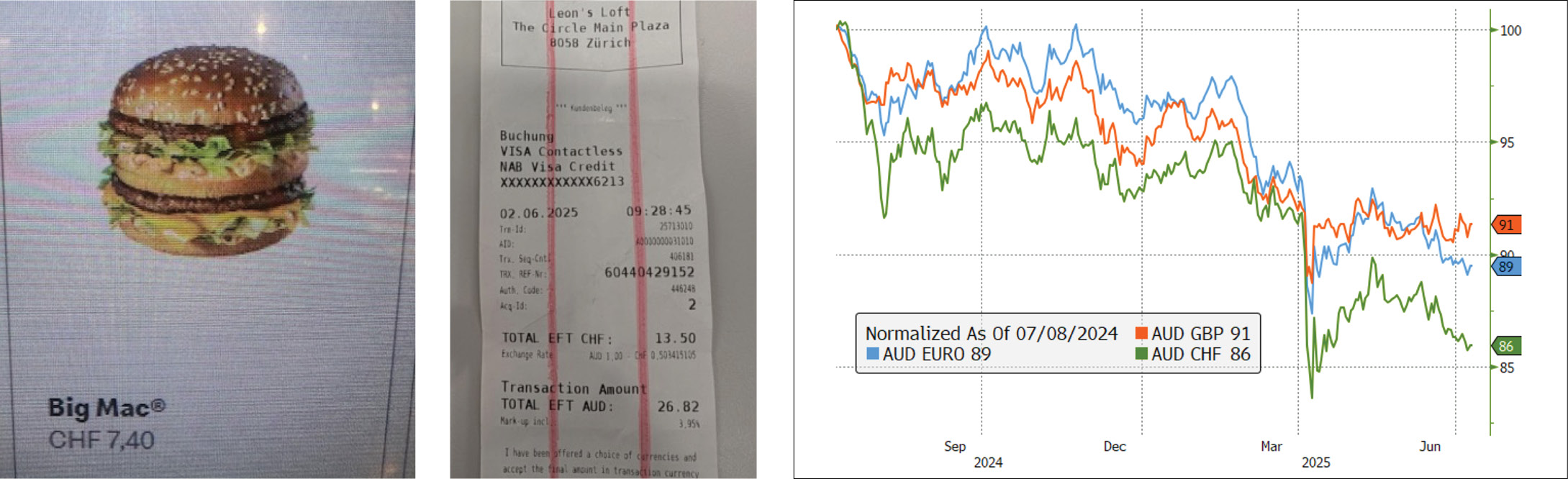

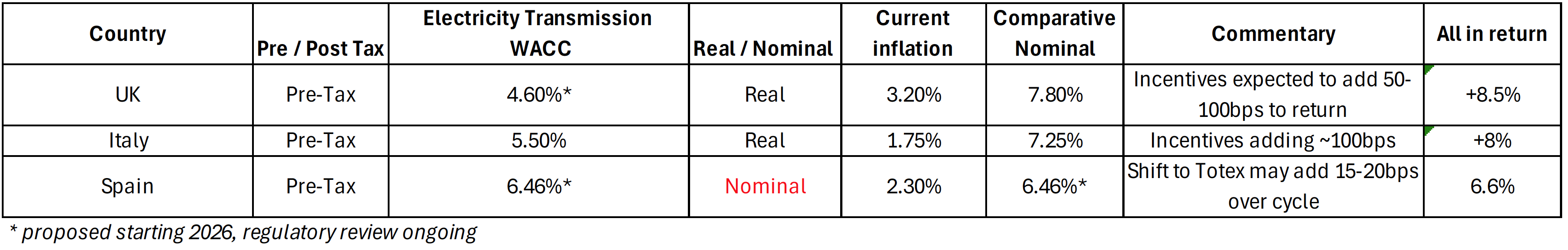

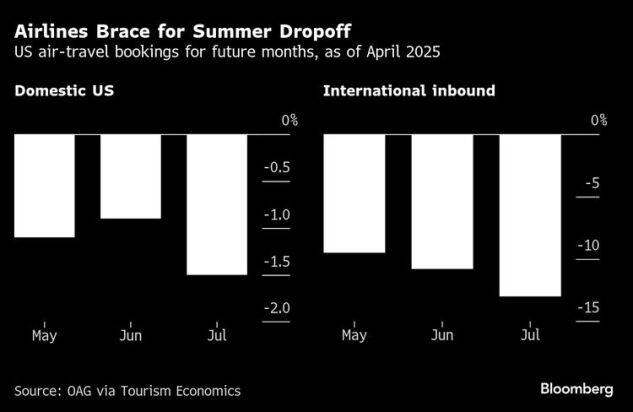

One of the most persistent things we felt throughout our trip was just how expensive Europe was. From the cost of hotels to coffees and regular restaurant meals, what would seem reasonable in Euros, Pounds or Swiss Francs, felt egregious when converted into AUD.

This was largely due to the recent appreciation of the Euro. The main beneficiary of a weaker USD in 2025 has been the Euro, with capital flows coming out of the US on fiscal concerns and a ‘end of US exceptionalism’ mantra this year. In the last 12 months, the Euro has appreciated ~12% versus the USD and AUD. Also, it should be noted that the Euro strength is a double edged sword for Europe – being a headwind to its export-led economies, particularly while growth remains sluggish.

The Euro strength was exacerbated by the depressed Australian dollar (relative to most currencies) over the last few years, now jokingly referred to by some as the ‘Pacific Peso’ as well as the relative impacts of inflation across the respective countries since COVID. Understandably we think Australians will have to think twice about that summer trip to Mykonos and forget about the skiing holiday in Switzerland.

Figure: Cost of Big Mac in Zurich, roughly $15 AUD, Cost of 2 coffees in Zurich - $27 AUD, AUD depreciation over last 12 months as sourced by Bloomberg

UK

The UK economy has somewhat stabilised in the improved political environment. GDP is expected to expand by approximately 1% in 2025. Growth remains modest with recent negativity about US tariff impacts, but generally momentum is improving, supported by resilient services activity, stabilising consumption, and a mild housing recovery. Interestingly however, the London property market remained very subdued as the city exodus appears to be gaining, not losing, momentum.

Inflation has been a significant challenge for the UK, and at 3.5% is still well above the Bank of England's 2% target. The BOE expects tariffs to slow the UK economy and lead to lower inflation than previously expected, while the market is still pricing in another two rate cuts by year end. Commentary on the ground still spoke to an affordability issue and a general deterioration in living standards.

The UK’s fiscal situation also remains challenging, with high public debt and a high deficit in a subdued growth environment. The government initially stumbled in its budget delivery with substantial tax increases and significant spending pledges resulting in a plunge in business confidence. This had improved in recent months with subsequent commitments to fiscal prudence, alongside an improving trade outlook with both the US and Europe. Importantly, post the trip in early July this had again plummeted after the government backtracked from welfare cuts and question marks arose on the longevity of Chancellor Rachel Reeves. This highlighted the fragility of the environment in the UK, with competing pros and cons for the future.

Importantly, UK has been one of only three countries to ‘reach’ a trade deal with the US before the expiry of the extended 90 day Liberation Day deal cut offs, which has reduced some uncertainty for domestic households and businesses.

France

France has seen an ongoing deterioration in its economic outlook driven by heightened political uncertainty. Business investment and consumer spending are subdued, with public sector wage pressures and confidence shocks weighing on momentum.

Moreover, the fiscal situation remains worrying in France with a deficit stuck above 5% of GDP and debt rising towards 115%. This pessimism is reflected in elevated CDS spreads (risk measure) which remain higher than their European peers, including Italy and Spain.

Spain

Spain continues to outperform most of its eurozone peers, supported by strong domestic demand, a booming tourism sector, and robust absorption of EU recovery funds. Prime Minister Pedro Sánchez’s minority government remains politically fragile, but its ability to pass budgets and deliver structural investment has surprised to the upside.

GDP growth is expected to reach 2.4% in 2025, underpinned by consumption, employment gains, and public investment. Inflation has moderated to 2.2%, with both headline and core readings now largely in line with ECB targets. While domestic politics remain noisy, this has not materially impacted Spain’s macro stability or market perception. As with last year the feel on the ground was relatively positive with high levels of visible consumption (restaurants, travel plans etc).

Germany

Germany remains the weakest major economy in the eurozone, weighed down by industrial stagnation, subdued external demand, and energy-related cost pressures. GDP is projected to grow by just 0.2% in 2025, with no meaningful recovery expected until late 2026. The export-driven growth model is struggling to adapt to deglobalisation, China decoupling, and a structurally tighter energy environment.

Headline inflation has eased to 2.4%, largely driven by declining goods and energy prices, though labour shortages continue to fuel service-sector inflation.

The more significant development has been fiscal: in March, the Bundestag approved a €500 billion multi-year investment package and passed constitutional reforms to partially relax the national ‘debt brake.’ This shift paves the way for increased public investment in infrastructure, defence, and energy transition, but implementation remains key, with several of the corporates we met speaking of the difficulty of the task ahead.

Nevertheless, the promise of German stimulus remains the most consequential element of wider Eurozone policy.

Italy

Italy has emerged as a source of relative stability, surprising markets with solid macro management and political cohesion under Prime Minister Giorgia Meloni. While risks remain, particularly related to high public debt and long-term structural constraints, the government has stayed within EU fiscal limits, delivered on EU fund deployment, and avoided major populist disruptions.

GDP growth is expected at 0.5% in 2025, with inflation declining to just under 1.8%. The country continues to benefit from ECB support, robust tourism, and steady industrial output. Crucially, BTP-Bund spreads remain well contained, reflecting investor confidence in the government’s fiscal prudence and policy continuity.

Meloni’s government has walked a pragmatic line — maintaining eurozone alignment while emphasising national sovereignty on social issues. That balancing act has helped stabilise perceptions and reduce Italy’s risk premium. This was clearly evident in-country, through confidence in management investment profiles as well as consumer sentiment.

Switzerland

Switzerland remains politically and economically very stable, warranting little comment. However, the strength of the CHF makes visiting Switzerland a very expensive affair which over the medium term could impact tourism and domestic competitiveness.

Infrastructure

While the European infrastructure landscape remains dynamic in 2025, key themes have emerged and evolved. Our latest observations highlight several interesting trends.

- Energy: Growing power demand, proactive policy response, the energy transition and rise of technology remain dominant sectoral themes, with the focus now firmly on execution over ambition. The Iberian blackout (in late April) highlighted not only the need but the scale and speed of required investment to ensure security of supply in a rapidly evolving environment. European utilities are working to decarbonise portfolios, shore up baseload supply, enable regional interconnection and invest heavily in network infrastructure, all while managing the pressures of execution, customer affordability, and relative returns. If managed well, these factors can support incremental and long-term earnings growth and shareholder returns. However, relative policy support for investment plans versus the acceptable level of bill-shock, remain central to investment risk and competing demands for finite capital.

- Airports: European travel momentum remains solid, supported by the continuing structural shifts in consumer behaviour post-COVID. Availability of aircraft capacity has been hindering near-term growth, but as this eases over the next 12 months strong underlying passenger momentum should support earnings. We were surprised to learn that to date, there have been limited signs of weakening US travel. Should it materialise, it could be supportive of increased intra-European travel favouring our top pick AENA. In addition, in-sector there are a number of unique catalysts that see us favour AENA and Fraport over others.

- Diversified: The diversified messaging was very mixed. At the infrastructure level there was increasing policy concerns because of uncertainty around French road concessions and S899 impacts on US investment plans. While these are largely valuation-neutral to the stocks, there was definitely a sentiment overhang. By contrast, at the contracting level, there were very visible positive tailwinds as a result of increased German stimulus and global investment plans.

- Communications: A strong inflexion in messaging from the European tower operators. MNO consolidation and the potential threat to tower growth and earnings was seen as less of a concern with expectations that stronger MNO balance sheets were supportive of improved network investment dynamics, with or without consolidation. Further strong messaging on supportive shareholder remuneration and expectations of improving yield dynamics gave us confidence in our overweight to the tower sector. By contrast, a revisit of the satellite sector saw some green shoots but incredible near term headwinds.

We touch on each of these below, as well as wrap up a few other sector dynamics.

Longevity of infrastructure – if well maintained

One of the highlights of our trip was an asset tour we did with ACEA – the company that manages the Roman water network. We were taken to Acquedotto Vergine, an ancient aqueduct built in 19BC, one of several Roman aqueducts that still delivers water into Rome and feeds several fountains including the famed Trevi – where we were also shown the inner workings. The experience highlighted the enduring power of infrastructure: when well designed and properly maintained it can endure for very long periods of time. Either that… or the Romans were just superb engineers!

Images: ‘Chiocciola del Pincio’ the spiral Staircase leading into the Acquedotto Vergine and walking through the Viaduct

Images: Fountain de Trevi, behind the fountain and the original “billing system” for Roman water supply

Utilities

Networks continue to shine… and are even brighter post blackout risk

We have long viewed European electricity networks as greatly underappreciated in the energy transition. While renewables often get the most attention, in the past few years we have started to see politicians, regulators and increasingly other investors recognise their importance.

Our trip increased our conviction in the network growth story and interestingly we feel the investment outlook is starting to improve in countries that had previously lagged. Following the massive blackout in Iberia, governments have been quick to acknowledge the economic importance of allowing sufficient investment into networks to avoid similar events. Importantly there is now a greater focus on network investment for resilience and security alongside facilitating renewable energy integration. The blackout was the number one topic of conversation in every utility meeting we had. It became clear that countries like the UK and Italy have been proactive in recognising the need for investment, while we think recent events should see investment accelerate in all countries, but particularly in laggard countries.

Iberia in our opinion has been one of the biggest laggards. Spain specifically has had a legally mandated cap on electricity network investment to manage customer bills. This cap was set over a decade ago prior to the significant rollout of renewables. It is under review by the current government and the blackout has acted as a catalyst for increased investment focused on grid modernisation, resilience and integration - which makes it more likely for the cap to be revised. This view was also supported by many of the Spanish utilities that we met, a number of whom had been previously pushing the government to be more proactive on investment.

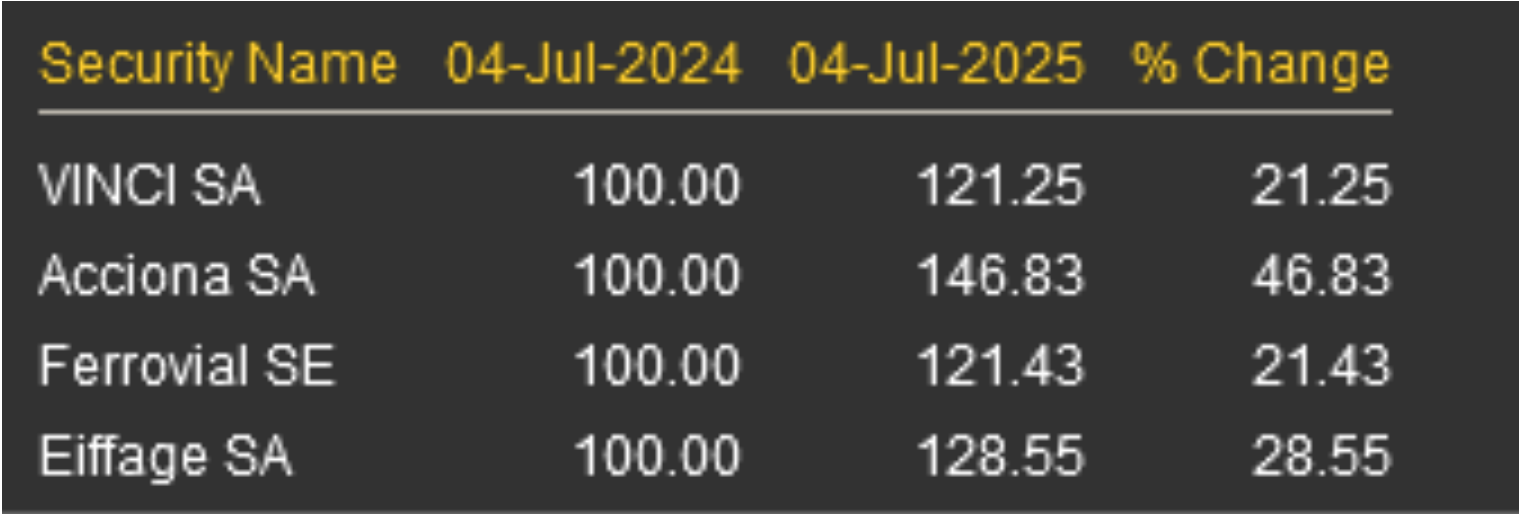

Importantly, with the huge need for investment in every European country, the competing demand for capital also becomes increasingly relevant. If operators have limited capacity but an uncapped opportunity, they are of course going to prioritise investment in those countries offering the most supportive policy and attractive returns. This has recently favoured investment plans in countries like the UK and Italy, where we are overweight, but we were/are hopeful this will translate to improved regulatory outcomes in Spain and elsewhere.

Unfortunately, post the trip the first draft of the Spanish regulatory proposal failed to live up to corporate expectations. While widely rumoured on the trip that the first draft was likely to propose a ~6.5% headline WACC return, it had been hoped that the Iberian blackout would have realised an improvement therein. The independent Spanish utilities had been clear that a 6.5% WACC without other means to improve the total return, would not see them increase investment. All the utilities were realistically looking at a minimum 7% all-in return across the framework. The first draft has proposed 6.46% WACC and falls short of allowing an overall 7% return through incentives. We can but hope that the Consultation Period realises an improvement. Otherwise, we feel other countries will be a more attractive destination of finite capital and Spain is at further risk of blackouts. The simple table below highlights the relative attractiveness of Italy and UK over Spain under the current proposals, and why globally diversified utilities like Iberdrola are prioritising investment in higher return jurisdictions like UK, over their home country Spain.

Zonal Pricing a key market concern

Zonal pricing has been a controversial issue that has plagued a number of UK utilities and generators. UK currently operates in a single market with a uniform wholesale electricity price. Under a zonal pricing model, the UK would be divided into multiple ‘zones’, each with its own wholesale electricity price reflecting local supply and demand conditions and network constraints. Areas with abundant cheap renewable generation (like northern Scotland) would theoretically have lower prices, while demand-heavy areas with less local generation (like the Southeast of England) would have higher prices. Our view was that zonal pricing would unnecessarily overcomplicate the system and discourage critical investment in renewables and generation.

Talking to corporates and other analysts in the region, the feeling was that it was increasingly unlikely to go ahead. Companies stressed to varying degrees why this was the case – some categorically said they had been told so by ministers, others were more nuanced, saying instead they had presented their case effectively to ministers. Importantly, they were all in agreement that the introduction of zonal pricing would unnecessarily delay much needed investment in both generation and grids, which would run counter to core government priorities of green energy security.

SSE were very open about the impact zonal pricing would have on their business, highlighting that the market was missing the portfolio ‘flexibility’ available to their Scottish arm should it be implemented. Their messaging resonated and should we see zonal pricing implemented, with an associated SSE sell off, and we could use this as a buying opportunity.

Green Hydrogen silence

A quick comment on Green Hydrogen – or not as the case was this year. After several years of excitement around the green hydrogen thematic, it barely rated a mention this year. The only player still singing from the GH song sheet over the near term was Spanish gas utility, Enagas, who to be fair, have nothing else to drive future investment returns. Interestingly, while they remain believers, even they commented that it won’t happen as fast as was anticipated and that should the investment scenario, once defined, not prove attractive enough they could opt not to invest and rather become a cash cow/yield play. This later scenario actually looks attractive given the quantum of FCF they would be generating, but unfortunately we cannot invest into it until their strategic plans around Green Hydrogen are better understood.

Nuclear debate

By contrast, discussions around the importance of nuclear to the future energy mix have gained a lot of traction.

- Spain is again considering the extension of existing nuclear fleets to support the security of the system, particularly topical post the Blackout caused by a dominance of renewables in the system.

- Italy has opened the debate on increased nuclear in the mix with the 2040 Energy Plan suggesting that 10% of energy could be nuclear (growing to 11-22% by 2050) supporting a reduced dependency on imported commodities. The proposal is looking at small modular reactors which would require an 8-10 year FID process. But first it must go to a referendum…

- Belgium has agreed to a 10 year extension for the operation of two nuclear reactors Doel 4 and Tihange 3 until 2035, to enhance energy security and reduce reliance on fossil fuels.

- Germany is actively reconsidering its stance on nuclear energy, with discussions about restarting nuclear power plants gaining momentum. This shift is influenced by energy security concerns, economic pressures, and evolving political dynamics and a marked shift in public perception towards nuclear.

- France continues to lead, with plans to replace its aging nuclear fleet with six new reactors by 2050, with an option for an additional eight.

European developers have hit pause on US renewables

European utilities and renewable energy developers—including ENEL, Iberdrola, RWE, Engie, Ørsted, and EDPR—are among the largest players in the US renewables market. Until recently, the US was seen as the most attractive growth market, supported by its vast size, increasing power demand, and generous tax incentives under the Inflation Reduction Act (IRA). However, with the US government scaling back portions of the IRA and rising political uncertainty—particularly around President Trump's vocal opposition to renewables, especially offshore wind—many of these European developers have slowed or paused their US expansion plans.

Rising costs, permitting delays, and policy instability have further eroded confidence and put question marks on returns, prompting some to shift focus back to more stable domestic or European markets or in the case of integrated utilities, shift more capital into networks. Iberdrola significantly shifted their investment capacity away from renewables and into networks a number of years ago when the interest rate trajectory increased the relative attractiveness of grids. On this trip, they gave us a strong indication that at the next strategic update this shift would gain even further momentum. This was a sentiment shared by other European players.

UK water sector still hampered by uncertainty

The UK water sector has faced a challenging few years since the UK Environmental Agency (EA) and Water Utility regulator Ofwat launched separate investigations into storm overflows at UK Water Companies.

These investigations concerned flow to full treatment, referring to the level of rain and wastewater, a wastewater treatment works must treat before it is legally permitted to discharge excess flows to storm tanks or into the environment. These potentially illegal discharges had captured significant public, media and government attention. The UK Government legislated to place legally binding duties on companies to reduce the number of overflows, especially near bathing or high priority / ecologically important sites.

Subsequently and positively, there has been a sizeable step-change in allowed investment in the latest AMP8 regulatory period, to tackle these environmental issues with elevated investment expected to continue for decades to come.

However, even with the higher levels of growth and investment, the sector is still challenged by several factors, which is adding to uncertainty. This includes the government commissioned Cunliffe review into the water sector regulatory system, the continuing Ofwat and EA investigations and the ongoing saga with debt-laden Thames water.

While some of these factors have very limited impact on fundamentals (namely Thames), they continue to weigh on sentiment towards the sector. Many investors remain reluctant to invest despite compelling valuations and a generational step change in investment, choosing instead to focus on easier alternatives like energy networks.

Airports

Travel remains resilient – for the time being

Trump has created major uncertainty in the air travel industry alongside the wider economy. As the CEO of Delta Airlines highlighted, “economic anxiety was fuelling a downturn in travel demand” when the airline withdrew full year guidance amid the height of tariff discussions.

While Trump’s tariff rollback improved sentiment from the depths of early April, his wider ‘America First’ policies and immigration crackdowns have served to impact travel intentions of both US and international travellers.

The most notable was in Canada where in February 2025, Canadian travel to the US dropped by 40% compared to the prior year and 20% in April, following inflammatory comments suggesting the US annex Canada as the 51st US state. According to Tourism Economics, this trend has continued with a 33% reduction in flight bookings over the May – July period.

Similarly, European travel to the US is said to be experiencing a 10% downturn particularly during the summer season.1 Like the Canadians, Trump’s political rhetoric has put many Europeans offside, and many are preferring to travel to other non-US destinations.

Ferrovial management also confirmed the trend stating they were expecting that JFK’s terminal opening in H2 2026 would be impacted by a lower international passenger outlook as US/global travel slows around Trump nationalism.

The strength of the US economy and US dollar post pandemic has also been a major tailwind for travel into Europe. While the proportion of transatlantic travel varies across the continent, for many airports there has been a trend of outsized US passenger growth and also retail spending. As the US dollar has declined over 12% versus the Euro, fuelled by concerns around the US economy, this could dampen US travel into Europe.

Naturally, in all our meetings with European airports these were key points of discussion. To date the airports have been fairly resilient, managing to maintain their full year guidance, which to an extent already encapsulated the Trump related impacts, among other passenger limitations. Several management teams highlighted that even with recent USD depreciation, lower inflation in travel / leisure in Europe still made the continent very attractive for US travellers.

AENA, which is our key pick in the sector had the most promising outlook, with limited exposure to North America and the highest intra-Europe traffic among listed peers. The airport operator, which operates all of Spain’s airports, was benefiting from its higher Low-Cost Carrier exposure (LCC), with key customer Ryanair expecting up to 4% annualised growth across their European network. They were also better placed to add capacity in coming years versus many other airlines.

Figures: Adolfo Suárez Madrid–Barajas Airport, Owned by AENA

By contrast we think the most impacted by travel uncertainty with the US would be Aeroports De Paris – which owns both Charles De Gaulle and Orly, as well as a wider portfolio throughout the Middle East and Asia. While Orly has been resilient and supported by LCC and intra – Europe travel, some weakness has been seen at CDG but overall, not significant enough to change the company’s full year outlook. Overall US traffic accounts for 9% of all traffic and 13% of retail spend for ADP.

The other common theme impacting passengers across the airport space was aircraft availability and new aircraft delivery with Lufthansa and Swiss appearing to be the most negatively impacted. This remains an overhang for Zurich and Fraport as they await the resolution of these capacity issues. The Pratt & Whitney aircraft recall should be resolved towards mid 2026, while new aircraft delivery for Swiss could be late 2025/26. Also impacting Swiss is ongoing staffing issues which also must be rectified if they want to get the new aircraft in the air. By contrast, Lufthansa has a structural seating issue on the new Dreamliner which is going to take time to resolve limiting capacity expansion for Lufthansa through 2026.

Diversified Infrastructure

French Uncertainty

The government has announced a sharp increase in the corporate tax rate from 25% to 33.5% for 2025. French companies we met with suggested this higher rate could easily be extended beyond 2025, adding to the sense of unpredictability. This comes on top of the new long-distance transport infrastructure tax introduced in 2024, which imposes a 4.6% levy on French revenues above €120 million—a measure currently being challenged in court.

The long-term outlook for French toll road concessions remains clouded. Both Vinci and Eiffage noted there has been no dialogue yet about potential concession extensions/renewals, but they are preparing for a full retendering process when current agreements expire in the early 2030s. Given the strategic and financial importance of these concessions, it raises important questions about how both companies plan to offset this potential loss – increasing the chance of transformational M&A for similar infrastructure assets to help plug the gap.

Section 899

We commented on this above, but this was a topic for the diversified players as it could have influenced their US investment plans. Importantly, all remained committed to the US strategy despite Trump nationalism. While S899 was on their radar they were not yet overly concerned and believed US-based opportunities remained relatively attractive.

M&A

As always, very topical to the transport names, is the quantum of upcoming opportunities and the competitive dynamics surrounding them. Positively, the companies still see some solid concession opportunities globally to support ongoing growth.

- Ferrovial continues to prioritise US State-based investment opportunities with a view that there was steady momentum in their bid pipeline. At the same time, they admitted that the competitive environment was getting tougher and they had to be more constructive in their bids, capitalising on their significant market experience.

- Sacyr remain very active in the concession market, targeting 3-4 new projects per annum across the landscape of concession assets, from roads in the US to hospitals in Italy and waste treatment plants in Chile. At the same time, they were active in their divestment plans to fund the ongoing recycling strategy.

- Vinci didn’t see any transformative concession opportunities into 2025 but were as always very opportunistic about what came to market in both the primary and secondary market. However, they continue to see significant growth potential in their Energies business.

- Eiffage continued to concentrate efforts on countries where they already have a presence. We continue to see Getlink as the most relevant recipient of their M&A capital.

German stimulus and Contracting

Germany’s fiscal stimulus has provided a major boost for European infrastructure companies with construction arms. The expectation is that as the German government ramps up spending on infrastructure and defence, firms like Eiffage, Vinci, Ferrovial, and Acciona—well-established European leaders in construction—will see a meaningful uplift in their order books.

In our meeting with Eiffage, management underscored the scale of the opportunity, particularly pointing to the need for civil infrastructure upgrades, including reinforced roads and bridges, to support the movement of tanks and other armoured vehicles across the country.

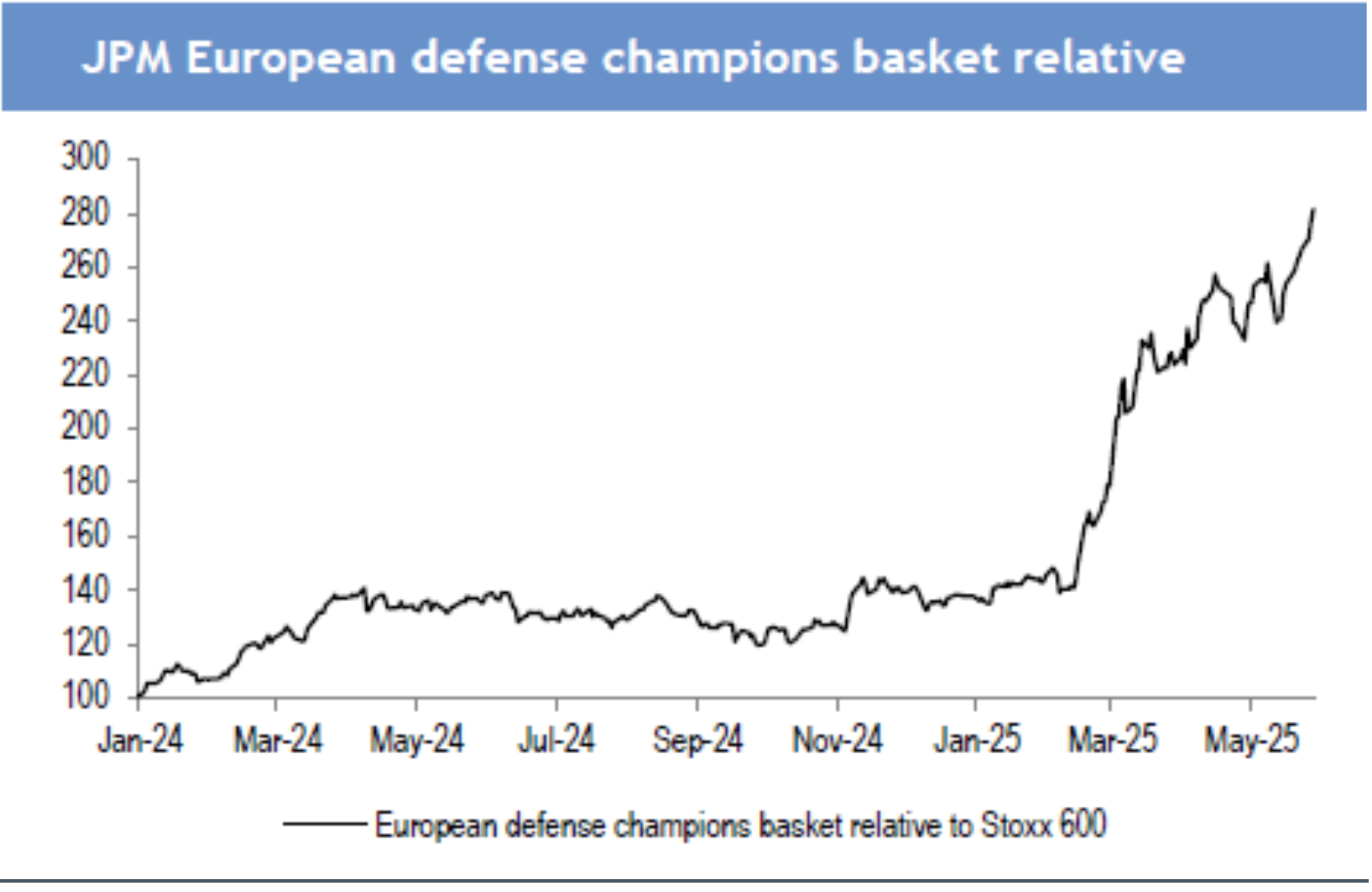

The market has responded enthusiastically to this theme, with shares in these companies ranking among the top performers in our coverage, with even stronger outsized performance seen in European Defence stocks.

While we are positive on the tailwind to order books, we do not base our investment decisions on the contracting arms of these businesses.

Figure: Performance of EU Infrastructure Stocks over 1 year as per FactSet

Figure: Outperformance of European Defensive Champions relative to Stoxx 600 EU Index

Communications

Competition concerns overdone; investment to increase

For investors in European mobile tower companies like Cellnex and Inwit, the consolidation of mobile network operators (MNOs) has long been a key concern. The primary risk is a reduction in tenancy - when MNOs merge, they often streamline their networks and decommission overlapping tower sites, leading to fewer tenants. This can, in turn, put downward pressure on pricing and long-term revenues.

However, as our meetings with these companies again reinforced, these concerns may be overstated for several important reasons:

- Regulatory Scrutiny: Regulators are increasingly requiring significant network investment from MNOs as a condition for approving mergers, ensuring continued demand for infrastructure.

- Improved MNO Financial Health: Healthier profit margins and better-capitalised balance sheets mean MNOs are in a stronger position to invest in network upgrades and expansion.

- Contractual Safeguards: Tower companies have strong contractual protections, such as ‘all-or-nothing’ and network protection clauses, which safeguard their revenues during MNO mergers.

- Co-Beneficial Agreements: Tower companies are striking flexible deals with MNOs, offering concessions on certain sites in exchange for longer-term, mutually beneficial contracts.

Shareholder remuneration increasing

Stronger cash flow generation at European tower companies is leading to more attractive returns for shareholders.

Inwit, for example, is paying an 11% total yield through a mix of dividends and share buybacks. The company's continued cash generation and debt reduction are also expected to add another €1 billion to its balance sheet capacity by 2030, creating the potential for even higher shareholder payouts.

Similarly, Cellnex has launched its inaugural shareholder return program, beginning with an €800 million share buyback. The company aims to repurchase a minimum of 5% of its shares by the end of 2026 and introduce an inaugural dividend of at least €500 million in the same year.

Portfolio positions

Despite ever-evolving political and economic headwinds across the globe, this trip sees us reaffirm our investment overweight to Europe. We have factored in the relative opportunities and risks and believe the value proposition of the quality infrastructure names continue to be incredibly attractive.

In summary:

- Energy: A core structural investment thematic globally, this trip reinforced our positive view on the network investment opportunity across Europe in both power and gas. We returned comfortable with our overweights to markets where we see supportive return dynamics at play, namely the UK and Italian operators, and it revived our interest in markets where we see a strong opportunity for improvement, such as Spain.

- Airports: We continue to see attractive opportunities in the European airport space. AENA continues to deliver on passenger growth, commercial spend and investment potential and is positioned incredibly well to capitalise on any shifts in travel dynamics away from the US. By contrast, our other core pick, Fraport, finally feels like it has turned a corner with investment programs coming to an end, international exposure performing well and shareholder returns back on the table. Lufthansa remains a key overhang, but we believe this is well understood and more than priced in.

- Diversified: We remain exposed to those diversified names with strong infrastructure assets that are relatively immune to the increasing political volatility around concessions and returns. The construction tailwind is attractive, but does not drive our investment decisions.

- Communications: Another positive inflexion in messaging supporting our overweight to the European tower sector. Growth appears to be back – slow but back – yield direction is supportive and shareholder returns are attractive.

As always, we maintain a diversified portfolio of high-quality infrastructure names globally, and currently believe Europe is offering an incredibly attractive mix of quality and value with strong relative policy, economic and political tailwinds

To view the full article, download the article below.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.

[1] https://www.bloomberg.com/news/articles/2025-05-23/europeans-plan-fewer-summer-trips-to-us-in-latest-trump-backlash?embedded-checkout=true