This is the abridged version of the article, which can be read in full here.

Company management meetings and site visits are integral to our investment process, and where possible, we look to visit core regions at least annually. 2022 was our first trip post COVID, and was a particularly unique trip given the breadth of headline issues facing both Europe and the UK – including the Russia-Ukraine war, lingering COVID overhangs, the ongoing energy crisis, rampant inflation, travel chaos and a worsening economic environment. It was interesting to be back on the ground this year and see what concerns had dissipated, and what was still causing sleepless nights.

In this piece, we highlight some interesting themes and observations from the trip that support our ongoing overweight to the region.

Politics

Politicians across Europe, and around the world, remain under pressure. They managed to survive the 2022 energy crisis thanks to a warmer winter and market intervention. However, 2023 sees them struggling to deal with sustained inflationary pressures, rising interest rates and an associated affordability crisis. While it received little airtime this year, energy security has not been resolved, and as winter approaches, any increase in energy prices could exacerbate already elevated inflation and affordability issues.

While the Eurozone member countries are all facing similar challenges, certain countries are more vocal in their displeasure, forcing political noise.

Economics

The economic outlook across Europe remains uncertain.

Although an energy-led collapse seems to have been avoided, mixed data continues to make policy response very difficult.

It would be easy to be negative in an environment of higher inflation and costs, interest rates still below peak, declining savings rates, less supportive fiscal policy, lower overall liquidity, and a volatile global landscape. However, households keep on consuming, corporates continue to raise prices and invest in growth and employment, while worked hours and unemployment readings continue to reflect a strong labour market.

Global activity and the re-opening of China has been slower than expected, further weighing on industrial activity and the manufacturing sector, while the services sector remains relatively buoyant. This disparity in domestic economic drivers is favouring certain countries over others (for example, Spain over Germany). Overall, GDP growth has been muted and is expected to remain so through 2023 and into 2024.

Inflation, while still elevated, does look to have peaked (subject to energy and a winter weather outlook). However, it is proving to be sticky at elevated levels, with the decline very gradual to date. This is particularly the case in the UK where challenges have been compounded post Brexit. Despite consensus forecasts seeing a reversion to targets in 2024, the trend certainly doesn’t suggest this will be realised that quickly. As such, we remain overweight inflation which we look to capture and compound in our earnings models.

While the data and outlook are certainly not robust, our experience, as we travelled through the various markets, was of consumption. People were travelling, eating out, and spending.

Maybe this is partly due to us being largely in big cities and this could be very different outside urban areas where affordability has hit harder. It could also be prolonged post-COVID “revenge spending”, which could dissipate over time as savings rates continue to deteriorate. However, we also think it could be partly structural – having survived COVID and its associated lockdowns and furloughs, consumers and corporates alike are aware that in dire situations they can survive with the help of government handouts. The need to “save for a rainy day” is being perceived as far less important than “living in the moment”.

Whatever the case, the conflicting signs certainly make the central banks’ job harder, and it does feel like this time around things could be different.

Queue at Hermes in Rome

Infrastructure

- Travel: the pent-up demand continues despite macroeconomic headwinds. Unlike last year, the user experience has vastly improved, with less disruption from delays, strikes and staff shortages.

- Energy: the long-term outlook for utilities remains particularly strong, with the energy transition gaining traction amidst the ongoing Russia / Ukraine conflict. While Europe seemingly navigated the energy crisis last year, and the discussions this year had a very different focus, it’s not fully out of the woods just yet

- Government intervention: government intervention has lessened in the utility space, but threat of intervention is increasing in other sectors. Ongoing cost of living difficulties are putting pressure on governments to act.

Airports

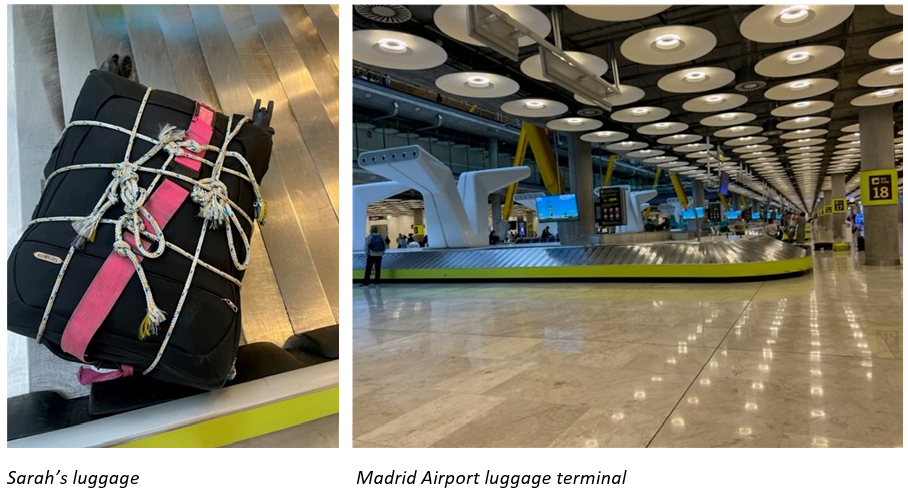

Last year we saw first-hand the well-publicised travel chaos that plagued the airport sector post the COVID re-opening. We had flights delayed, spent hours in customs and security lines, almost missed flights and lost luggage, spending a few very frustrating hours at Heathrow Airport tracking it down.

12 months on, we are pleased to report that the experience has dramatically improved, although it’s still not perfect. While the flow of airports was much better, we still saw some unwarranted flight cancellations and Sarah’s luggage, again, proved to be an issue, arriving off the luggage carousel worse for wear (thank you Iberia).

Alongside the travel experience, there were some interesting observations from our meetings with management.

Traffic recovery supported by strong demand

Ongoing post-pandemic traffic momentum was confirmed by all management teams. While several European airports had already moved the anticipated timeline to recover passenger numbers to pre-pandemic levels forward, a few now expect it to happen by year end, with several monthly traffic prints already exceeding equivalent numbers pre-pandemic. For example, AENA (the Spanish airport operator) has a FY23 traffic guidance of 94-104% of 2019, but has recently said final numbers would be closer to in-line or above 2019.

The strong momentum continues to be driven by leisure passengers with pent up travel demand. In AENA’s case, this is evidenced by massive demand to tourist hotspots of the Canary and Balearic Islands (already tracking +10% vs 2019), while Madrid and Barcelona are seeing comparatively slower recovery (partly explained by an uptick in high speed rail usage between the two cities – we opted to rail rather than fly and had a seamless experience).

Fraport Greece has been a leader in Europe, with passengers 10% above 2019 levels in Q2 and 116% of 2019 in July. Fraport stated that a “good European summer season will bring the group airports close to 2019 levels in 2023”.

Diversified player, Vinci also commented that the passenger outlook across their airport network remains robust with all but the Asian assets very close to, or above, 2019 levels, and still growing. Even Italian traffic controller, ENAV, were maintaining robust traffic targets of +6% this year, +6% next year and a +2.5% long-term CAGR off a base already above 2019.

Airport operators appeared surprised by the continued strength in travel demand given record ticket prices alongside the economic headwinds of higher rates, slowing growth, and cost of living pressures. Airports and airlines both see this as somewhat of a structural change in mindset, not just pent-up demand or revenge spending. Their quantitative data and empirical research suggest travellers are willing to give up other forms of discretionary spend amidst cost of living pressures in order to continue investing in travel and associated experiences.

While momentum remains strong, and travel-starved passengers continue to dish out on holidays, operators concede that the true effect of the macro headwinds could eventually have some impact in the future – they just are yet to see signs of it.

Interestingly, however, one management team suggested that the cost of living headwinds could arguably be a tailwind for passenger numbers. Due to ongoing cost of living pressures, travel budgets are likely to be reduced rather than cancelled, with holiday makers deciding to:

- Stay closer to home – benefiting intra Europe and domestic routes and operators such as AENA

- Shortening the duration of the holiday – if flying, this still results in a trip in and out per traveller, but if holiday durations are shortened, stretched hotel capacity is freed up to accommodate more travellers. This arguably means more passengers in total, in and out – benefiting all short haul operators, road, rail and air.

This ongoing traffic recovery has happened without the return of Chinese tourists with capacity into and out of China still significantly below 2019, as discussed further below. This gives us confidence of ongoing solid traffic trends through the end of 2023 and into 2024, despite the economic overhang.

Retail revenues resilient despite macroeconomic headwinds

As with passenger momentum, non-aeronautical spend (retail, food and beverage, and services) remains very strong. Again, this is seen as somewhat of a structural change in mindset as travellers make the most of every part of the trip.

At the same time, higher inflation has boosted headline sales numbers in retail businesses, further flowing through to strong spend per passenger figures.

This optimism is highlighted by ADP, with their medium retail target spend of ~€30 in sales per passenger, a target which has already been achieved two years early. Clearly a lot of this is attributed to ADP’s significant investment in their luxury focused retail offering, but passenger attitudes towards spending money have played a strong role.

Similarly, AENA highlights unprecedented demand for local and speciality stores alongside VIP lounges / airport services as proof of traveller demand for a holistic, seamless and authentic experiences.

Further, for the UK traveller, or those travelling through the UK, Brexit has also structurally increased spend as duty free becomes a viable option again. This is a clear benefit to Heathrow as well as AENA’s network, which has a strong exposure to UK tourism.

Return of Asian travellers will support airport earnings

Most impressive is that the recovery to date has been with limited contribution from Asian passengers. While much attention has been placed on China’s reopening, it hasn’t yet translated into a material increase in Chinese traffic due to lengthy visa and passport processing times, and lower airline capacity.

To put some numbers to it, ADP stated that in Q1 of this year, Chinese passengers were at just 10% of the level reported in Q1 2019. Regarding airline capacity, it was highlighted that some airlines have been slow to ramp up capacity as profitability on Chinese flights has reduced due to the ban on Russian airspace. For ADP, at the end of June, the number of flights to China were at just 27 per week, compared to 95 a week pre COVID.

However, there is confidence in the return of the Chinese traveller. Fraport highlighted that there had been a steady recovery since re-opening from 18% of pre-pandemic levels in January, to 52% in June, with expectations this will continue to ramp up in the second half of the year. They have left their outlook unchanged for the financial year, anticipating Q3 will be back to 50-60% of 2019 while Q4 is expected to reach 80%, with December at 90%.

This is not just a volume story. Chinese passengers tend to be among the highest travel spenders globally. In Paris airports, Chinese passengers only account for 2% of passengers, but have an outsized impact on SPP (spend per pax) of almost 15%. In the absence of a slowdown in existing passenger mix, the ongoing normalisation of Chinese and Asian traffic will provide a kicker to earnings, and provide a buffer if/when a broader slowdown takes hold.

Operational issues improved but not resolved

Delays at airports caused by staff shortages and strikes created havoc last summer. While we experienced a marked improvement this year, there were still a few signs of ongoing issues.

Capacity at airports is still constrained, resulting in ongoing flight cancellations, and the threat of strike action was ever present. Fraport commented that the recovery at Frankfurt had been held back by capacity shortages in ground handling as well as at airlines and air traffic control – this saw them reduce the number of maximum movements at Frankfurt airport to 90% of 2019 levels. Importantly, these slots are gradually being released suggesting the operational momentum still has some legs.

Ferrovial also commented that the demand at Heathrow was well above 2019 levels already, but airline capacity and slot restrictions were limiting the recovery – importantly they too were seeing gradual improvements with capacity in July higher than expected. All in all, the momentum is positive albeit the situation is not fully resolved.

Rail/sustainable travel

A recurring long-dated concern from management teams and industry participants is sustainable travel. Certain short haul routes are particularly at risk given the EU’s push to limit flights on short haul destinations and rail alternatives as part of its Sustainable and Smart Mobility Strategy. Naturally, there’s also a strong focus by airport operators to cut CO2 emissions and reduce exposure to energy costs with more onsite generation.

Our view is that there is upside to this shift if airports have the ability to reallocate less profitable short haul slots to meet long haul demand, improving the overall per passenger profitability of the airport. This is not immediate but is being strategically planned for by the airports. ADP agrees, stating that they would see margin expansion without capacity spend from the reduction in short haul flights and reallocation of slots over time to more profitable long-haul slots. Long-haul aeronautical fees are close to 3 times a short-haul fee and retail spend is around 2.5 times the fee.

Regulation

The current macro environment is favouring those operators that have, or should have, some flex over annual tariff adjustments (AENA, Frankfurt, Heathrow).

AENA has a proposed a 4.09% increase to 2024 tariffs which, while not yet approved, does include a P-Factor[1] adjustment of 3.5%, which the CNMC[2] has already agreed to in principle. Unfortunately, since the submission and trip, RyanAir has appealed the increase, arguing that it would be against the intention of the government to freeze the tariffs in DORA 2 (the current regulatory period) to sustain tourism, and it would negatively impact traffic volumes and local economies. The decision is in the hands of DGAC[3], but we expect political pressure could come into play.

Post our trip, Frankfurt announced at their H1 results presentation that they had put in a 9.4% increase to their 2024 aeronautical tariffs, which had been agreed with by their core airline partner, Lufthansa. This would be a significant up-tick to consensus numbers anticipated by analysts in models, as well as our own current forecast.

Heathrow Airport, which should have a clear inflation passthrough per its regulatory construct, has seen a denial by the regulator, with Ferrovial having to contest the outcome. Unfortunately, there is limited recourse should their objection be dismissed, and we believe the outlook is not great given the ongoing elevated UK inflation and political headwinds. This could see investment deferred at the airport and could be the impetus to see Ferrovial exit the asset.

From a non-aeronautical standpoint, all the operators are benefiting from inflation pass-through into retail SPP. This particularly benefits ADP, which has a much higher spending culture at its airports.

M&A

There have been no material M&A developments in the airport space recently, with the focus on execution of those deals already announced.

Utilities

Utilities were at the forefront of most investors’ minds in 2022 due to the energy crisis brought on by the Russia-Ukraine conflict. With Europe having navigated through the winter and with a normalisation in power prices, there was a notable shift in company outlooks.

Energy security and crisis

Interestingly, the term ‘crisis’ was seldom used in our discussions, but operators were very clear that Europe is not out of the woods just yet. While Europe was quick to pivot away from Russian gas, they were lucky due to the mild 2022 winter and increased LNG availability from reduced Asian demand (China remained in lockdown for nearly all of 2022). If these factors were to change this year, alongside any unpredictable moves from Russia (such as putting Russian flows to zero), or further adverse changes in existing European supply / production, then the coming winter could be problematic. This could see an upward reversal in gas prices and, subsequently, power prices, which would impact European energy consumers and economies.

Importantly, at the time of drafting this article, the European Commission announced that Europe’s gas storage levels have hit the 90% target set to be achieved by 1 November, providing some safety net ahead of the upcoming winter. They also highlighted ongoing efforts to diversify the supply of energy in the near and long term.

High customer bills and energy market intervention

There was a major headwind for integrated utilities and energy suppliers during the crisis last year as governments sought to shield consumers from skyrocketing energy prices. Intervention still remains in a number of European markets, but is less noticeable, as price caps and clawbacks are not being applied as power prices have fallen significantly.

There is divergence among countries, depending on their individual political environments. Some jurisdictions are expecting to scrap measures all together, while others are likely to keep measures in place, at least over the medium term. Nevertheless, given the ongoing cost of living pressures, government and regulators will look to keep as much pressure on operators as possible to ensure lower bills.

Network returns

Transmission and distribution networks are monopoly assets that earn a return on their regulated asset base. This return generally follows the market environment to ensure a fair return on capital, and is largely formulaic based on a building block CAPM model. Given the significant step up in rates, several transmission and distribution operators expect regulators to increase returns to accommodate the higher cost of capital. For example, in Italy, regulatory WACCs are expected to increase ~80bps next year across most sectors in an intra period adjustment.

Further, given the step up in returns anticipated, and the huge and growing investment needs to ensure the security of supply as the energy transition progresses, integrated players are currently prioritising investment in networks over other less secure return profiles.

Despite the government intervention up the supply chain during the energy crisis in 2022, we did not see any wholesale impact on the regulated earnings of pure play utilities. Therefore, despite the potential impact of a cold winter on wholesale power prices, we don’t expect utilities to directly bear the burden of affordability.

Renewables returns

Renewables remain a topical issue for utilities and developers as returns face pressure on continued cost inflation and supply chain challenges. In Europe, contract/PPA prices have adjusted significantly to account for the increasing cost environment, and is the main reason cited by companies remaining comfortable with their existing return targets. However, sentiment has remained negative due to European developer exposures to US offshore wind, where regulators have been reluctant to adjust pre-agreed contract prices for inflationary pressures in US offshore wind developments.

Supply chain challenges continue to be problematic, despite some easing in the pandemic-related pressures. This was highlighted by turbine manufacturer, Siemens Gamesa, which recently highlighted a substantial increase in failure rates of their wind turbine components. In addition, TPI Composites, a leading outsourced wind blade manufacturer, announced an unexpected warranty issue and ongoing production issues in its latest quarterly earnings.

Naturally, there is concern that this may be a symptom of a wider issue for the industry.

Renewable pipelines – is there value?

The energy transition is a multi-decade investment opportunity. Significant renewables deployment is required not just for global net zero goals, but to achieve energy security – which is now increasingly important post the 2022 energy crisis. Governments recognise the importance of accelerating the transition, and are fast tracking approvals and investment, further bolstering the investment proposition for renewables.

At 4D, we have always struggled with attributing value to ‘potential’ renewable investments (the so-called ‘pipelines’ of assets). These pipelines raise many questions including: what would the return profile be, when would it be delivered, what success rate do they have of converting pipeline to operations, and what would be the offtake price and term? Ultimately, this leads to too many variables in an asset class that relies on visibility. As such, we have only attributed value to operational assets or those that had reached financial close, were under construction, and/or had an offtake contract in place.

Integrated businesses a standout in the sector for 2023

2022 was a tough year for some of the utilities diversified across generation, networks and energy retailing. Many of these companies struggled to procure energy for their retail customers. Their own generation output was impacted by weather-related issues, and amidst the energy crisis, they were forced to pay sky high prices in the wholesale market to meet customer demand. This resulted in significant losses in retail businesses, which had an impact on earnings and share prices.

However, for many prudent operators, the crises proved a longer-term opportunity. Several management teams we met with confirmed that many customers were eager to sign up to longer contracts at higher prices in the uncertain market environment. Subsequently, wholesale power prices normalised as the peak crisis period passed. The cost of energy supply has thus dropped significantly, while many utilities have locked in favourable selling prices. Profitability has therefore improved, and the retail/supply sector is looking like one of the more profitable business segments for a number of European utilities in the near term.

Hydrogen

Hydrogen, and in particular green hydrogen, has become a bit of a buzz word in the energy sector over the past few years, and was again a key discussion topic with sector participants. What remained clear was that while it’s widely believed that hydrogen will have an important role in the energy transition, viability for serious investment is still at least five years away. Before committing significant capital, operators need to see a cohesive framework and a lowering of the cost curve. Interestingly, we heard more talk around biomethane and other green gases over hydrogen in the shorter term. The CFO of Snam stated that while their network could be hydrogen ready very quickly, it is not viable at these levels and is still five plus years away, with pilot projects at the moment in biomethane and CCS.

Climate change

An extremely hot summer across Europe for a second year in a row is again causing havoc. In the near term, direct consequences include lower generation output (particularly hydro and wind) leading to higher energy prices as well as the risk of regulatory penalties for certain utilities, which could impact returns. For example, UK water utilities are front page of the press for sewage leakages, and for other utilities there is a risk that power line faults have caused fires.

Over the medium term, we can expect revisions down to capacity factors which could limit returns on some existing wind assets. Neoen suggested that capacity factors on certain projects had been “over-estimated”, but was not of the view that there had been an actual structural decline in output – consistent misses across operators, however, suggest otherwise.

Positively, over the longer term, transmission, distribution, and water networks should see higher investment allowances to deal with the greater climate risk and security of supply needs.

Diversified infrastructure/toll roads/rail

French toll roads under scrutiny

French motorways are among the best performers post-COVID, and are some of the most stable assets globally due to their resilience and inflation protection. However, with the macro headwinds in France, scrutiny into these concessions has increased.

The French government believes operators are earning ‘super profits’ from these roads and have proposed additional taxation or a shortening of the concession lives. Listed operators, Eiffage and Vinci, are adamant that no excess profits are being earned, and highlighted ongoing discussions with the government on the issue. Given the strength of these concession contracts, we believe the government will not be able to legally reduce concession lengths. It now appears the government is pursuing the route of increased taxation. This still could be a breach of the contract, but the issue will likely remain a headwind until further clarity emerges.

Prior to publication, media reports suggested that the 2024 French budget law would look to include a tax on concessions (motorway and airports), with the government looking to raise €2.5bn through to 2030, and €500-600m p.a. thereafter. Apparently, airports would be included following the state council’s advice in June to the government that raising taxes is only possible if the new rule hits all transport concessions, and not the motorways exclusively. The detail suggests a new eco-tax would be introduced on airline tickets of €1-2 for economy tickets and €20 for business tickets, generating €100mn in tax income for the government to sustain investments in railways. Other taxes being considered would impact large vehicles with high CO2 emissions and fleet vehicles.

On the H1 results call, Autoroutes’ management reiterated their opposition to the new tax and its view that such a move would be unlawful. Interestingly, there’s not much evidence of contracts being tested in the French courts to give us an indication of how the judiciary will react. Vinci commented that contracts have not really had to be tested by courts before, as the parties have always negotiated well together. However, they will take it to the courts if its detrimental to shareholder value. While France is important for Vinci, it is absolutely core for Eiffage, and it becomes difficult to quantify the risk for Eiffage until more details emerge.

Traffic resilient despite high inflation

European toll road traffic has remained resilient despite economic challenges. So far inflation and high rates have resulted in minimal, if any, demand reduction. A continued economic downturn is likely to have a greater impact on heavy versus light vehicles, as truck traffic is more strongly correlated with GDP. Meanwhile, light vehicle traffic is more resilient in a downturn and could potentially increase. Operators highlighted that if people are forced to spend less on travel, a driving holiday becomes more attractive for a typical family relative to more expensive train and air travel. This clearly benefits the road operators Vinci and Eiffage, as well as Getlink, over the summer period.

Contracting and inflation

Messaging around contracting was positive but less optimistic than last year. Operators highlighted the strength of order books, but seemingly are facing margin pressure on fixed price construction contracts. Contracting in certain industries, such as real estate, has been significantly impacted (e.g. down 20-30% in France), while new growth areas such as energy/renewables are helping offset some adverse impacts.

Communications

5G investment lagging

5G investment continues to lag in Europe due to a lack of investment drivers. In most European jurisdictions, the investment case for pure 5G networks is low, due to poor returns and lack of user demand impacting commercial viability. As such, tower operators are not seeing tower demand driven purely by 5G. Instead, demand for new macro towers and increased points of presence (space on mobile towers), is still largely driven by 4G and hybrid 5G coverage needs. The latter is often contracted with build-to-suit programmes with tower infrastructure companies like Cellnex.

Small cells, which are largely used to densify 5G networks, have thus far seen limited demand across Europe and continue to have a questionable return profile. However, Distributed Antenna Systems (DAS) are being increasingly used to improve coverage in buildings and indoor spaces.

Longer term, tower operators expect 5G investment (as well as potential small cell investment) to pick up as demand and use cases increase. They highlight that investment by just one mobile network operator (MNO) may accelerate industry investment as others rush to upgrade their competitive offering to prevent customer churn. Similarly, ongoing MNO consolidation should support long-term company financial health and investment plans, potentially accelerating 5G investment.

Efficiency, debt reduction and balance sheet optionality

In contrast to the last decade, M&A and sector consolidation got little airtime from the tower operators, with the focus turning to organic growth, cost efficiency and stabilising balance sheets in the high rate environment, ultimately leading to increased shareholder returns.

The cost structure of towers is relatively straightforward, with land lease costs the biggest driver, while power costs are passed onto customers. Staffing is the other major cost, while maintenance capex tends to be very low. Operators are focused on creating leaner operating structures utilising technology to reduce staff costs. Meanwhile, lease renegotiations and land buyouts are the key strategies being employed to keep leases in check and help improve margins.

Towers are also highly leveraged given the visibility of their long-term contracts. However, in the current high-rate environment, they’ve been penalised for this high gearing. Debt reduction/optimisation has therefore become a key part of management strategies to remove this overhang on share prices.

Companies are accelerating their debt reduction targets, which along with ongoing FCF generation, will improve balance sheet optionality, and likely translate into improved shareholder remuneration. Inwit talked about balancing growth with shareholder returns with natural deleveraging over time (investment grade is not a focus), while Cellnex was all about organic growth and the path to investment grade credit and subsequent shareholder returns. Importantly, for both, the organic growth outlook remains robust to see solid earnings momentum. Their biggest bottleneck to growing faster is no longer execution, but MNO budgets.

Remain overweight Europe

Despite ongoing political and economic headwinds in Europe, this trip sees us reaffirm our overweight to the region. We have factored in the risk and believe the value proposition of the quality infrastructure names continues to be very attractive.

As always, we maintain a diversified portfolio of high quality infrastructure names globally, and at the moment, believe Europe is offering an attractive mix of quality and value despite near-term economic and sector headwinds.

[1] P-Factor – measure of efficiencies/opex

[2] CNMC – National Commission on Markets and Competition

[3] DGAC – Director General of Civil Aviation

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.