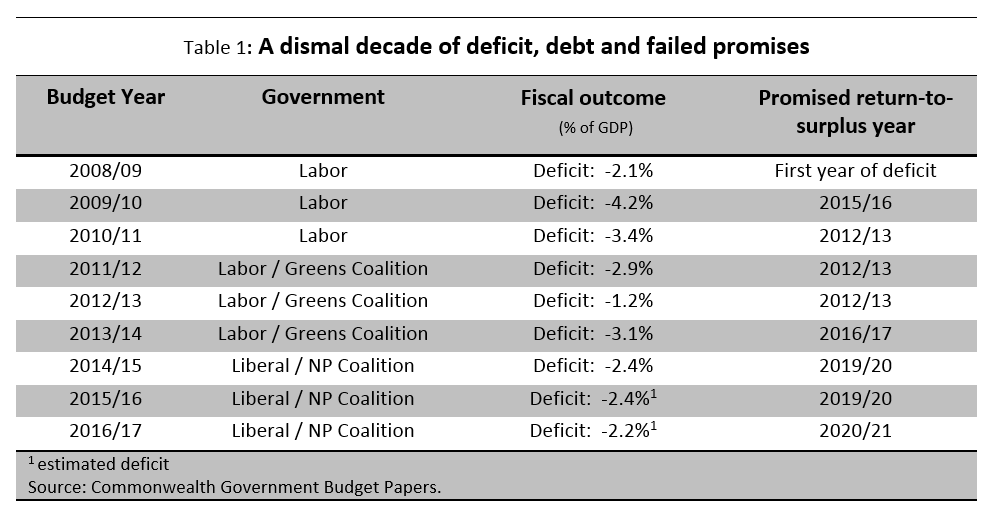

The past decade has seen the Commonwealth Government in virtually a permanent state of fiscal deficit. Up until the 2008/09 fiscal year, the budget had been in surplus for nine of the previous 10 years. As Table 1 shows below, not only have there been a continual stream of deficits since, there has also been a continual stream of broken promises about when the budget will be returned to surplus.

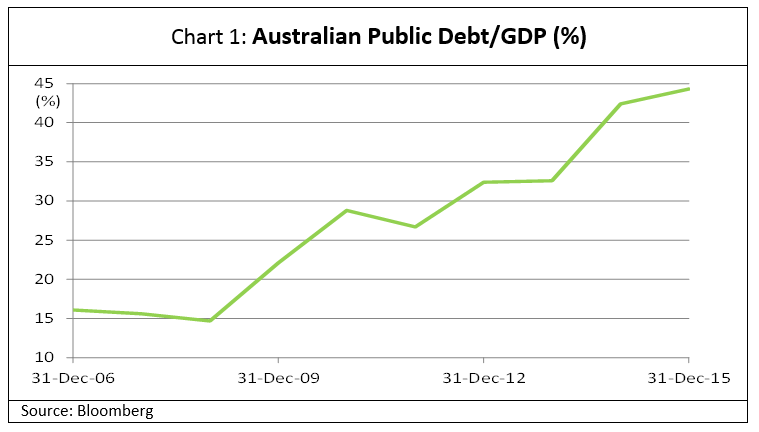

The inevitable consequence of these deficits is that Australia has been rapidly building a pile of public debt, as shown in Chart 1.

Of course past governments of the day are not solely to blame for this predicament. There have been a number of contributing factors including:

- a hung parliament with populist/celebrity independents unwilling to recognise the electoral mandate of the lower house, or meaningfully negotiate with the ruling government on legislative change;

- major parties playing politics with important legislative reforms, and essentially frustrating the wishes and mandate of the lower house. Most recently this involved expenditure cuts, blocked by the opposition during the previous parliament, now being adopted by them as policy in the current election campaign. Plainly this form of politics is contrary to the national interest; and

- increasingly professional, well-funded lobby groups targeting proposed special interest reforms, placing great pressure on the government of the day to retreat.

Potential credit rating downgrade looming

Many of these factors will be prevalent in the new parliament, and the level of fiscal deficits may rise further. This will potentially put Australia’s ‘AAA’ credit ratings at risk of downgrade. These ratings are very important to the nation for a number of reasons:

- they impact the cost of borrowing of the sovereign, especially in non-A$ raisings. Australia is currently benefitting from globally low interest rates in servicing its debt. However, as the current debt pile is not about to be repaid anytime soon, inevitably there will be a period of higher interest rates in the future where a strong credit rating will help mitigate an escalating debt servicing cost;

- the sovereign rating in a country tends to act as a ‘ceiling’ for all credit ratings in that country. In other words, if the sovereign is downgraded there could be a rating downgrade cascade effect to other private and public borrowers, where their rating is downgraded as a consequence, and their cost of funding rises. Ultimately such cost increases impinge economic growth;

- Australia is one of only 10 nations [1] with Triple-A credit ratings from the three major rating agencies (Standard & Poor’s, Moody’s and Fitch). These ratings are internationally recognised symbols of sovereign financial strength and stability. For potential foreign investors they are key indicators of sovereign risk. They are certainly very important, globally recognised financial metrics that should not be surrendered lightly.

Is fiscal policy just too important to leave in the hands of our elected politicians?

Given the fiscal mess of the past decade this question is not as crazy as it might sound. Indeed, as we show below, a number of nations have already concluded that fiscal policy is too important to leave to politicians. They have moved to a ‘rules based’ approach whereby key fiscal policy parameters are encoded either in legislation or the constitution. For example:

- Switzerland: in 2003 introduced a ‘debt brake’ rule. This limits government spending growth to average revenue increases over a multiyear period. The rule reinforced the constitutional principle that government expenditure has to be mainly financed by revenues and not through increases in public debt.

- Germany: in 2009 introduced its own ‘debt brake’rule.This established in the constitution that the cyclical deficit for the Federal Government is restricted to 0.35% of GDP from 2016.

- European Union (EU):in 2012 it introduced its ‘fiscal compact’. This followed the Swiss and German ‘debt brake’ rules, and requires EU member states (excluding the UK and the Czech Republic) to balance their budgets. General deficits are not to exceed 3% of GDP, and a structural deficit is not to exceed a number specific to that country.

- Singapore: the constitution prohibits the government from spending borrowed money. Fiscal surpluses are accumulated in a sovereign wealth fund and presidential approval is needed to use any of the country’s ‘past reserves’. While Singapore has a public-debt-to-GDP ratio in excess of 100%, all the debt was issued to help develop the domestic financial markets and is primarily held by The Government of Singapore Investment Corporation (GIC) - Singapore’s sovereign wealth fund.

- Chile: in 2001 introduced a ‘structural surplus’ rule.This ties government spending to cyclically adjusted revenues (ie. they exclude cyclical revenues, such as those from a commodity boom, in balancing the budget), and directs government to save any surplus in a stabilisation fund. Chile has public debt-to-GDP of just ~17%, has built a substantial sovereign wealth fund, and has an S&P credit rating of AA-. This experience is very relevant to Australia as Chile is a commodity dependent country, with 50% of exports from copper where prices are currently very depressed.

- Brazil: In the very troubled nation of Brazil, one of the first reform measures proposed by interim president Michel Temer is a constitutional amendment to cap public spending increases at inflation for at least the next 10 years. Hopefully revenues will grow at a faster rate, helping to close the budget deficit.

How successful have these policies been?

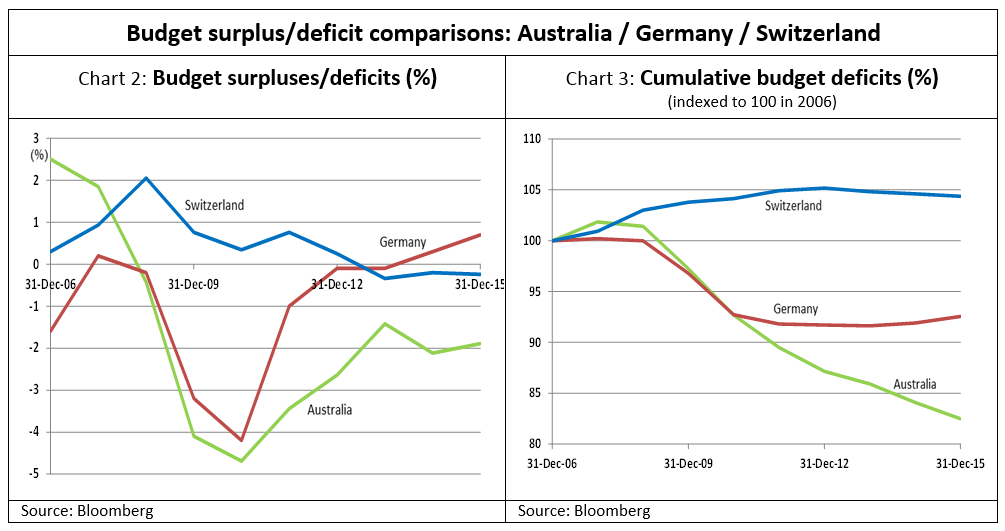

Comparing Australia with Germany and Switzerland, the results could not be more stark. Over the past decade Australia’s budget position has gone from being the best to the worst (Chart 2), which is reflected very clearly when shown on a cumulative basis (Chart 3).

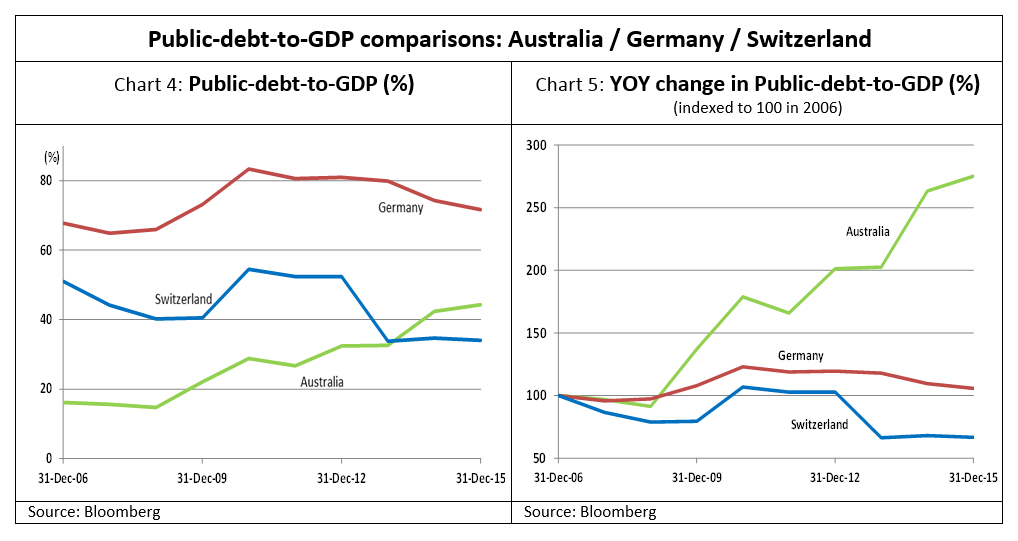

While Australia’s public-debt-to-GDP (%) is not currently excessive by global standards (Chart 4), its trajectory is alarming (Chart 5). Between 2006 and 2015 Switzerland’s public-debt-to-GDP (%) declined, Germany’s stayed broadly flat while Australia’s has risen from 16% to 44%, or an increase of over 170%. This rate of growth is not sustainable.

Conclusion

Due to a combination of factors and forces Australia has experienced a decade of fiscal mis-management. Spending proposals announced in the current federal election campaign suggest there is no real end in sight to this fiscal madness.

While a rules based approach to fiscal policy has been raised in Australia before[2], it is time to revisit the concept and consider the example set by a number of other countries in how we might better manage our scarce fiscal resources. Switzerland, Germany, the broader EU, Chile, Singapore and potentially now even Brazil have all concluded that fiscal policy is indeed too important to leave solely in the hands of our elected representatives, and that there is a better way to manage and control this important resource.

It is often stated that running fiscal deficits represents an inter-generational issue of ‘equity’. That is, the current generation is continuing to consume borrowed public money at the expense of future generations who are left to repay the debt. The consequences of this could be dire in terms of necessary future tax and spending adjustments. It is imperative therefore that we act now to address this issue in order to preserve the lifestyle, freedoms and inter-generational equity of the children of the future.

[1] The 10 nations with ‘AAA’ ratings from the three major ratings agencies are: Australia, Canada, Denmark, Germany, Luxembourg, Netherlands, Norway, Singapore, Sweden and Switzerland. As an indication of just how elite this group is the United States, the largest economy in the world, is not a member.

[2] Papers that have raised a rules based fiscal concept for Australia have been published by: The Centre for Independent Studies (2009 & 2013), The National Commission of Audit (2013) and the Business Council of Australia (2013).