4D 2025 Outlook extract;

“The election cycle of 2024 gives way to policy implementation in 2025, and with this comes increased geopolitical uncertainty from Trump’s foreign policy stance, position on trade, immigration and the war on drugs. Trump will no doubt be highly consequential for existing conflicts, where he is trying to strong-man his way to resolutions (in the Middle East and Ukraine), and an unknown for those that have been simmering for years (China-Taiwan, South China Sea conflict, Red Sea conflict).

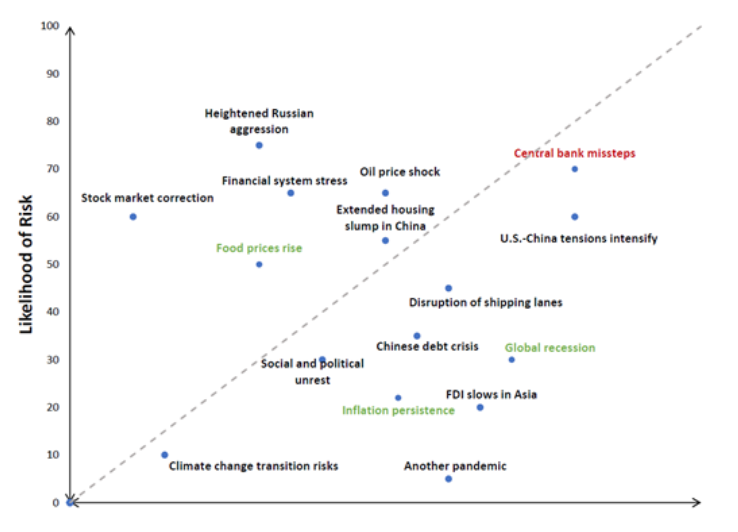

Moody' Key Geopolitical Risks

Source – Moody's Analytics. Red indicates increased severity and/or probability of risk; Green indicates decreased severity and/or probablity of risk.

Source – Moody's Analytics. Red indicates increased severity and/or probability of risk; Green indicates decreased severity and/or probablity of risk.

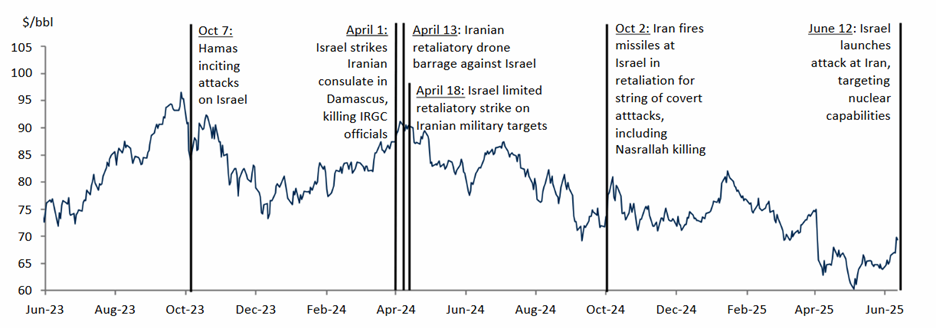

On the night of 12 June, Israel attacked Iran in Operation Rising Lion – targeting Iran’s nuclear programme, several top military figures and nuclear scientists. This resulted in almost two weeks of drone and missile attacks on military and residential targets in Israel and Iran, and civilian loss of life on both sides. It culminated in US military strikes on three nuclear facilities, using B-2 bombers to drop over a dozen 10 tonne bunker buster bombs. Iran’s retaliation was not as bad as feared and Israel and Iran remain in a tepid truce – with what President Trump is claiming the end of the “Twelve Day War”.

Over this period, there was a 10% spike in oil price (from $68 to $75) and a 23% spike in June. This was over fears of damage to Iran’s oil infrastructure and supply to the market, as well as the risk of closing the Strait of Hormuz. The Strait of Hormuz is a key shipping route between Iran (to the north) and the UAE and Oman (to the south). It connects the Persian Gulf to the Gulf of Oman and the Arabian see, and being only 21-52 nautical miles wide it is a potential choke point for global oil supply during such conflicts. 20% of total oil consumption flows through the Strait (15mb/d of crude oil and 6mb/d of oil-related products). In a note to clients, Barclays stated “The Strait of Hormuz has never been closed, but its proximity to Iran places it at the heart of geopolitical tensions and underscores its vulnerability to disruption.”

Strait of Hormuz Map

Source – JP Morgan

Source – JP Morgan

Oil price spikes have several impacts on the broader global economy and global listed infrastructure (GLI) sectors. Sustained oil price rises can materially contribute to inflation (which most developed markets have just got under control, supporting an easing cycle) – while also hitting economic growth (which is already fragile with increased tariff uncertainty post April 2 ‘Liberation Day’). These macroeconomic factors can – and do – impact particular GLI sectors: oil price rises can help oil-exposed names, such as pipelines, while potentially hindering air travel (higher fuel costs and ticket prices, lower demand, lower tourism during conflicts).

Oil prices since October 7

Source – RBC

Source – RBC

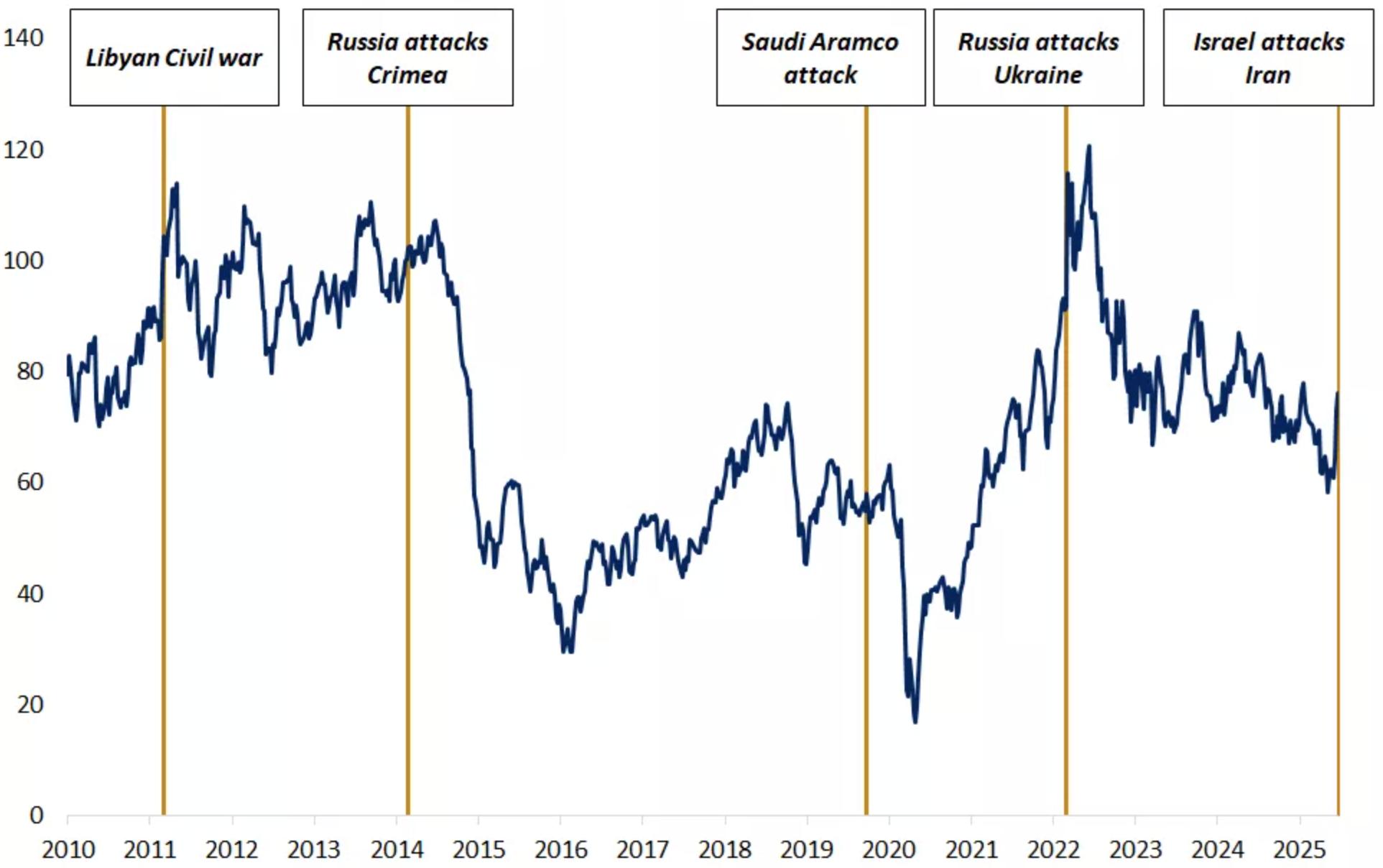

We continually assess the impact of oil price spikes on markets and GLI – and any potential lasting impact on valuations and share prices. We find that oil price spikes are often very short lived – in both oil prices, equity market impact and on key GLI sectors.

Regardless of the dramatic moves over the last week including the US attacks on Iranian nuclear sites, Iranian’s measured retaliation and the fragile Israeli-Iranian ceasefire – and the subsequent unwind of the ‘geopolitical risk premium’ in the oil price, it is worthwhile discussing the potential impacts of oil on risk assets, the economy and more specifically GLI, as further geopolitical ructions in the Middle East (and beyond) are likely.

Geopolitics & Oil

Broadly speaking, the impact of geopolitical events on financial markets tend to be short lived. Particularly with flare ups, and direct action, as we are seeing now in the Middle East – there is often a flight to safety (yields down, equities down, and within equities defensive utilities tend to outperform cyclicals).

It is also important to understand the oil demand and supply backdrop when these geopolitical events occur. Leading into the current flare up, OPEC+ have been adding production to the market, keeping a lid on prices in the low $60s. This has also been while there have been growth concerns on a slowing US economy (from tariff uncertainty) in 1H25 and weaker Chinese demand.

Over the past 15 years, similar events have not led to sustained oil price rallies or market disruptions. Over that time, the US economy has also become a net oil exporter, and efficiency gains and increase of services as a % of GDP has lowered the economic transmission mechanism of oil spikes to the wider economy.

15 year view of oil price reactions to major geopolitical events

Source – Edward Jones

Oil geopolitical ‘risk premium’ and economic impact analysis during the latest conflict

With regards to the current Middle East conflict, some strategists and commodity analysts have run scenarios on the specifics of a Strait of Hormuz disruption or closure on the impact on oil prices and expected follow on to wider risk assets.

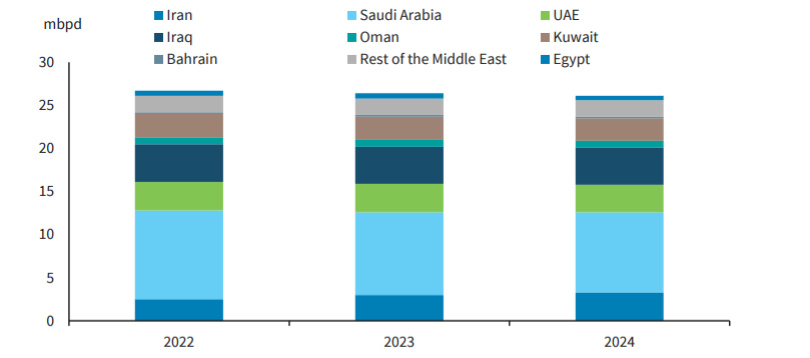

Barclays estimated that if Iranian oil exports are cut in half, they expect Brent to move to $85/b (from $65/b). In the worst case scenario of a wider conflagration, they expect prices to move past $100/b. This is based on the disruption to the global oil supply chain from the Middle East and Egypt that flow through the Strait.

Middle East and Egypt contribute 25% of global oil supply

Source - IEA, Barclays

Source - IEA, Barclays

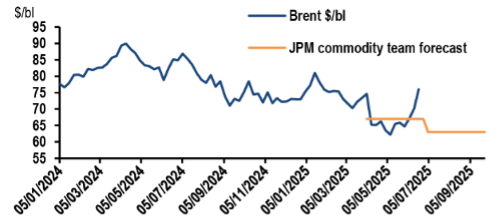

JP Morgan estimated that leading into the weekend of the US involvement, the market was assigning a probability below 20% of the Strait closing, pricing in a roughly $10-12/b premium to their fair value model. On their estimates, a full closure could cause oil prices to surge to $120-130/b and cause US CPI to spike to 5%.

JPM Forecast of Brent

Source – Haver, JPM

Source – Haver, JPM

Importantly, JP Morgan believe any geopolitical policies that might drive oil and inflation higher would likely yield to Trump’s primary objective of maintaining low energy prices — a campaign promise to “rapidly defeat inflation, quickly bring down prices, and reignite explosive economic growth” (Trump 6/9/24). Trump made energy policy a pillar of his campaign, pledging to lower oil costs through a mix of deregulation, increased domestic production, and strategic geopolitical manoeuvring. RBC held similar views to this:

“If oil is caught in the cross-fire, we anticipate that President Trump will seek OPEC spare barrels to try to keep a lid on prices and shield US consumers from the economic impact of the Middle East conflict.” (RBC, Head of Global Commodity Strategy)

JP Morgan are of the view that the closure of the Straight is a low-risk event as Iran would be damaging its own position, both economically and politically, by irritating its main customer (China). Main Gulf players in the Middle East have strong incentives to keep the conflict contained given their economic transformation plans require sustained peace.

Similarly, UBS also see the closure of the Strait as low probability, especially as long as Iranian oil exports are still flowing. The Strait is critical for Iran's own exports as its terminal outside of the Strait only has limited capacity. A closure would also have a material negative impact for several other countries such as Qatar and China and would likely present a challenge for Iran.

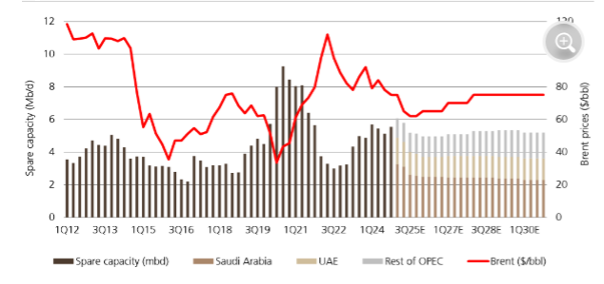

Furthermore, oil continues to flow, and in fact UBS predict OPEC+ are more likely to ramp up production. As such, in the absence of major disruption to oil exports from the region, UBS still see the significant spare capacity that OPEC+ has as limiting the upside risk to the oil price. OPEC still holds slightly more than 5mb/d of spare capacity excluding Iran/Venezuela, including >4mb/d from Saudi Arabia and the UAE. They believe OPEC+ partners are now very likely to decide to raise production again by 411kb/d in August when they meet on 6 July.

OPEC spare capacity

Source – UBS

Source – UBS

Morgan Stanley assessed the Israel/Iran conflict through three scenarios.

- Scenario 1 saw no disruption to oil supply, which would take prices back to $60b. 90% of Iran’s oil goes to China, with Iran being a top three source of Chinese oil imports – a relationship that Iran would not want to frustrate by closing the Strait. This would bring back a potential rising surplus after the summer, keeping the lid on prices.

- Scenario 2 would see a decline in Iran’s oil exports and a more balanced market to $75-80/b. This would be from direct Israel attacks on Iran’s energy infrastructure, but so far that has been focused on gas fields which are used primarily for domestic consumption.

- Scenario 3 would see wider supply disruption to the Strait, prices spike to $120/b leading to demand destruction. These are similar levels to after the Russian Ukraine invasion in 2022.

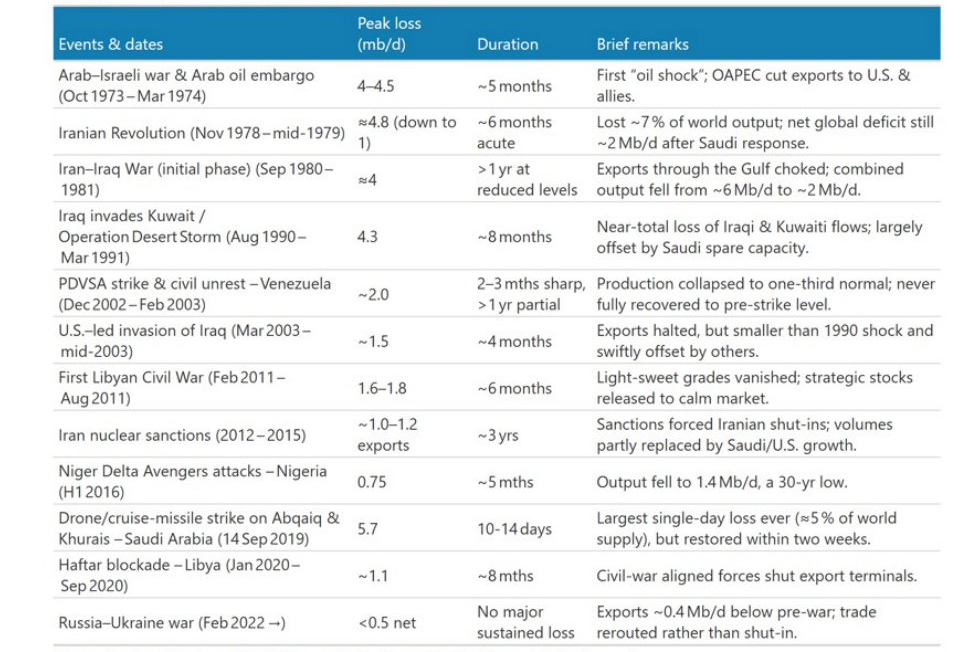

Morgan Stanley’s outlook aligned with Scenario 1 as the most likely outcome, even as Scenario 2 and 3 risks elevated over the past two weeks. Large, sustained oil supply disruptions do happen, but are rare and circa once per decade; “Even in 2022, when oil market participants widely expected that Russia's exports would decline 3 mb/d, the actual loss that year was only marginal”.

Major conflict driven oil supply disruptions

Source – Morgan Stanley: Events that removed >1mb/d for at least several weeks

Specifically in regards to Europe, Santander flagged that EUR Brent remains at pre-Liberation Day levels (compared to USD + 10%). It typically takes three weeks for changes in oil prices to fully pass through to pump prices, but they expect a short term CPI impact. Looking longer term, a sustained EUR Brent price rise will have a larger impact for the ECB and rates outlook – as a large part of its 1.6% 2026 HICP inflation forecast was based on lower energy prices. The ECB predicted the current rally (up to last weekend) could add 20bps to their 2026 projection, reducing the risk of undershooting.

Brent prices in USD and EUR

Source – Santander, Bloomberg

Source – Santander, Bloomberg

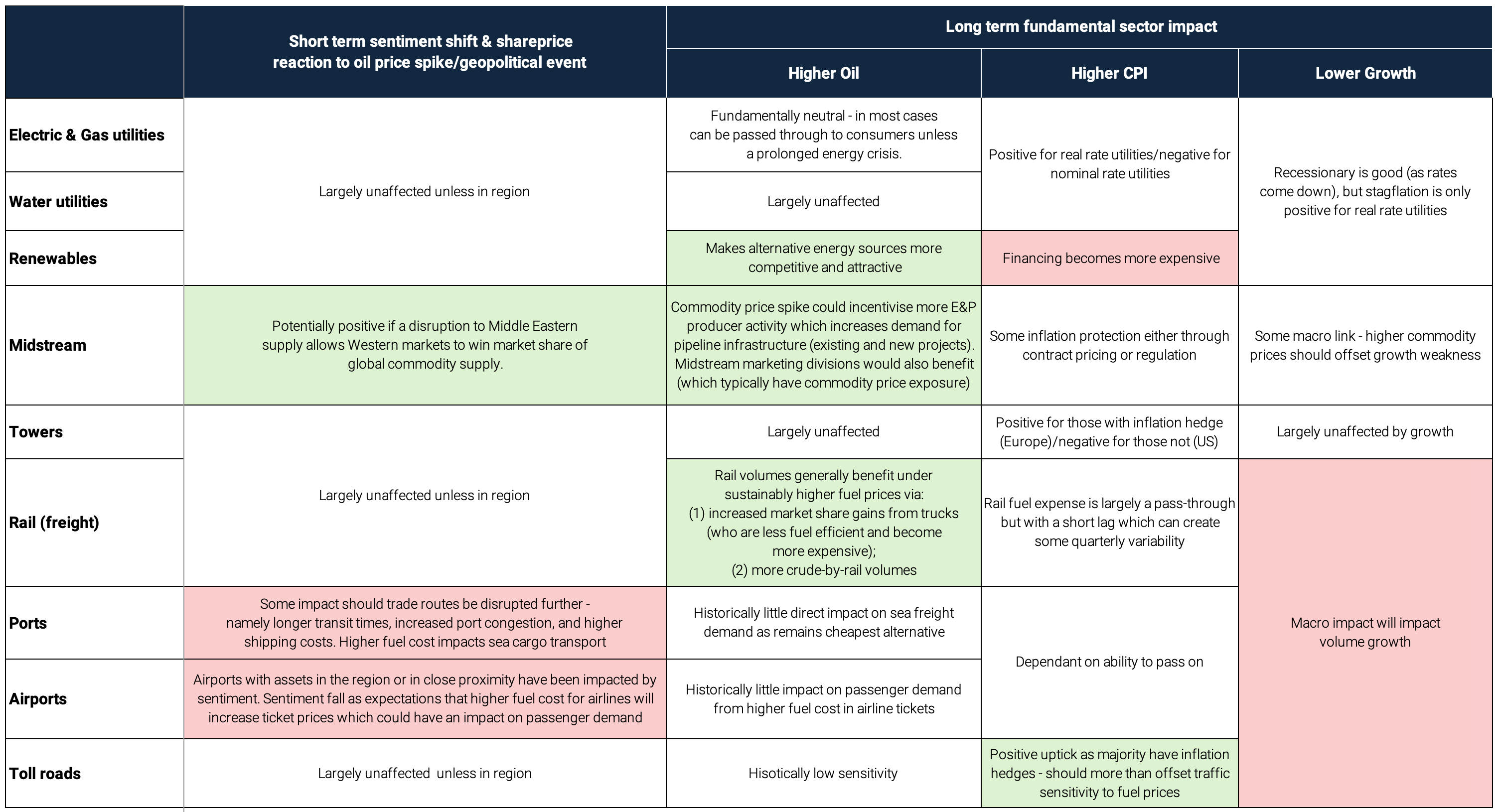

Oil & geopolitics – GLI sector valuation impacts

From the perspective of 4D’s regional analysis across sectors, there is a range of impacts from oil price shocks and sustained higher oil prices – from expected short term sentiment shifts and share price reaction to longer term fundamental impact on individual sectors. The second order impact of a sustained higher oil price on the economy – through higher inflation and lower growth – will also impact these sectors differently.

Short term and long term impact of oil price shocks on GLI sector sentiment & fundamentals

Source - 4D

Source - 4D

Oil, geopolitics & GLI – A look back at major events

We have looked at the major oil supply disruptions of the last 30 years, and looked at the one day, one week and one year moves in oil prices (WTI), S&P 500 and global equities (MSCI World). For GLI, due to a larger universe of stocks listed over the time, we have used the US utilities index (UTY), the US pipelines index (Alerian) and a Global Airport Sector equal weighted basket (8-15 listed stocks existed over the time period).

The results broadly match with our analysis above – that is, the one day spike tends to be short lived, sometimes washed out in a week.

- Event day move – oil up, US utilities outperform equities, pipelines outperform equities (and positive more than half the time), global airports down marginally more than broader equities.

- Event day + 1 week – oil close to flat, utilities still outperforming equities, pipelines marginally stronger and airports have recovered most losses to be in line with equities.

- Event day + 1 year – oil is elevated (other drivers) and despite this, fundamentals drive asset returns in the equities, utilities, pipes and airports.

Further analysis can be found in the appendix.

Impact of oil spikes on equities & GLI sectors

Source- 4D, Bloomberg

Source- 4D, Bloomberg

Conclusion

Geopolitical flashpoints which result in major oil supply disruptions do impact risk assets in the short term, but these do not last long (as other oil supply/demand dynamics take place, economic transmission mechanisms occur, and fundamentals on equity earnings come through).

In such events, when oil prices spike, broadly speaking airports may slightly underperform short term (alongside general equities), with utilities and pipelines outperforming. This weakness unwinds often as quickly as a week, but in most precedent events within a year after the event.

4D’s ability to actively position the portfolio to take advantage of short term volatility and dislocation is something we see as a competitive advantage. Geopolitical risks are real and deserve to be monitored – but the impact on fundamentals and over the longer term is often overstated – particularly for GLI and can be used as a buying opportunity.

Appendix

The content contained in this article represents the opinions of the authors. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.