By facilitating trade and powering industries and by moving bulk and industrial commodities and handling intermodal freight, rail enables the movement of goods across the country and to ports, linking global supply chains and economies.

There has only been one major North American Class 1 railroad merger since the early 2000s, but recent Trump political appointments have increased the chances and potential regulatory support for another Class 1 merger. In this News & Views we provide a brief overview of the sector, and explore merger regulations, the most likely merger outcomes, and how 4D Infrastructure is positioned.

Introduction

In the late 1990s, a flurry of mergers and acquisitions reshaped the North American rail industry, reducing the number of operators from over 30 to a handful of large players. This trend stalled in 2001 when the Surface Transportation Board (STB), the sector’s regulator, imposed stricter requirements that made large scale mergers far more difficult. Canadian Pacific’s 2021 acquisition of Kansas City Southern proceeded only because it qualified for a waiver from the post-2001 rules, meaning those tougher regulations remain largely untested. Despite this, speculation about a further round of consolidation has persisted and recently that talk has intensified, with some suggesting that a second Trump administration could bring a more merger-friendly STB. The rail companies themselves have now confirmed they are actively exploring potential deals, giving credibility to the chatter.

The North American Rail operators

The North American freight railroad sector (‘the rails’) is one of the oldest and largest in the Global Listed Infrastructure (GLI) universe, with the five listed rails accounting for 10% of the US$4trn 4D GLI Universe1. GLI investors are drawn to the sector as it exhibits many of the hallmarks of core infrastructure assets: stable cash flows, high barriers to entry, pricing power and essential service characteristics. While the rails don’t have long-term contracts that lock in volumes like some other infrastructure sectors, they are regulated and remain deeply embedded in the functioning of the world’s largest economy – a connection that has underpinned their performance and resilience over their long 170-year history.

Warren Buffet said in a 2009 CNBC interview if he were stranded on a deserted island and able to look at only one economic indicator he would choose the weekly freight rail volumes.

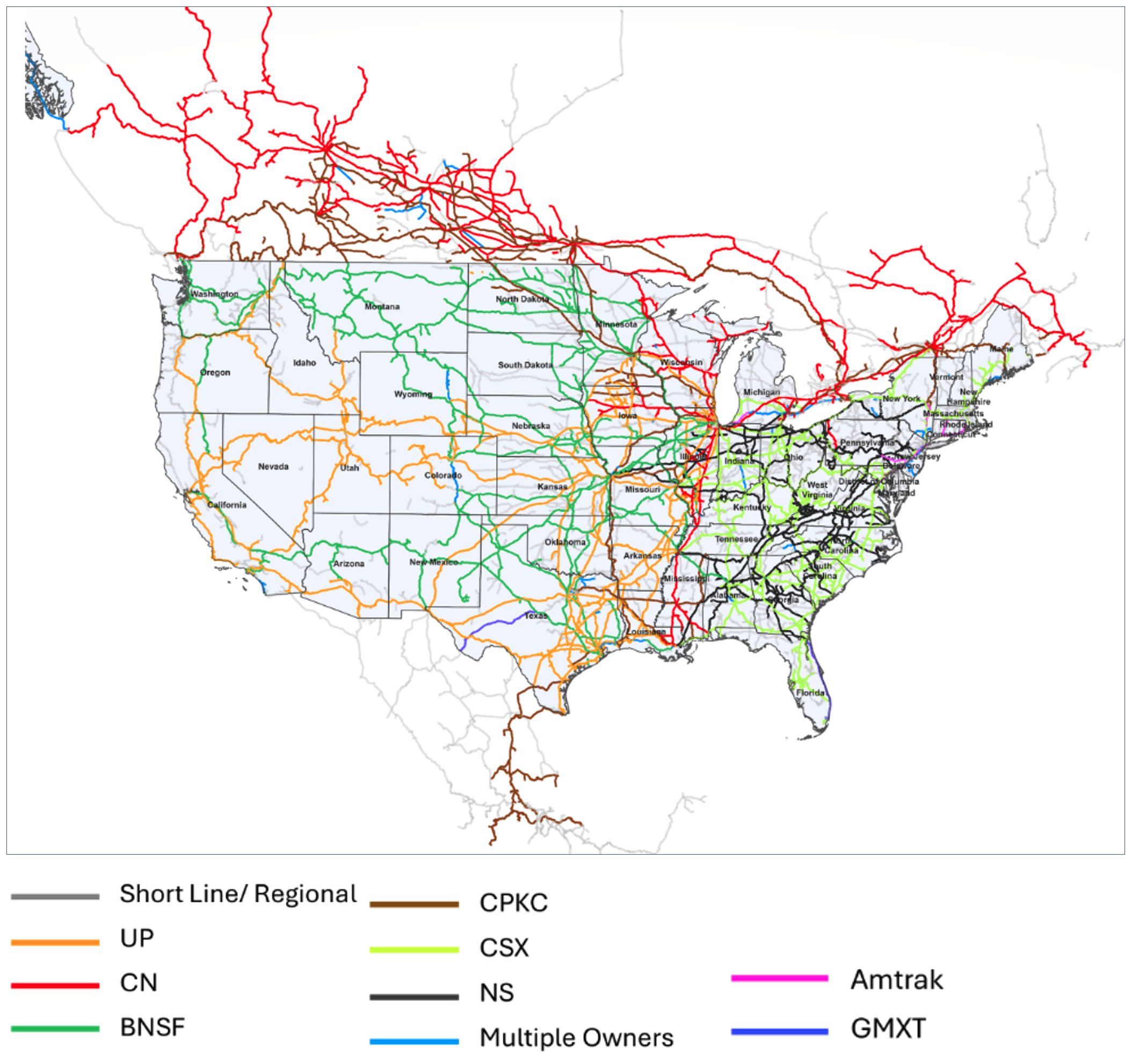

Today, there are six ‘Class 1’ rails in North America, with class being differentiated by revenues (Class 1 = >US$250m pa). Five of them are public companies, and one is private (owned by Buffett’s Berkshire Hathaway). Together these six giants command over 95% of all US freight rail revenue2. Their dominance isn’t just about scale, it’s also about geography. As seen in Chart 1 below, the market is essentially split into three regional duopolies, with each pair of railroads primarily competing within its own territory. In this regard:

- UNP and BNSF are the largest in the US but operate almost entirely west of the Mississippi river;

- CSX and NSC cover East US; and

- CNR and CP-KC operate mostly in Canada, with Canadian Pacific now connecting through the mid-South US to Mexico via its recent acquisition of Kansas City Southern railroad in 2023.

The importance of the rail companies to the wider US economy cannot be underestimated – and is an important consideration as to the political sensitivity of merger approvals. As per the Association of American Railroads, every rail job creates 3.9 additional jobs across manufacturing, logistics and technology (749,000 jobs) and every $1 invested in rail transportation drives $2.50 in economic activity.

Table 1: Overview of North American rails

Source - 4D, FactSet, company filings

Source - 4D, FactSet, company filings

Chart 1: Map of the North American Rails

Source – Association of American Railroads

Source – Association of American Railroads

A quick history of the rails

The sector hasn’t always been so concentrated with the rails having undergone significant phases of expansion, contraction, and consolidation:

- 1850–1910: The boom years - Railroads quickly spread across North America, connecting cities and opening new frontiers. This period saw an explosion in track mileage as rail became the backbone of economic growth.

- 1910–1940: The rules tighten - US and Canadian Governments step in with intense regulation on prices and services, slowing growth. At the same time, new competition emerges from trucking and inland waterways.

- 1950–1970: Rough Patch - The industry is plagued by overcapacity and mounting competition from trucks. Harsh regulation made it tough to adjust prices or abandon unprofitable lines, culminating in a wave of bankruptcies.

- 1980–2000s: Deregulation and comeback - The US rail industry was transformed by the 1980 Staggers Act, which gave the rails more freedom on pricing and operations. The result? Major cost cuts, smarter routing, and a flurry of mergers. The number of Class 1 railroads in the US reduced from 33 to just five over this period. In Canada, the previously nationalised CN is privatised.

- 2000s to present: Stability and efficiency - Big mergers slowed as regulators raised the hurdle for approval. The industry settled around only a few dominant players. Railroads focus on efficiency, using new methods like Precision Scheduled Railroading (PSR), and capital management with shareholder returns replacing growth.

Who approves railroad mergers and what are the rules?

Usually, big mergers in the US need a green light from regulators like the Federal Trade Commission (FTC) and Department of Justice (DOJ), who watch out for deals that might hurt competition or consumers.

Class 1 railroads are different. They are one of the very few industries that are exempt from the normal DOJ/FTC review process because they fall under the exclusive jurisdiction of the Surface Transportation Board (STB). That might sound simpler, but actually, the STB use a broader ‘public interest’ test that’s tougher than the usual DOJ/FTC checks.

The Public Interest Framework

The wave of mergers during the ‘Deregulation and Comeback’ era led to severe operational problems from all the newly combined railroads. Many struggled to integrate their operations, causing major service disruptions, network congestion, and widespread customer frustration. These issues, combined with growing fears about declining competition, forced the STB to step in and overhaul its merger rules in 2001.

These new rules introduced the ‘Public Interest Framework’, which significantly raised the bar for merger approval. It wasn’t enough anymore to show that a merger wouldn’t harm competition. Now, railroads had to prove that a deal would enhance competition and deliver clear, measurable public benefits – like better service, improved efficiency, and network connectivity. Further, those benefits must clearly outweigh any downsides, including risks of anticompetitive behaviour or service degradation.

Since the rules were changed, no major Class 1 mergers have occurred under them, leaving the framework largely untested.

The most recent major merger, the 2021 Canadian Pacific (CP) and Kansas City Southern (KCS) deal, was granted an exemption from the new merger rules because of: (a) its size (would still be the smallest); and (b) low competition concerns (network was end to end in nature and had few overlapping routes).3 As a result, it was reviewed using the older, more lenient rules.

The only formal application of the new framework came when the STB rejected Canadian National’s proposed voting trust for KCS which was denied because it failed the public interest test.4

So what’s changed?

Quite simply, politics. The STB consists of five members, all appointed by the President, though no more than three can be from the same political party. Under a second Trump presidency, the board is likely to tilt more Republican, potentially making the environment more favourable for mergers.

With Trump’s stated intention to roll back regulation and a Republican chairman appointed in early 2025, M&A speculation picked up with some believing the conditions may be right for a final round of consolidation. One of Trump’s earliest political appointments on his inauguration day (January 20, 2025) was to promote Patrick Fuchs to Chairman of the STB, who is seen as a key proponent of industry consolidation.

That speculation gained traction in May, when Union Pacific CEO Jim Vena publicly floated the idea of a transcontinental merger.5 That is, the combination of two rail companies to create a full west to east coast network. Since then, talk has accelerated, with media reports suggesting multiple Class 1 railroads have engaged advisers including UNP (as potential acquirer) who confirmed in their recent 2Q quarterly that they are in “advanced discussions” with NSC.

What merger seems most likely? East to West fits Best

In terms of likely mergers, a Western rail (UNP or BNSF) buying one of the Eastern rails (CSX or NSC) appears to be the most likely scenario. At a stretch, you could see both happen.

In our view, a cross border deal appears unlikely. A merger involving a Canadian railroad would likely face political resistance under a ‘Buy American’ agenda and would require dual regulatory approvals from Canada and the US adding complexity and risk.

However, the East-West US pairings could meet the STB’s rigorous Public Interest Framework, and we believe could make sense at an industry and operator level. Here’s how:

- Does the merger enhance competition?

East to West US rails don’t have much overlap which arguably means customers wouldn’t see a reduction in competition. In terms of enhancing competition:

- Rails should point to the recent CP–KC merger which boosted North South competition and sparked new service offerings. That deal prompted Canadian National (CN) to partner with Union Pacific (UNP) and Ferromex (part of Grupo México Transportes, GMXT) to launch the ‘Falcon Premium’ service line, delivering faster and more efficient options for customers.

- A larger geographic network offers scale advantages which if passed on to the customer further enhances competitive dynamics.

- Do the public benefits outweigh costs?

The transaction could be framed to offer a number of public benefits including:

- Improved Service: End-to-end ownership would eliminate time-consuming interchanges between carriers, effectively speeding up shipments for customers.

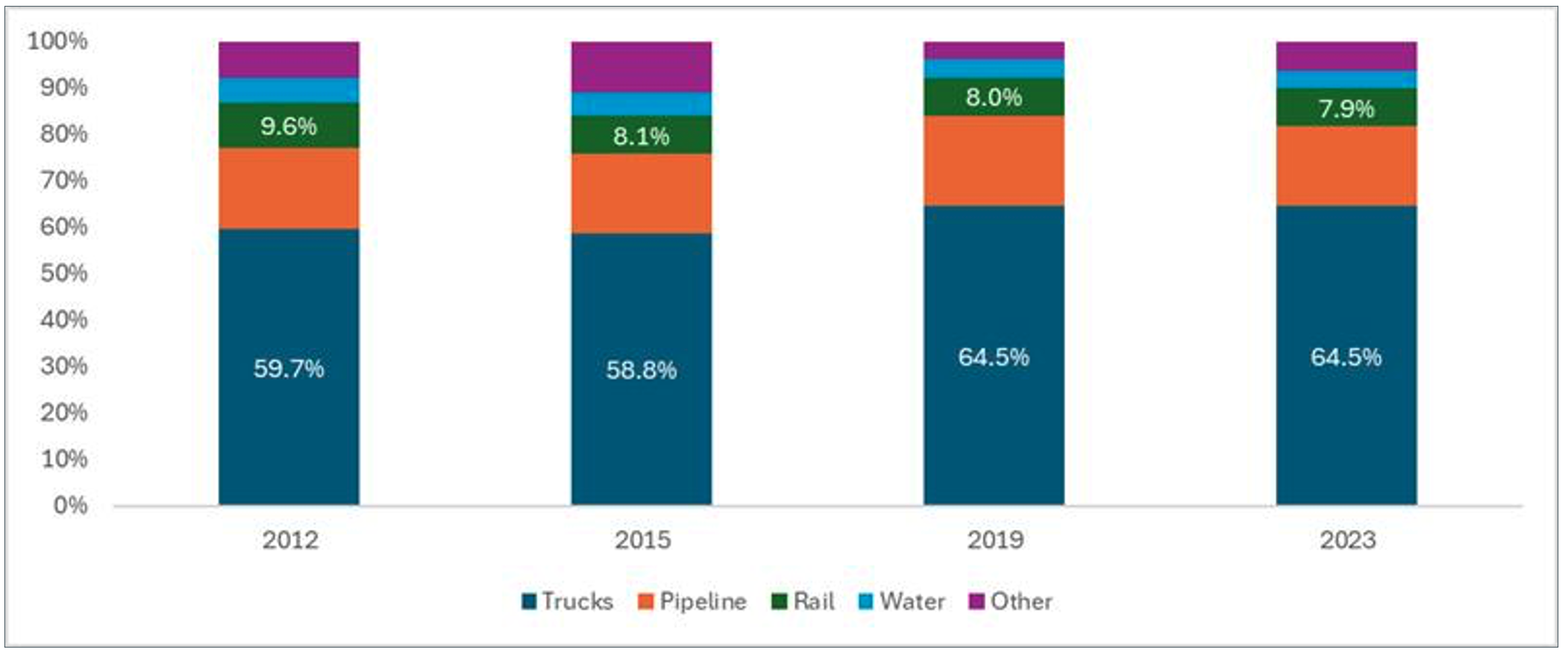

- Environmental Gains: As per Chart 2 below, trucks still dominate U.S. freight, and railroads have slowly been losing share over. Yet rail is 3-4x more fuel-efficient than trucking. A stronger rail network could pull freight off highways, easing congestion and reducing emissions.

- Economic Value: Enhanced freight efficiency could support job creation and North American supply chain resilience.

Chart 2- US Freight mix by mode of transport over time (by freight weight)

Source – 4D, US Department of Transportation

Source – 4D, US Department of Transportation

4D positioning

At 4D Infrastructure, we have exposure to both CSX and NSC. While we initiated positions on fundamental grounds (NSC: margin repair; CSX: onshoring) we understand the investment narrative has now shifted to M&A activities. At this stage we don’t see a relative preference for either as we believe two deals are more likely than one. In this regard, if NSC merged with UNP, CSX would likely be allowed to merge with BNSF for competitive purposes. Fundamental valuation continues to support our ongoing decision to hold, and we will continue to monitor this exciting M&A landscape as it evolves and adjust accordingly.

Conclusion

The North American railroad sector is an important sector for infrastructure investors, as well as for tracking the pulse of the US economy. Trump, beyond tariffs, immigration and geopolitics, has had direct impact on this sector in his second term by appointing a pro-industry consolidation chair to the regulator. The winds of change seem to be turning in favour of imminent industry consolidation – and this should have an impact on the US economy, with important direct and indirect benefits to industries, consumers and the wider economy. While we continue to hold two potential participants of this industry consolidation, we are closely monitoring developments, mindful of fundamental valuations and any changes to the outlook.

1 As at 9 July 2025

2 Association of American Railroads, 2024, link

3 Frieghtwaves, 2021, link

4 Surface Transportation Board, 2021, link

5 Trains.com, 2025, link

6 Samafor, 2025, link

The content contained in this article represents the opinions of the authors. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.