This is the abridged version of the article, which can be read in full here.

Politics and Economics

Donald Trump’s second term has been marked by unpredictability and a heavy reliance on Executive Orders, creating regulatory uncertainty. Tariff policy has dominated, with sweeping import duties announced on ‘Liberation Day’ with many iterations discussed since. Legal challenges have stalled broad implementation, leading to sector-specific negotiations. These tariffs have pressured costs for infrastructure components and disrupted trade routes, with direct and indirect impacts on ports, rails and utility companies.

The passage of the One Big Beautiful Bill (OBBB) reshaped tax policy and clean energy incentives. While it extended tax cuts and introduced new deductions, it also reduced support for social programs and imposed restrictions on clean energy projects tied to foreign entities. Despite concerns, many infrastructure companies viewed the final form of the OBBB as a workable compromise that supports continued renewable development.

The US has so far reported solid economic growth and moderate inflation, but with signs of labour market weakness and deterioration of confidence. The Federal Reserve is expected to cut rates, with markets pricing in multiple reductions through 2026. The tech sector, particularly AI and data centres, has emerged as a key driver of GDP growth. Analysts suggest nearly all recent demand growth stems from tech-related investments. However, a government shutdown has added uncertainty, potentially dampening growth and investor sentiment further.

Key infrastructure takeaways

The trip reaffirmed the strong investment potential across US infrastructure sectors, particularly in utilities, midstream, and telecommunications. The load demand growth dynamic is a structural shift that will shape investment and earnings through the decade. We believe the next wave of technological advancements such as Gen AI, cloud computing, data centres and technological manufacturing is providing a once-in-a-generation investment opportunity for select US infrastructure sectors. The evolving landscape offers a compelling mix of quality and value for infrastructure investors. However, opportunities vary by region and company, and careful selection is essential.

Our summary view on key US infrastructure sectors is as follows.

Electric and gas utilities

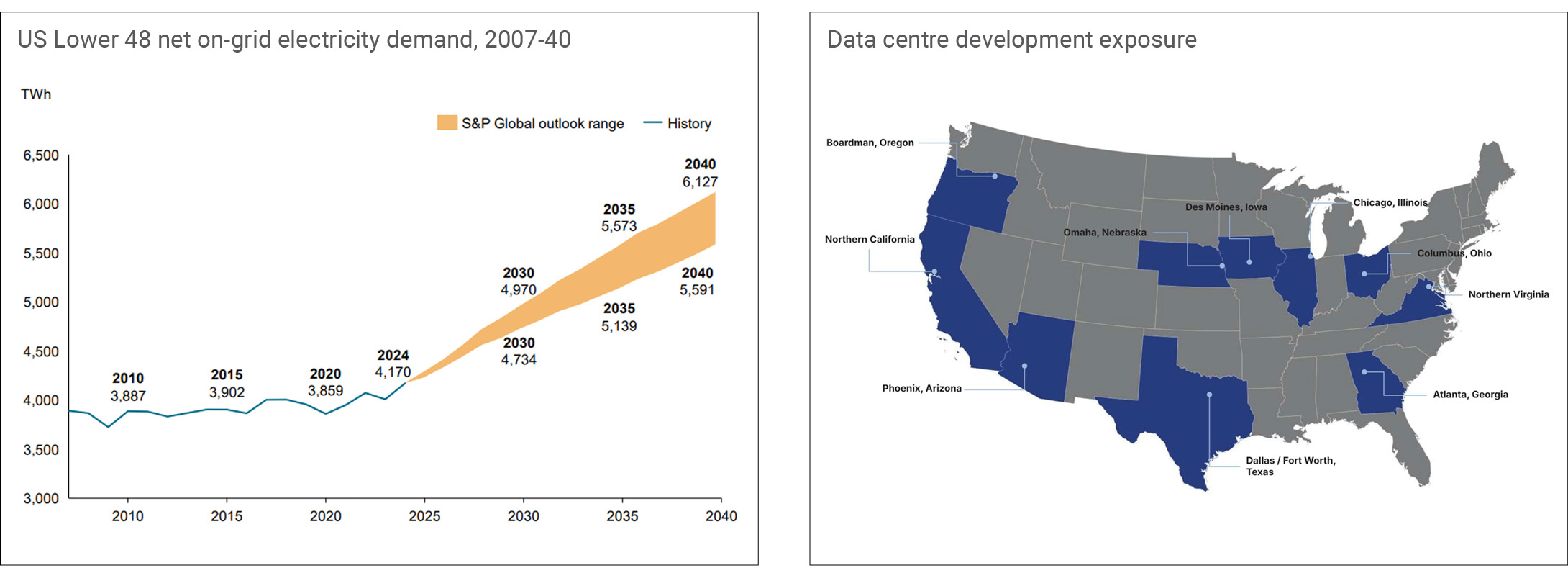

In the utilities sector, the load demand surge is reshaping investment strategies. Regions such as Texas, Virginia, and Ohio are experiencing the most significant growth, driven by data centre and industrial development.

Source: S&P Global Commodity Insights

Source: S&P Global Commodity Insights

Utilities are responding with tailored tariffs, long-term contracts, and collateral requirements to mitigate risks associated with large load customers. The opportunity is not uniform across the country, and we favour those companies with underappreciated growth potential, lower affordability (and regulatory) risk, supportive regulatory environments, strong relative cashflow, and healthier balance sheets. These include NextEra Energy, Alliant Energy, Dominion, Southern Co, and Xcel Energy.

Rising demand has also pushed up power prices, particularly for secure, clean baseload sources like nuclear and gas. This has created investment opportunities for independent power producers but also affordability concerns for customers. Utilities are addressing this by committing to rate freezes and optimizing operations to control costs.

Legislative support in several states has improved the investment recovery environment, enhancing returns and assuring financing capacity.

Midstream

Midstream companies are also benefiting from the energy demand boom, particularly in natural gas. With gas serving as a reliable and quickly deployable power source, companies like DTM and Kinder Morgan are expanding existing networks, while others like Oneok and Williams Co are adopting more aggressive investment strategies.

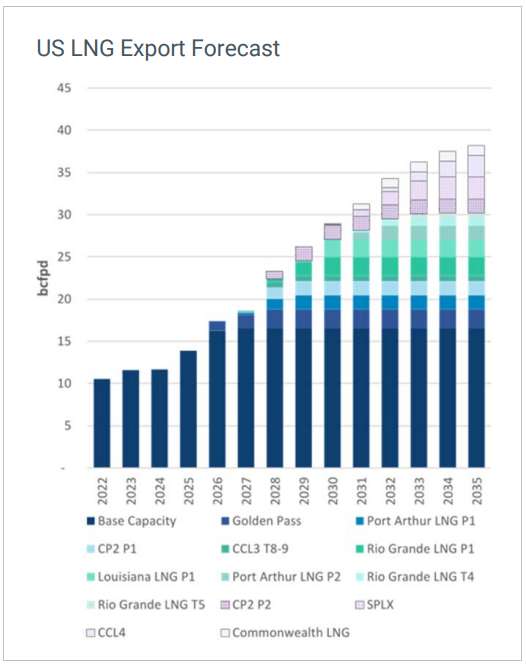

LNG export facilities continue to drive natural gas demand, with capacity expected to more than double by 2035.

Source: Jefferies Research

Source: Jefferies Research

Permitting reforms under Trump’s administration have also accelerated pipeline approvals, reducing regulatory barriers and enabling faster project execution.

Midstream firms with exposure to crude oil face uncertainty due to volatile global prices. While companies like Targa Resources remain confident due to their position in economically strong basins, others report limited visibility into future volumes.

Telecommunications towers

The rollout of 5G spectrum is transitioning from coverage expansion to densification, which supports high-frequency applications like Gen AI and autonomous technologies. This trend is expected to boost tower tenancy and drive organic earnings growth. Meanwhile, Elon Musk’s Starlink acquisition of mid-band spectrum is seen as complementary rather than competitive, offering reliable connectivity in underserved areas.

Summary

We maintain a diversified portfolio of high-quality infrastructure names globally, and believe that specific names in the US currently offer an attractive mix of quality and value, with the load demand growth dynamic and attractive valuations supporting potential returns.

Download the full article below.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.