In December 2006, at the London School of Economics Asia Forum, former Indian PM Manmohan Singh said[1]:

“The most important development, I believe, of the 21st century will be the rise of Asia. China has already trebled its share of world GDP over the past two decades and India has doubled it. Both these giant economies of Asia are bound to (re)gain a considerable part of their share of world GDP that they lost during the two centuries of European colonialism …”

In this paper, Greg Goodsell, Global Equity Strategist at 4D Infrastructure, examines the central tenets of this quote and how they suggest we are truly living in the Asian century.

Introduction

A consistent theme of our research over the past two years has been the emerging strength, changing character and relative importance of the economies of our northern neighbours in developing Asia. We have examined different elements of this thematic in a number of Global Matters papers, including: Young tiger stalks ageing dragon (September 2016); Inside the tiger’s den (November 2016); The emerging middle class and its implications for global investment (April 2017); and All aboard the new Silk Road (June 2017).

In this paper, we both consolidate and develop on those themes. Sustained higher rates of economic growth, an expanding middle class, compelling demographics, improved education and major policy initiatives like the new Silk Road will continue to propel Asia forward, driving infrastructure investment for decades.

1. Asia has changed significantly over the past 20 years

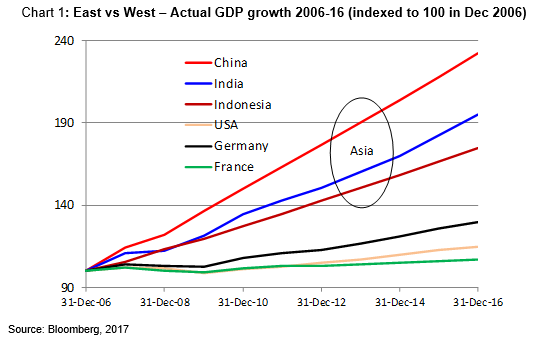

The Asian region has changed enormously since the turn of the century. At a macro level, this is illustrated in the divergence in GDP growth rates between the East and the West. Chart 1 shows this growth for China, India and Indonesia (East) versus that of the United States, Germany and France (West).

It is clearly illustrated that over the past decade, the East has manifestly out-performed the West.

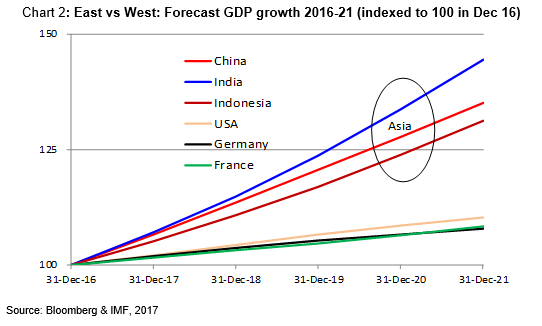

The trends in economic growth of the past decade look likely to continue into the future, as shown in Chart 2. A combination of Bloomberg consensus and IMF forecasts strongly suggest that, in GDP growth terms, the East is expected to significantly outgrow the West to 2020 and beyond.

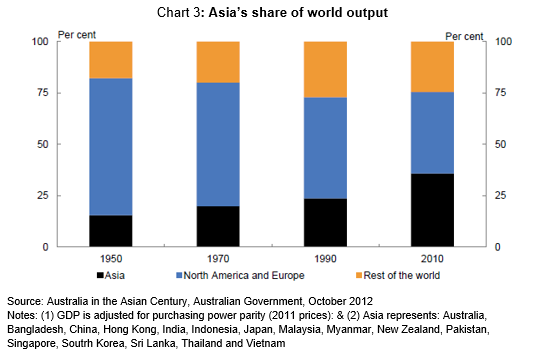

This rapid GDP growth in Asia is seeing a change in Asia’s share of world output, which has grown from ~15% in 1950 to ~35% in 2010—at the expense of the developed world (see Chart 3[2]).

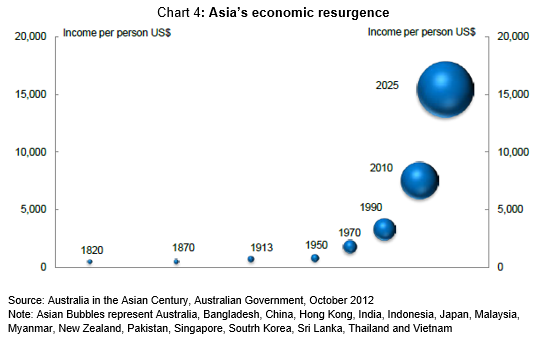

China and India have almost tripled their share of the global economy over the past 20 years. The bubbles in Chart 4 reflect the GDP size for Asian economies, adjusted for purchasing power parity in 2011.

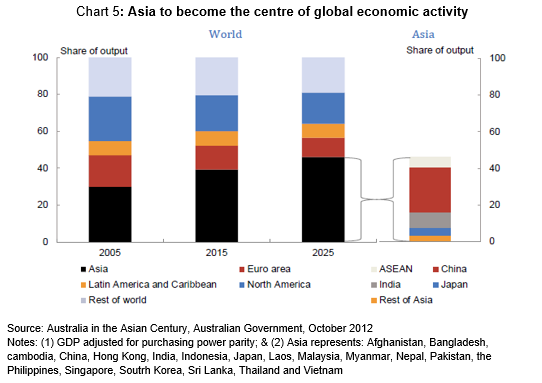

As Asia’s relative share of GDP growth increases, the global centre of economic activity will migrate from West to East, with India and China dominant. By 2025, the Asian region is expected to account for nearly half the world’s output.

2. Positive demographics provide a tail wind for the East

The western world, which enjoyed a long post-World War II economic upswing, has been seduced by increasingly hedonistic lifestyles which accompanied that long period of wealth accumulation. Society has changed, and it seems this has meant there is less room for children. As a result, the western world’s demographics are in a tailspin.

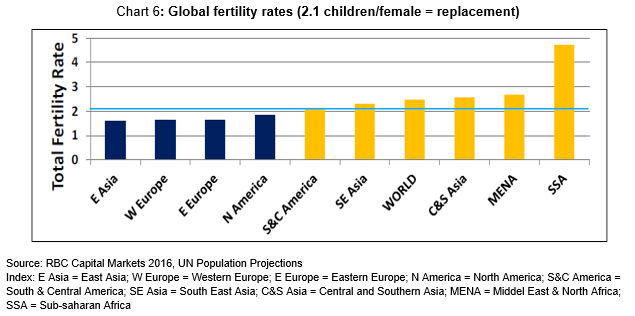

As shown in Chart 6, in both Western Europe and North America global fertility rates are well below the 2.1 children/women required to maintain the population. In contrast, both South East Asia and Central and Southern Asia have fertility rates above the key 2.1 metric.

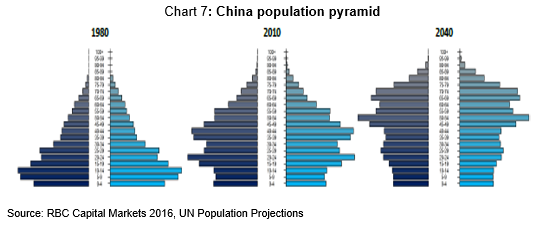

The exception to this is China (East Asia), the dominant nation in the East, which exhibits a low fertility rate and deteriorating demographics by virtue of its longstanding, but now relaxed, one-child policy. This is shown in the centre pyramid of Chart 7, where a bulge generation is followed by a much smaller cohort. However, at present China has a very large working-age generation which will help boost growth over the next few decades.

3. Asia catching up in education investment: facilitates ongoing GDP growth

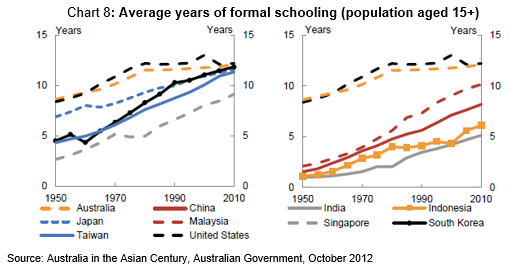

Asian countries have long recognised the crucial role education will play in their development. In developed Asian nations such as Hong Kong, Singapore, Japan and Taiwan (as well as China), education was often compulsory and by 1960 was prevalent. This trend has continued, with improved access to education across the region—primary school enrolment rates are nearly 90% in the Philippines, and close to universal in Cambodia and Indonesia[3].

However, it is the overall growth in the level of formal education in the key developing Asian nations that is most encouraging, as shown on the right-hand side of Chart 8. Malaysia, China, Indonesia and India all show ongoing significant improvement in the level of formal schooling.

India as a case study in improving education

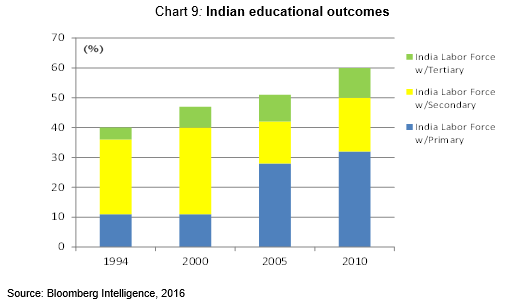

Like the rest of Asia, an important catalyst for continuing growth in India’s wealth is improved educational outcomes. Chart 9 shows India’s education levels have generally been improving over the past 20 years.

Indian Prime Minister Narendra Modi understands the critical importance of improved educational outcomes to India’s future prosperity. In July 2016, he initiated two skill-development programs involving total spending of US$3.3 billion, aiming to equip 15 million people by 2020 with the skills necessary to bring more high-grade manufacturing to the country.

To further help close the skills gap, Western companies in India are stepping up their own training. Boeing completed training for its first group of 30 recruits in the basics of aircraft assembly in early 2016, in collaboration with India’s National Skill Development Corp. All these graduates have been hired by an Indian supplier to Boeing. France’s Alstom sent 80 Indian nationals for training in Brazil and trained a further 250 in India to work at Alstom’s metro train manufacturing plant. In a similar vein, state-run Hindustan Aeronautics, a local Indian JV partner for many foreign defence and aeronautics firms, led the launch of the Aerospace Aviation Sector Skill Council to train hundreds of thousands of aerospace factory workers and 6,000 instructors over the next 10 years.[4]

4. The new ‘Silk Road’ will transform Asia and propel its growth

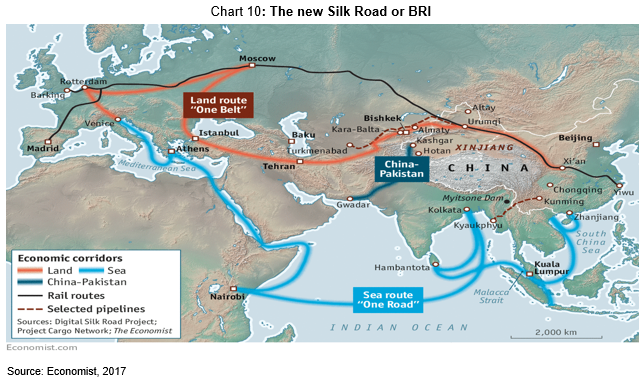

The new Silk Road in Asia, or more formally the Belt and Road Initiative (the ‘BRI’), is a major foreign policy and economic strategy of the People’s Republic of China. The term derives from the overland ‘Silk Road Economic Belt’ and the ‘21st-Century Maritime Silk Road’, concepts introduced by Chinese President Xi Jinping in 2013. These are the two major axes along which China proposes to economically link Europe and China through countries across Eurasia and the Indian Ocean. The BRI also links to Africa and Oceania.

Formally, the BRI emphasises five key areas of international co-operation. However, it is the huge investment in infrastructure needed to facilitate the BRI’s trade objectives that has received the most attention. While the quoted numbers tend to vary, in broad terms China is spending roughly US$150bn a year in the 65 countries that have signed up to the scheme[5], with potentially up to US$1 trillion[6] to be invested over the next five years.

BRI projects already stretch widely across Asia[7]. From Bangladesh to Belarus, railways, refineries, bridges, industrial parks and much else is being built. A new city is taking shape in Colombo, near Sri Lanka’s main port, with the total investment estimated at US$13 billion spanning about 25 years. China Merchants Port Holdings Company (CMH, a Chinese government majority-owned, listed port operator) owns the Colombo port and is backing a much-needed second terminal. A freight route linking China’s east coast and London has already commenced operations. Stretching over 12,000 kilometres and passing through nine countries, the railway allows cargo to travel across the Eurasia continent in less than 20 days.

Chinese President Xi has described the BRI as ‘the project of the century’ that would ‘add splendour to human civilisation’. We have no reason to doubt his conviction—it will be the signature policy of his presidency. The BRI will involve a huge amount of infrastructure spending, which will create investment opportunities, jobs and wealth for decades to come. It will reshape Asia and propel its growth and transformation.

5. What are the consequences, rewards and risks from the evolution of Asia?

The emerging middle class in Asia: consumption patterns change to services

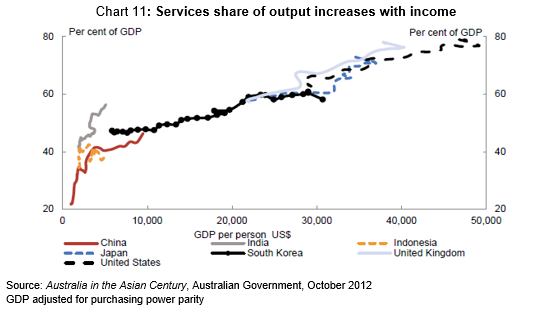

As Asian wealth increases, we believe the emerging middle class will be one of the most enduring investment themes of the next 30 years, and it will be accompanied by a fundamental shift in consumption patterns. This is illustrated in Chart 11, which shows that as GDP per person rises in Asia, the expanding middle class’s spending on services will become more significant, following the path of almost all advanced economies.

The opportunities in Asia will be immense

As the ascendancy of Asia continues and individual wealth expands, opportunities for all nations to participate will grow—particularly for those fortuitous enough to be located in the region, such as Australia.

As observed above, consumption patterns in Asia will change towards services and experience-driven spending:

Demand for education, health and aged care services to grow

As wealth expands in Asia, so will society’s demands for a better quality of life—starting with the education of children, ongoing healthcare and ultimately aged care services.

Overseas and domestic travel to continue to grow: airports and ports needed

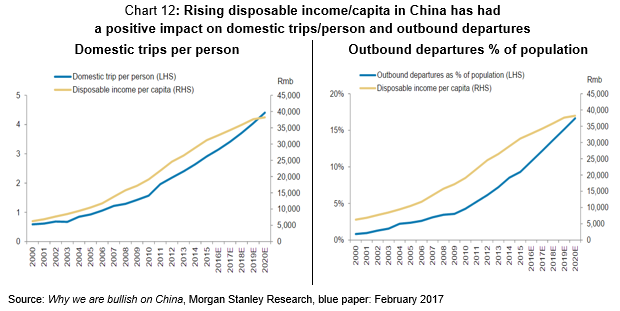

Chart 12 shows that, as disposable income has grown in China, so too has the amount of travel undertaken by Chinese residents, both domestically and overseas. We expect this trend to continue and be exhibited more broadly across Asia.

Modest level of passports on issue confirms the potential for travel growth

A further reference point for the potential for overseas travel growth is that, at present, around 10% of the Chinese population (and only around 5% of Indians) has a passport, and is therefore capable of travelling overseas. This compares with around 50% in the United States or Australia. If incomes continue to grow in China, there are likely to be a lot more international Chinese tourists.

Increased motor vehicle penetration: improved road infrastructure demanded

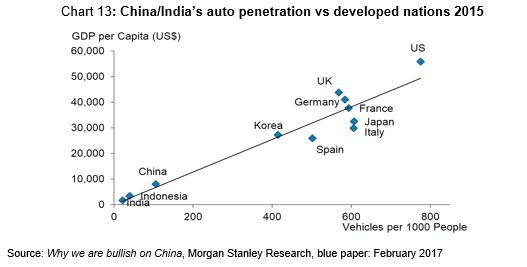

Chart 13 shows a natural correlation between growth in GDP per capita and vehicle ownership. China, India and Indonesia all have very low levels of vehicle ownership penetration. However, as each nation’s GDP per capita climbs, so too will each country’s level of vehicle ownership. As a result, demand for new cars can be expected to be strong, as will demand for new and improved road infrastructure.

Quality infrastructure will be a must

As our Asian neighbours’ standard of living increases, so too will their demand for more and improved infrastructure—be that airports to facilitate a higher propensity to travel, roads to drive new cars, or better basic utility services such as clean water, waste water management, and a reliable supply of electricity and gas. Construction and investment opportunities in these sectors will abound.

The geo-political dynamics from the advance of Asia cannot be ignored: Chinese ascendancy

The key geo-political issue arising from the advance of Asia, and the BRI in particular, is the rise of Chinese power and influence. The Chinese Government has stated that the BRI is not a strategic initiative and does not represent a form of ‘alliance’. However, the BRI may well lead to a seismic shift in the balance of global economic, and hence political, power between East and West.

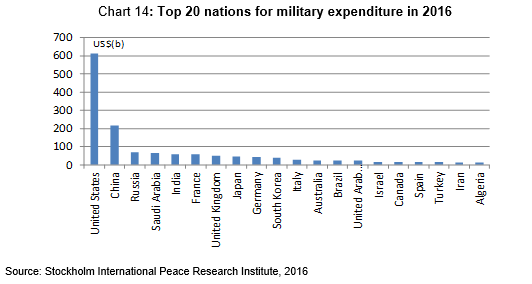

As shown in Chart 14, for the foreseeable future the US will retain its absolute global military hegemony by virtue of the massive amount of funds it spends on the military. However, the ascent of China on the global political stage comes just at a time when a new Trump administration in the US is forging a ‘Make America great again’ or ‘fortress USA’ foreign policy—ripping-up the Trans-Pacific Partnership free trade agreement, revisiting the North American Free Trade Agreement and building walls with Mexico.

In contrast, the Chinese Government under President Xi is heading in exactly the opposite direction. China is actively seeking to be recognised as the world’s leading advocate for free and open trade—a long-held position of the US, but one which they now appear to be vacating. Even though China states that the BRI has no strategic goal, with economic influence comes global political power.

Conclusion

In October 2012 the Australian Federal Government released a research paper titled ‘Australia in the Asian Century’, excerpts from which we reproduce in this paper. The foreword to that paper stated, inter alia:

‘…..Whatever else this century brings, it will bring Asia’s rise. The transformation of the Asian region into the economic powerhouse of the world is not only unstoppable, it is gathering pace. In this century, the region in which we live will become home to most of the world’s middle class. Our region will be the world’s largest producer of goods and services and the largest consumer of them. History teaches us that as economic weight shifts, so does strategic weight. Thriving in the Asian century therefore requires our nation to have a clear plan to seize the economic opportunities that will flow and manage the strategic challenges that will arise…’

We concur fully with this view, and believe it accurately reflects the arguments we make in this paper. Sustained higher rates of economic growth, an expanding middle class, compelling demographics, improved education and major policy initiatives like the BRI will continue to propel Asia forward, driving a huge amount of infrastructure investment. Indeed, we believe the biggest risk to Asia’s rise is that the infrastructure investment needs emanating from this rapid expansion are not adequately met.

We are living in the Asian century and Australia needs to be ready.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. In particular this newsletter is not directed for investment purposes at US persons.

[1]: Quote sourced from the 2010 OECD Development Working Paper 285

[2] The definition of ‘Asia’ varies slightly between some of the charts due to data constraints in the source document. Where possible, the constituents of Asia are defined in individual charts.

[3] Australia in the Asian Century, Australian Government, October 2012

[4] Wall Street Journal, 8 August 2016

[5] Economist, What is China’s Belt & Road Initiative, 15 May 2017

[6] UBS, Patronomics; Does the Belt and Road Matter, September 2017

[7] Bloomberg, Chinese spending lures countries to its Belt and Road Initiative, 10 May 2017